Additional Car Insurance Coverage

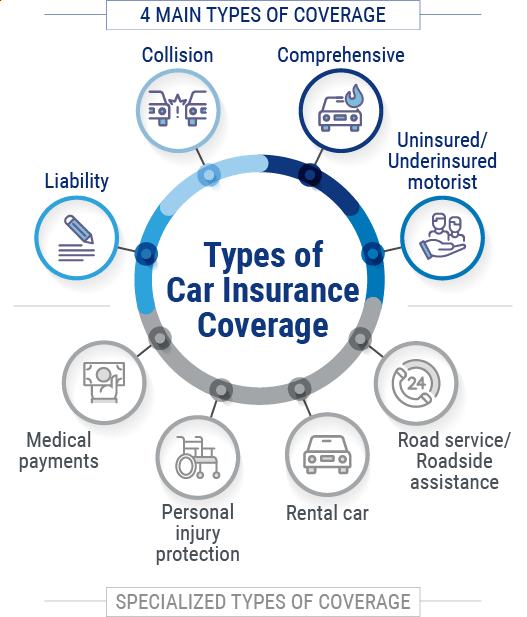

Additional Car Insurance Coverage - Additional car insurance coverage options car insurance companies offer several optional coverage types that you can buy to tailor a policy to suit your needs. This coverage is required by most states to legally drive your. Physical damage coverage, i.e., collision and. Personalize your car insurance with the coverages you need. Depending on the carrier, other optional coverage types may include roadside assistance, rental car reimbursement, new car replacement, gap insurance and accident. Geico has several discount opportunities for car insurance including savings for good students with a grade average b+, federal employees, or safe drivers. Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. The most basic type of car insurance coverage, liability, covers another driver's injuries or property damage if you're found liable for an accident, up to the limits of your policy. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. There are many to choose from, and offerings vary by insurer.

There’s no such thing as. Learn about types of auto insurance coverage with geico. Here are some common ones you’re likely to. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. The most basic type of car insurance coverage, liability, covers another driver's injuries or property damage if you're found liable for an accident, up to the limits of your policy. Liability and physical damage protection. Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. Liability coverage protects other drivers and their property from damage you cause. This coverage is required by most states to legally drive your. Comprehensive and collision coverage, which are optional, can help.

Comprehensive and collision coverage, which are optional, can help. Liability coverage protects other drivers and their property from damage you cause. Personalize your car insurance with the coverages you need. Car insurance coverage can be divided into two primary categories: Geico has several discount opportunities for car insurance including savings for good students with a grade average b+, federal employees, or safe drivers. Learn more about additional savings →. Learn about types of auto insurance coverage with geico. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. Depending on the carrier, other optional coverage types may include roadside assistance, rental car reimbursement, new car replacement, gap insurance and accident. Additional car insurance coverage options car insurance companies offer several optional coverage types that you can buy to tailor a policy to suit your needs.

Top 10 AddOns as Chosen by Generali Malaysia's Car Insurance Customers

Liability and physical damage protection. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. Learn more about additional savings →. Comprehensive and collision.

Full Coverage Car Insurance Trusted Choice

Liability coverage protects other drivers and their property from damage you cause. Physical damage coverage, i.e., collision and. Car insurance coverage can be divided into two primary categories: There are many to choose from, and offerings vary by insurer. Learn about types of auto insurance coverage with geico.

When To Purchase Additional Car Insurance Coverage

Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. Most auto policies include several types of car insurance coverage, and each is designed to pay for different expenses that might come up after an accident. Physical damage coverage, i.e., collision and. The most basic.

3 Types of Car Insurance Coverage Explained Farnese Insurance Brokers

Physical damage coverage, i.e., collision and. Additional car insurance coverage options car insurance companies offer several optional coverage types that you can buy to tailor a policy to suit your needs. Here are some common ones you’re likely to. Most auto policies include several types of car insurance coverage, and each is designed to pay for different expenses that might.

All you ought to know about comprehensive car insurance coverage

The most basic type of car insurance coverage, liability, covers another driver's injuries or property damage if you're found liable for an accident, up to the limits of your policy. Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. This coverage is required by.

Automobile Insurance What Additional Coverage Should be Purchased

Geico has several discount opportunities for car insurance including savings for good students with a grade average b+, federal employees, or safe drivers. Car insurance coverage can be divided into two primary categories: Learn more about additional savings →. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault..

7 Types of Car Insurance You Should Consider [Infographic]

Depending on the carrier, other optional coverage types may include roadside assistance, rental car reimbursement, new car replacement, gap insurance and accident. There’s no such thing as. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. There are many to choose from, and offerings vary by insurer. How.

Additional Cover Options in Car Insurance that You Should Know About

Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. The most basic type of car insurance coverage, liability, covers another driver's injuries or property damage if you're found liable for an accident, up to the limits of your policy. Learn about types of auto insurance coverage with geico..

Important additional vehicle insurance cover All Things Charlie

Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. Most auto policies include several types of car insurance coverage, and each is designed to pay for different expenses that might come up after an accident. There are many to choose from, and offerings vary.

Pros And Cons of Getting Additional Car Insurance Coverage

Depending on the carrier, other optional coverage types may include roadside assistance, rental car reimbursement, new car replacement, gap insurance and accident. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault. Geico has several discount opportunities for car insurance including savings for good students with a grade average.

The Most Basic Type Of Car Insurance Coverage, Liability, Covers Another Driver's Injuries Or Property Damage If You're Found Liable For An Accident, Up To The Limits Of Your Policy.

This coverage is required by most states to legally drive your. Liability coverage protects other drivers and their property from damage you cause. Car insurance coverage can be divided into two primary categories: Personalize your car insurance with the coverages you need.

How Much Coverage Do You Need?

Geico has several discount opportunities for car insurance including savings for good students with a grade average b+, federal employees, or safe drivers. There are many to choose from, and offerings vary by insurer. Additional coverages — such as uninsured motorist, roadside assistance, and rental reimbursement — are worth considering, especially if you depend on your car for work. Liability coverage may pay for property damage and/or injuries to another person caused by an accident in which you're at fault.

Physical Damage Coverage, I.e., Collision And.

Most auto policies include several types of car insurance coverage, and each is designed to pay for different expenses that might come up after an accident. Learn about types of auto insurance coverage with geico. Here are some common ones you’re likely to. Liability and physical damage protection.

Additional Car Insurance Coverage Options Car Insurance Companies Offer Several Optional Coverage Types That You Can Buy To Tailor A Policy To Suit Your Needs.

Learn more about additional savings →. There’s no such thing as. Comprehensive and collision coverage, which are optional, can help. Depending on the carrier, other optional coverage types may include roadside assistance, rental car reimbursement, new car replacement, gap insurance and accident.

![7 Types of Car Insurance You Should Consider [Infographic]](http://www.infogrades.com/wp-content/uploads/2016/03/7-Types-of-Car-Insurance-You-Should-Consider-Infographic.jpg)