Adjusted Gross Income

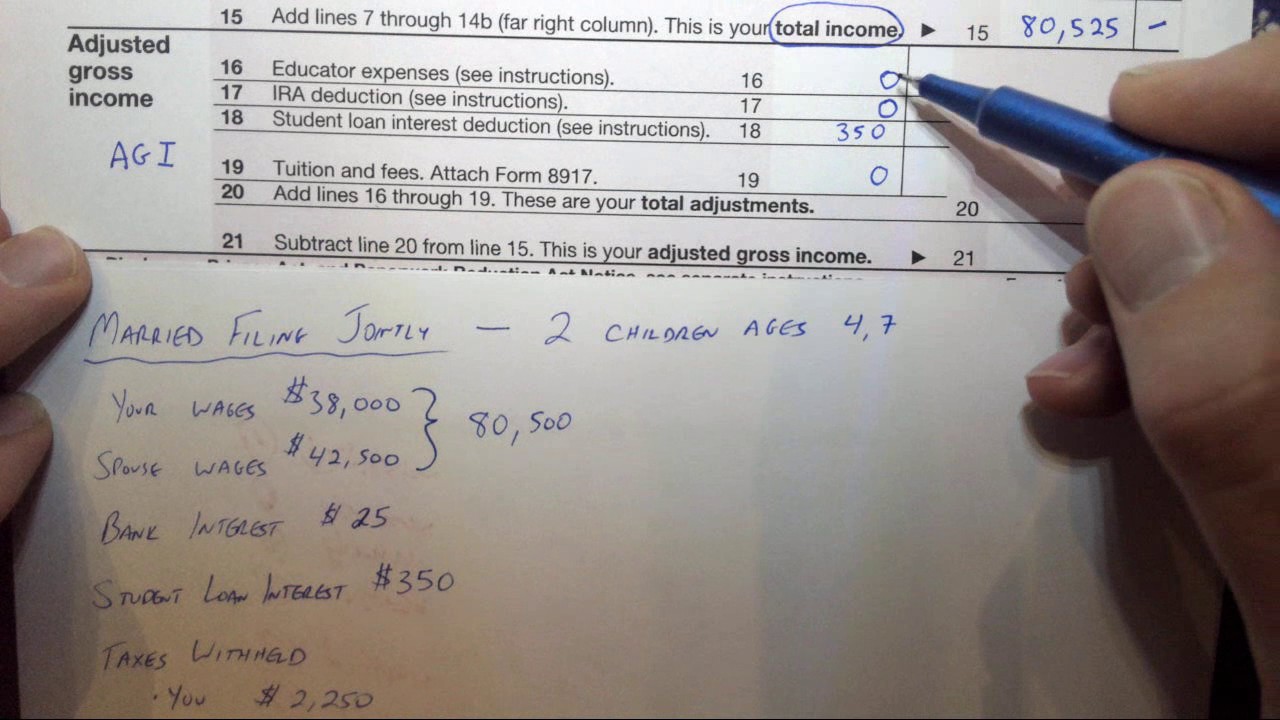

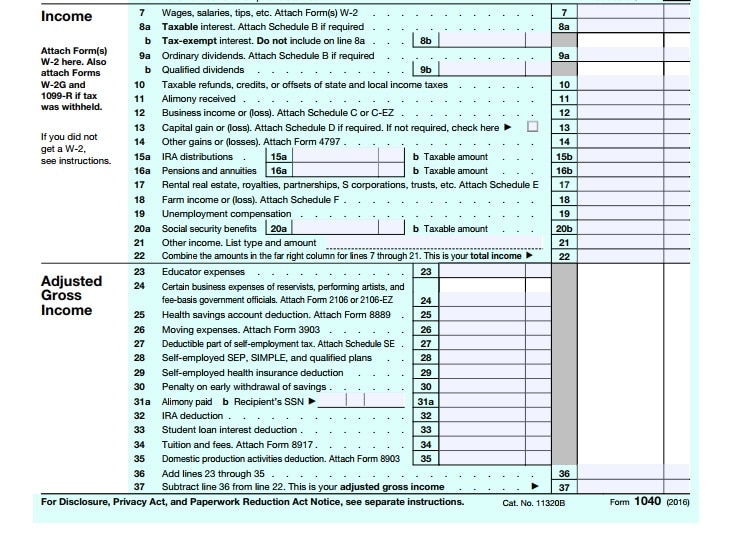

Adjusted Gross Income - Gross income includes wages, dividends,. The number is your total taxable income for the. Adjusted gross income, also known as (agi), is defined as total income minus deductions, or adjustments to income that you are eligible to take. Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine your income taxes owed for the year. Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. It refers generally to your annual gross income. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use it for their.

