Form 8843 Æ•™Å¸

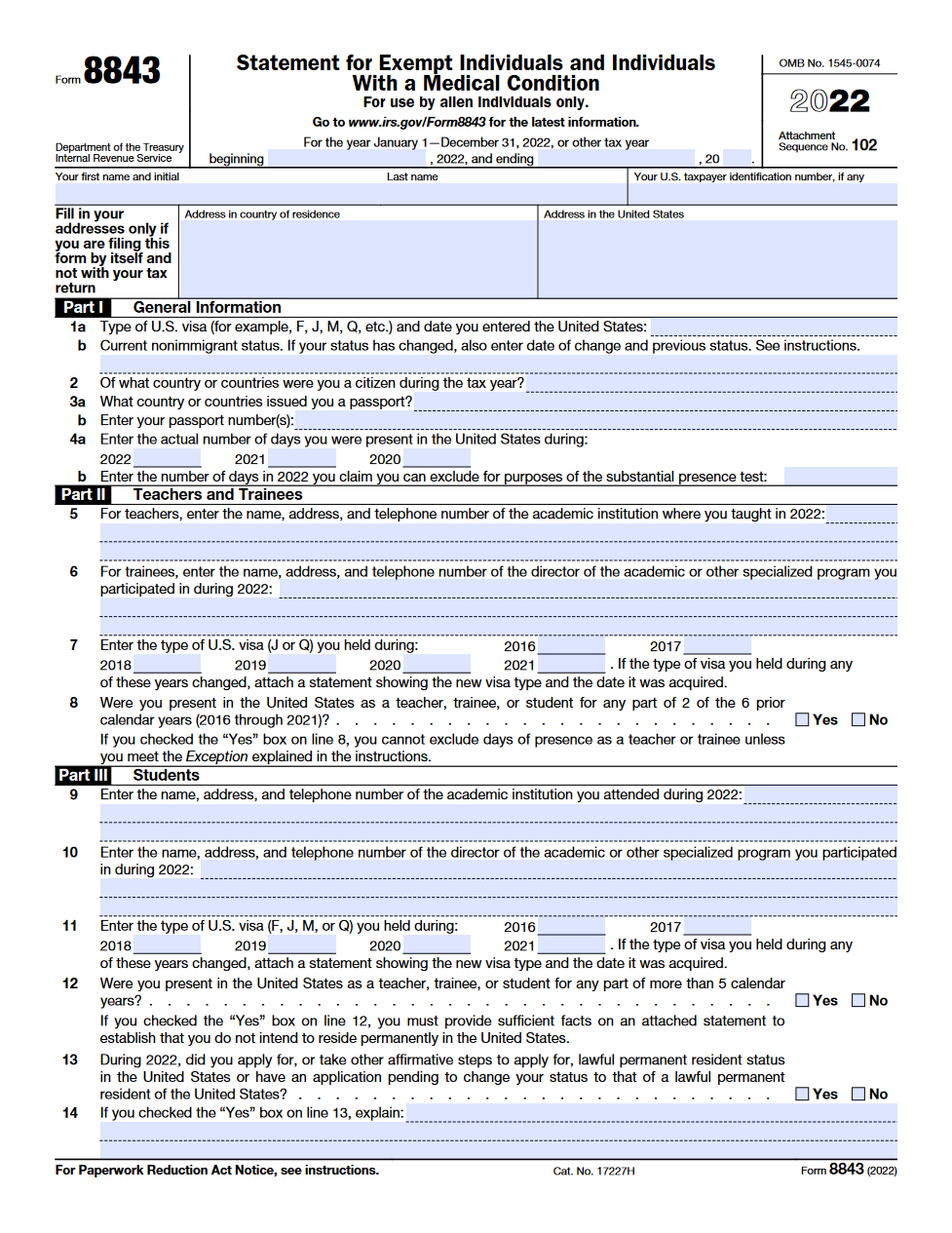

Form 8843 Æ•™Å¸ - What is a form 8843 and who must file one? Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8843 is statement for exempt individuals and individuals with a medical condition. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Tax calculations due to exempt status or a medical condition. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Mail your tax return by the due date (including extensions) to the address shown in. It is an informational statement required by the irs for. Form 8843 is not a u.s.

Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Form 8843 is statement for exempt individuals and individuals with a medical condition. Mail your tax return by the due date (including extensions) to the address shown in. Form 8843 is not a u.s. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. It is an informational statement required by the irs for. Tax calculations due to exempt status or a medical condition. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. What is a form 8843 and who must file one?

It is an informational statement required by the irs for. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. What is a form 8843 and who must file one? Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Source income in the taxable year (and thereby an. Mail your tax return by the due date (including extensions) to the address shown in. Tax calculations due to exempt status or a medical condition. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent. Form 8833 is a form. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for.

Form_8843_for_Scholars Government Of The United States United

Source income in the taxable year (and thereby an. Form 8843 is statement for exempt individuals and individuals with a medical condition. What is a form 8843 and who must file one? Form 8843 is not a u.s. Form 8833 is a form.

Form 8843 정의와 제출 방법은? [2024] Sprintax

Tax calculations due to exempt status or a medical condition. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Mail your tax return by the due date (including extensions) to the address shown in. Form 8833 is a form. Form 8843 department of the treasury internal revenue service.

