Can Irs Debt Be Discharged In Chapter 7

Can Irs Debt Be Discharged In Chapter 7 - A discharge releases you (the debtor) from. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop. Find out if you can discharge or pay your irs tax debts in chapter. Discharge of chapter 7 debt. Learn how bankruptcy affects your tax obligations and rights. Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for.

Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. Find out if you can discharge or pay your irs tax debts in chapter. Discharge of chapter 7 debt. Learn how bankruptcy affects your tax obligations and rights. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop.

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Discharge of chapter 7 debt. Find out if you can discharge or pay your irs tax debts in chapter. Learn how bankruptcy affects your tax obligations and rights. A discharge releases you (the debtor) from. Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop.

Can You File Bankruptcy on Medical Bills? Randolph Law Firm

Find out if you can discharge or pay your irs tax debts in chapter. Discharge of chapter 7 debt. Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. When you file a bankruptcy case, an injunction.

Can IRS debt be discharged in Chapter 13?

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. A discharge releases you (the debtor) from. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop. Find out if you can discharge or pay your irs tax debts in chapter. Learn how.

Chapter 13 Bankruptcy Can IRS Debt be Discharged? Internal Revenue

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Discharge of chapter 7 debt. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop. Learn how bankruptcy affects your tax obligations and rights. A discharge releases you (the debtor) from.

What Is a Bankruptcy Discharge?

A discharge releases you (the debtor) from. Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. Find out if you can discharge or pay your irs tax debts in chapter. Learn how bankruptcy affects your tax obligations and rights. Discharge of chapter 7 debt.

Can back taxes be discharged in chapter 7?

Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. A discharge releases you (the debtor) from. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Learn how bankruptcy affects your tax obligations and rights. Discharge of chapter 7 debt.

Which Debts Are Discharged in Chapter 7 Bankruptcy? Best Bankruptcy

At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Discharge of chapter 7 debt. Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. Find out if you can discharge or pay your irs tax debts in chapter. Learn how bankruptcy affects your tax obligations and.

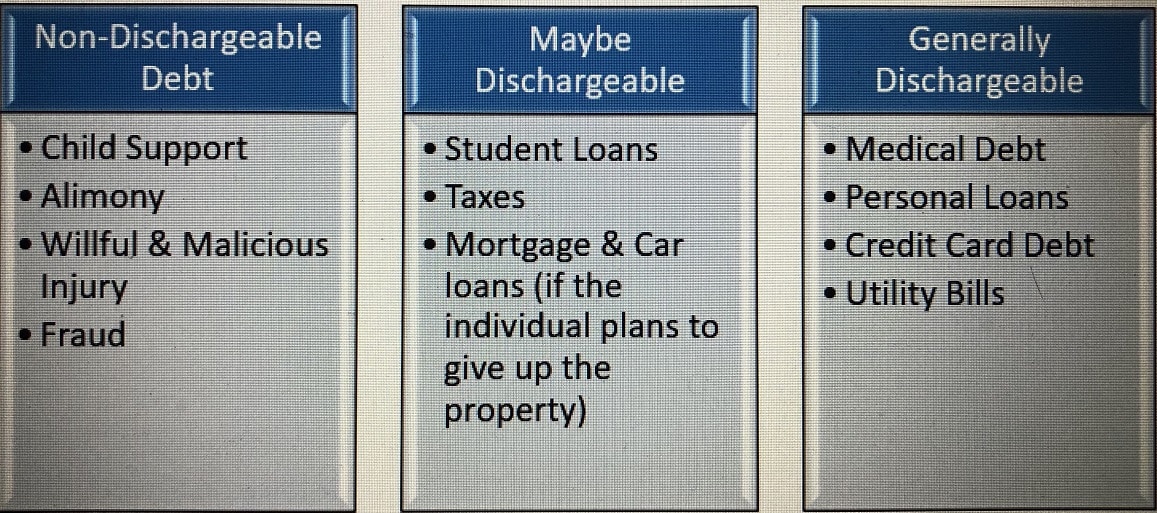

What Debt Can't Be Discharged Through Bankruptcy? DebtStoppers

Learn how bankruptcy affects your tax obligations and rights. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Discharge of chapter 7 debt. Find out if you can discharge or pay your irs tax debts in chapter. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay.

Can You File Bankruptcy On IRS Debt?

Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop. Find out if you can discharge or pay your irs tax debts in chapter. At the conclusion of your chapter.

Chapter 7 Bankruptcy 24 Hour Legal Advice Ask A Lawyer Live Chat

Learn how bankruptcy affects your tax obligations and rights. When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop. A discharge releases you (the debtor) from. Discharge of chapter 7 debt. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt.

Using Chapter 13 to Deal With Overdue Taxes

When you file a bankruptcy case, an injunction (a type of court order) called the automatic stay goes into effect to stop. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt. Learn how bankruptcy affects your tax obligations and rights. Find out if you can discharge or pay your irs tax debts in chapter..

A Discharge Releases You (The Debtor) From.

Under 11 usc 727, discharge is available to individuals in chapter 7 cases unless there are grounds for. Find out if you can discharge or pay your irs tax debts in chapter. Learn how bankruptcy affects your tax obligations and rights. At the conclusion of your chapter 7 bankruptcy you will receive a discharge of debt.

When You File A Bankruptcy Case, An Injunction (A Type Of Court Order) Called The Automatic Stay Goes Into Effect To Stop.

Discharge of chapter 7 debt.

:max_bytes(150000):strip_icc()/bankruptcy-discharge-what-is-it-and-when-does-it-happen-8eafb0f711c24a048d4854a82cdb5f70.png)