Gross income includes wages, dividends,. Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use it for their. Adjusted gross income, also known as (agi), is defined as total income minus deductions, or adjustments to income that you are eligible to take. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. The number is your total taxable income for the. It refers generally to your annual gross income. Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine your income taxes owed for the year.

Gross income includes wages, dividends,. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use it for their. It refers generally to your annual gross income. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine your income taxes owed for the year. Adjusted gross income, also known as (agi), is defined as total income minus deductions, or adjustments to income that you are eligible to take. The number is your total taxable income for the. Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return.

Key Facts You Need to Know About Definitions for Marketplace and

Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. The irs defines adjusted gross income as “gross.

You may want to read this about What Is An Adjusted Gross For Fafsa

Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine your income taxes owed for the year. The number is your total taxable income for the. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use.

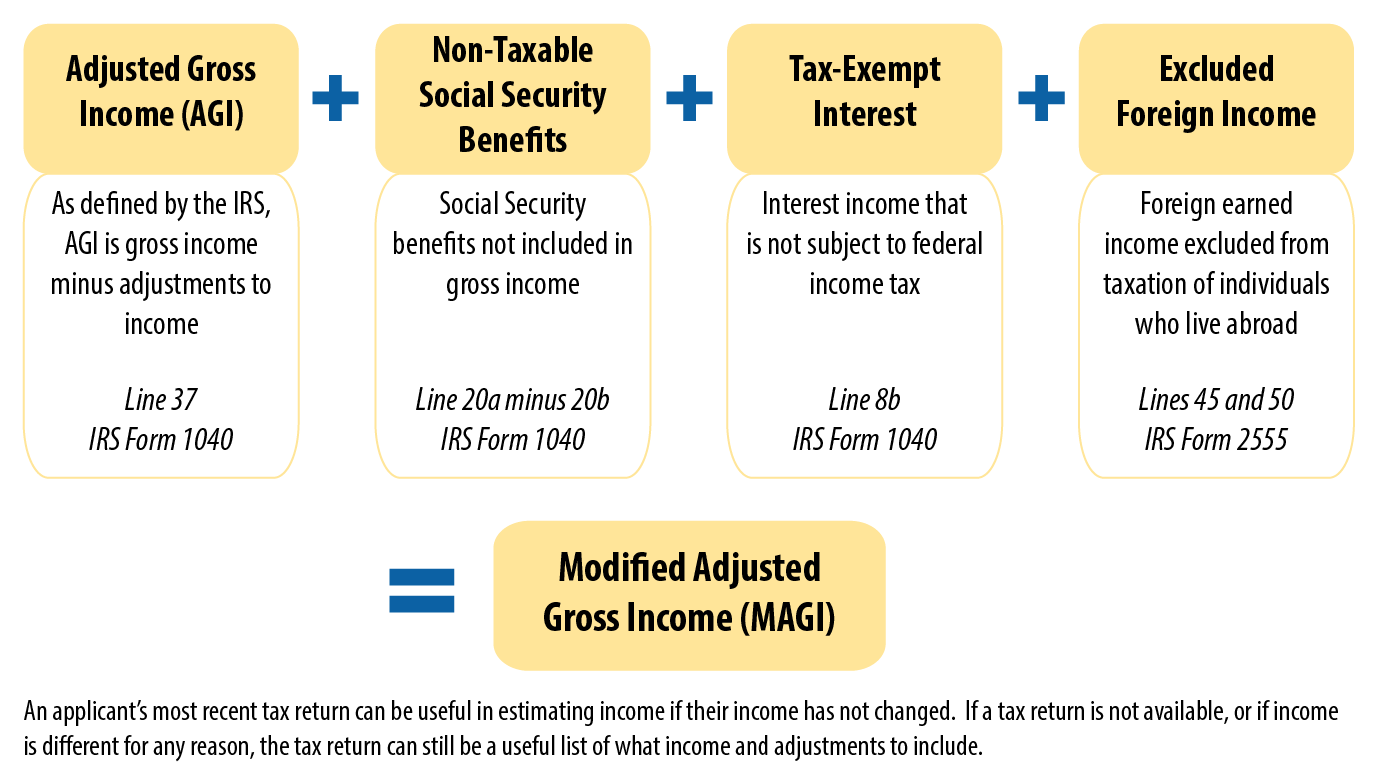

Modified Adjusted Gross under the Affordable Care Act UPDATED

Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. Adjusted gross income, also known as (agi), is.