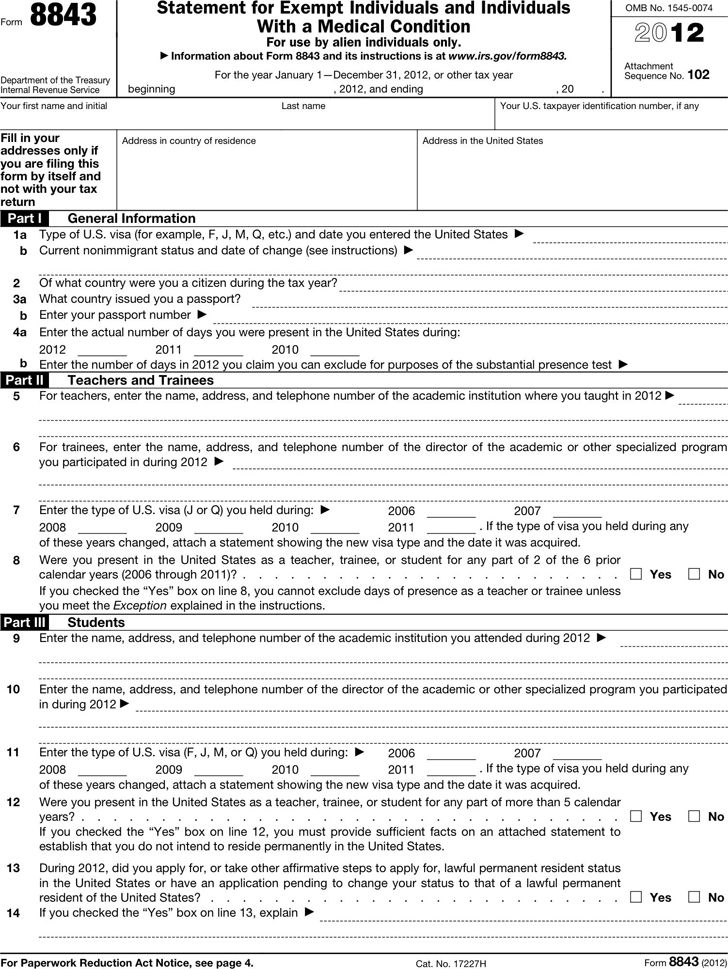

Free 2012 8843 Form PDF 99KB 4 Page(s)

Form 8843 is statement for exempt individuals and individuals with a medical condition. Source income in the taxable year (and thereby an. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Form 8843 is not a u.s. It is an informational statement required by the irs for.

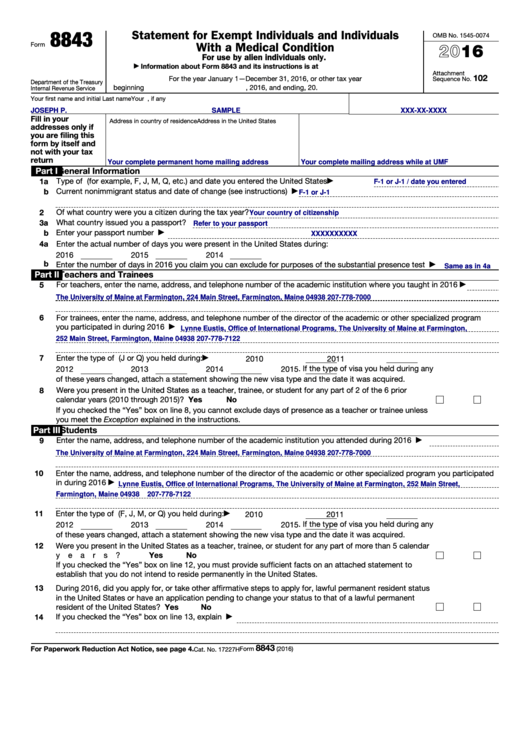

Form 8843 Fillable Printable Forms Free Online

It is an informational statement required by the irs for. What is a form 8843 and who must file one? Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition.

Still Haven't Filed Your Taxes? 5 Tax Tips for LastMinute Filers

Mail your tax return by the due date (including extensions) to the address shown in. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Form 8843 is statement for exempt individuals and individuals with a medical condition. What is a form 8843 and who must file one? Source income in the taxable year.

Form 8843留学生报税必填表格 Tax Panda

Form 8843 is not a u.s. Source income in the taxable year (and thereby an. Mail your tax return by the due date (including extensions) to the address shown in. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. What is a form 8843 and who must file one?

IRS Form 8843 Editable and Printable Statement to Fill out

Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8833 is a form. Tax calculations due to exempt status or a medical condition. Source income in the taxable year (and thereby an. Form 8843 is not a u.s.

Do I need to file Form 8843

Mail your tax return by the due date (including extensions) to the address shown in. Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8843 is statement for exempt individuals and individuals with a medical condition. Form 8843 is not a u.s. Instructions to file form 8843.

Form 8843 2019 PDF

Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for. Source income in the taxable year (and thereby an. Instructions to file form 8843 if you are a nonresident.

IRS Form 8843. Statement for Exempt Individuals and Individuals with a

Form 8843 is not a u.s. Form 8833 is a form. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Form 8843 is statement for exempt individuals and individuals with a medical condition. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent.

Form 8833 Is A Form.

Form 8843 is not a u.s. Tax calculations due to exempt status or a medical condition. Instructions to file form 8843 if you are a nonresident tax filer and have no u.s. Source income in the taxable year (and thereby an.

Form 8843 Is Statement For Exempt Individuals And Individuals With A Medical Condition.

Form 8843 is a statement for exempt individuals who use to show they are not counting their days within the us. Mail your tax return by the due date (including extensions) to the address shown in. It is an informational statement required by the irs for. Information about form 8843, statement for exempt individuals and individuals with a medical condition, including recent.

What Is A Form 8843 And Who Must File One?

Form 8843 department of the treasury internal revenue service statement for exempt individuals and individuals with a medical condition for.

![Form 8843 정의와 제출 방법은? [2024] Sprintax](https://blog.sprintax.com/wp-content/uploads/2021/01/KO-form-8843-1536x864.jpg)