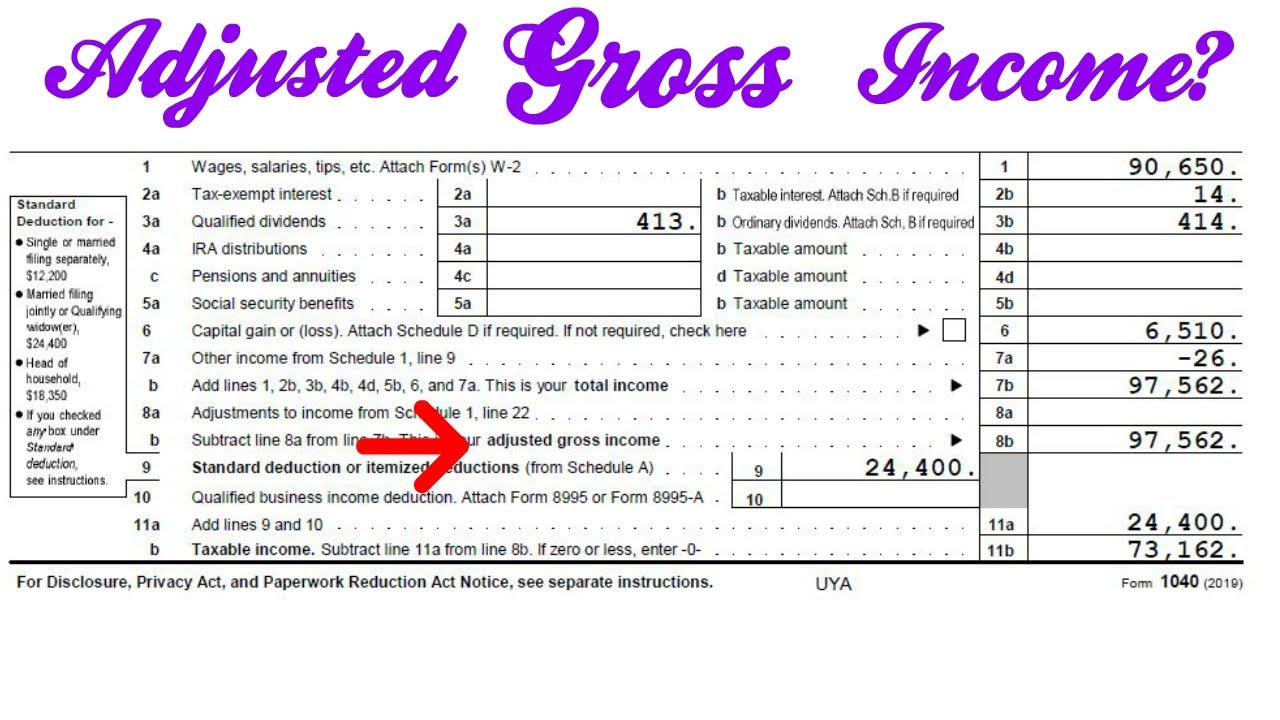

How To Find Out Agi Apartmentairline8

The number is your total taxable income for the. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use it for their. Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine your income taxes owed.

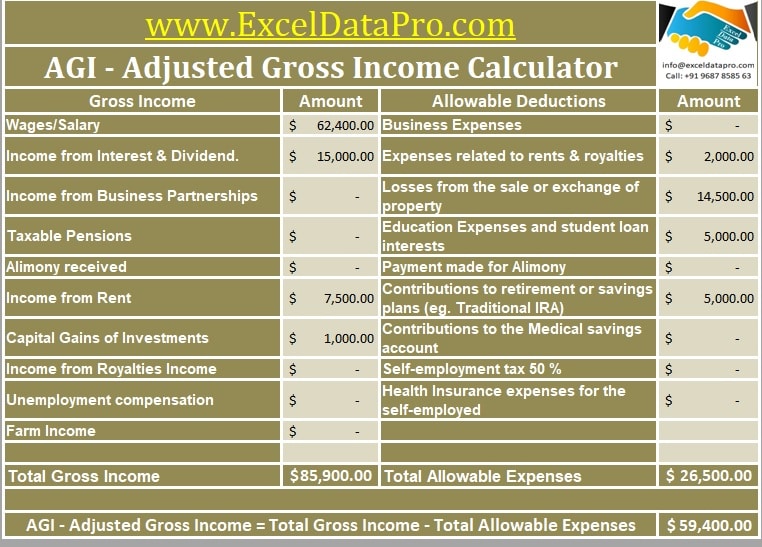

What is AGI Adjusted Gross ExcelDataPro

Adjusted gross income, also known as (agi), is defined as total income minus deductions, or adjustments to income that you are eligible to take. Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. The number is your total taxable income for the. Gross income.

Download Modified Adjusted Gross Calculator Excel Template

Adjusted gross income, also known as (agi), is defined as total income minus deductions, or adjustments to income that you are eligible to take. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. Adjusted gross income (agi) is the number that the.

What Is Modified Adjusted Gross For Medicare?

The number is your total taxable income for the. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. It refers generally to your annual gross income. Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine.

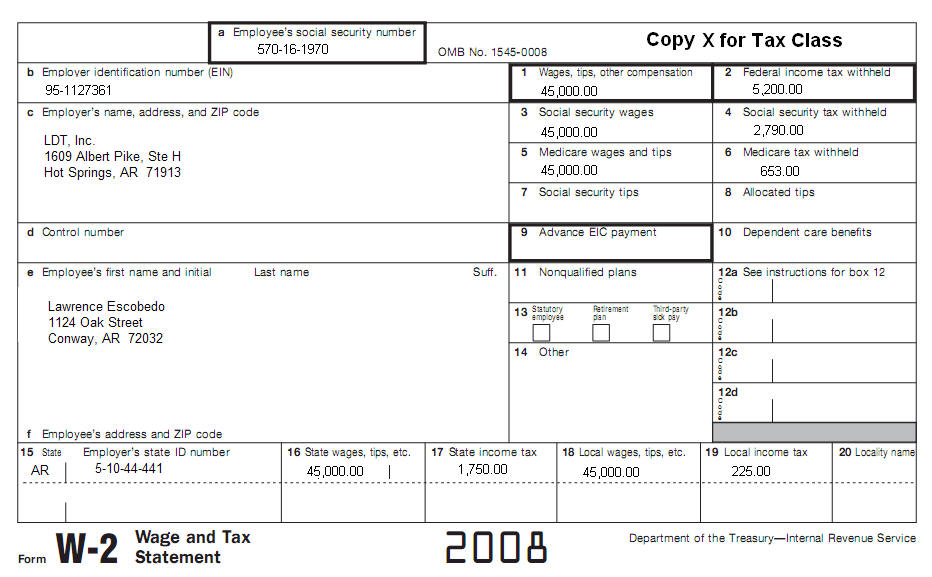

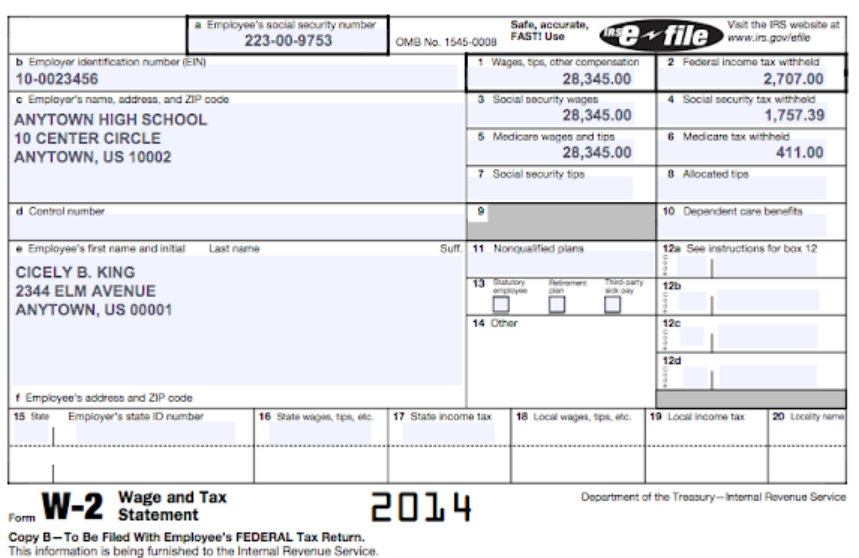

Adjusted gross on w2 cidad

Adjusted gross income (agi) is the number that the internal revenue service (irs) uses to determine your income taxes owed for the year. The number is your total taxable income for the. Gross income includes wages, dividends,. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest,.

What is Adjusted Gross Qualify for the Coronavirus Economic

It refers generally to your annual gross income. Adjusted gross income, also known as (agi), is defined as total income minus deductions, or adjustments to income that you are eligible to take. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use.

This is your federal adjusted gross 915,729,293

Gross income includes wages, dividends,. Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. Adjusted gross income,.

Adjusted Gross Income (Agi) Is The Number That The Internal Revenue Service (Irs) Uses To Determine Your Income Taxes Owed For The Year.

Your adjusted gross income (agi) is your total (gross) income from all sources minus certain adjustments such as educator expenses, student loan interest, alimony payments and retirement. Gross income includes wages, dividends,. It refers generally to your annual gross income. The number is your total taxable income for the.

Adjusted Gross Income, Also Known As (Agi), Is Defined As Total Income Minus Deductions, Or Adjustments To Income That You Are Eligible To Take.

Adjusted gross income, or agi, is a term you're likely to come across when working with tax documents or when filing your annual tax return. The irs defines adjusted gross income as “gross income minus adjustments to income.” it’s a number that is included on your federal tax form, and many states use it for their.