Education Credits From Form 8863

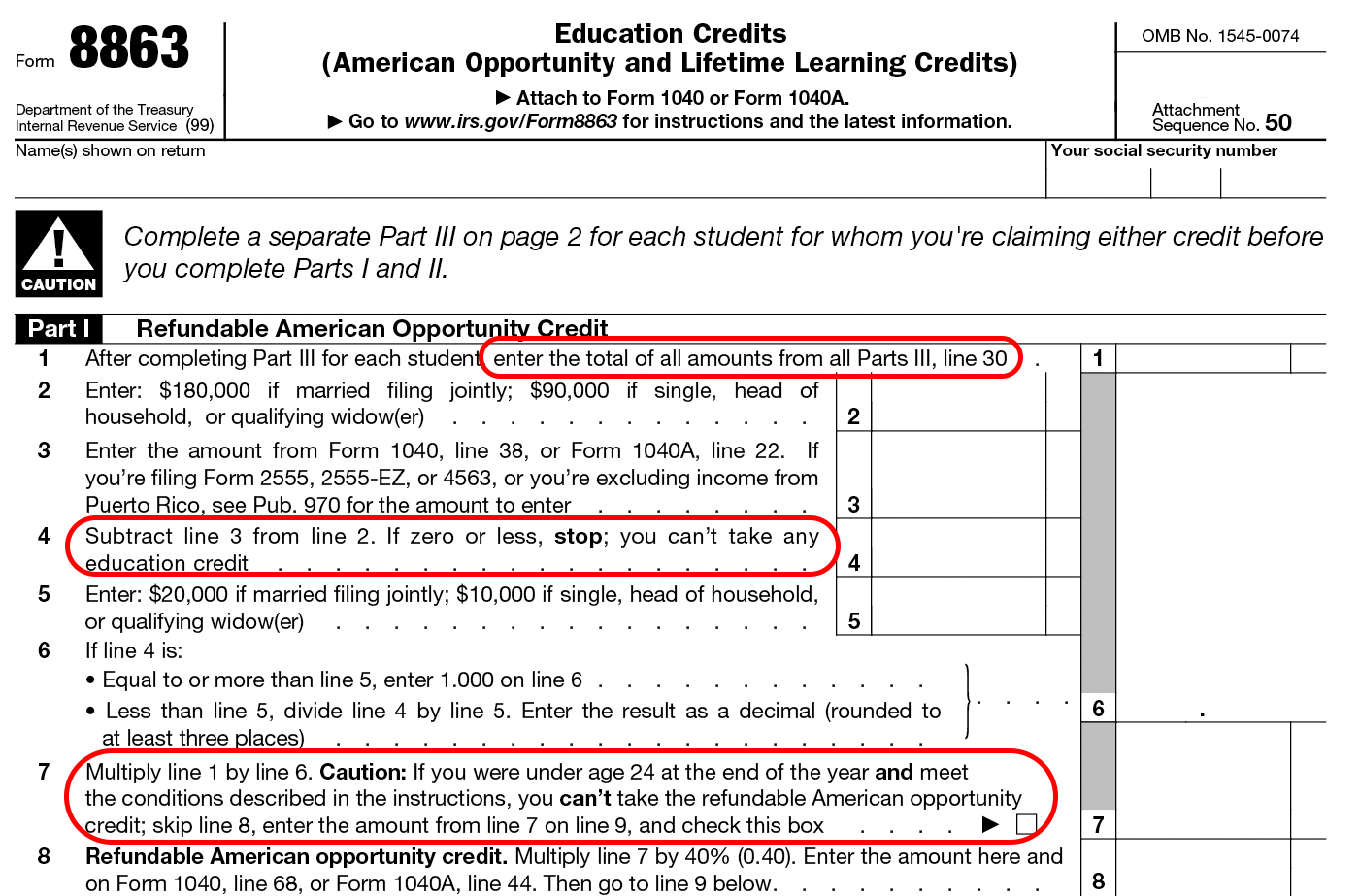

Education Credits From Form 8863 - Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Form 8863, education credits, is used to determine eligibility and figure each credit. Irs form 8863 allows taxpayers to claim two primary education tax credits: The american opportunity credit and the lifetime. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning.

Form 8863, education credits, is used to determine eligibility and figure each credit. Irs form 8863 allows taxpayers to claim two primary education tax credits: Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. The american opportunity credit and the lifetime.

Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. The american opportunity credit and the lifetime. Form 8863, education credits, is used to determine eligibility and figure each credit. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863 allows taxpayers to claim two primary education tax credits:

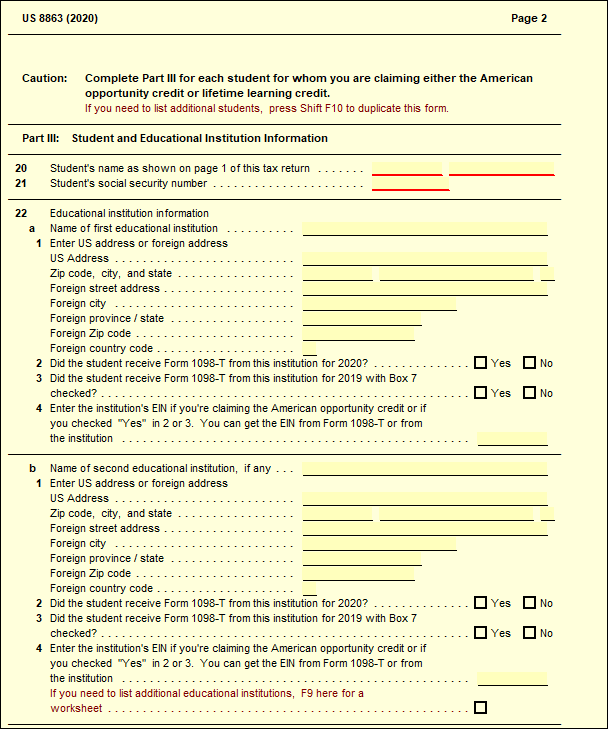

Appendix A (Continued)Form 8863 Education Credits (Hope and Lifetime

The american opportunity credit and the lifetime. Irs form 8863 allows taxpayers to claim two primary education tax credits: Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit.

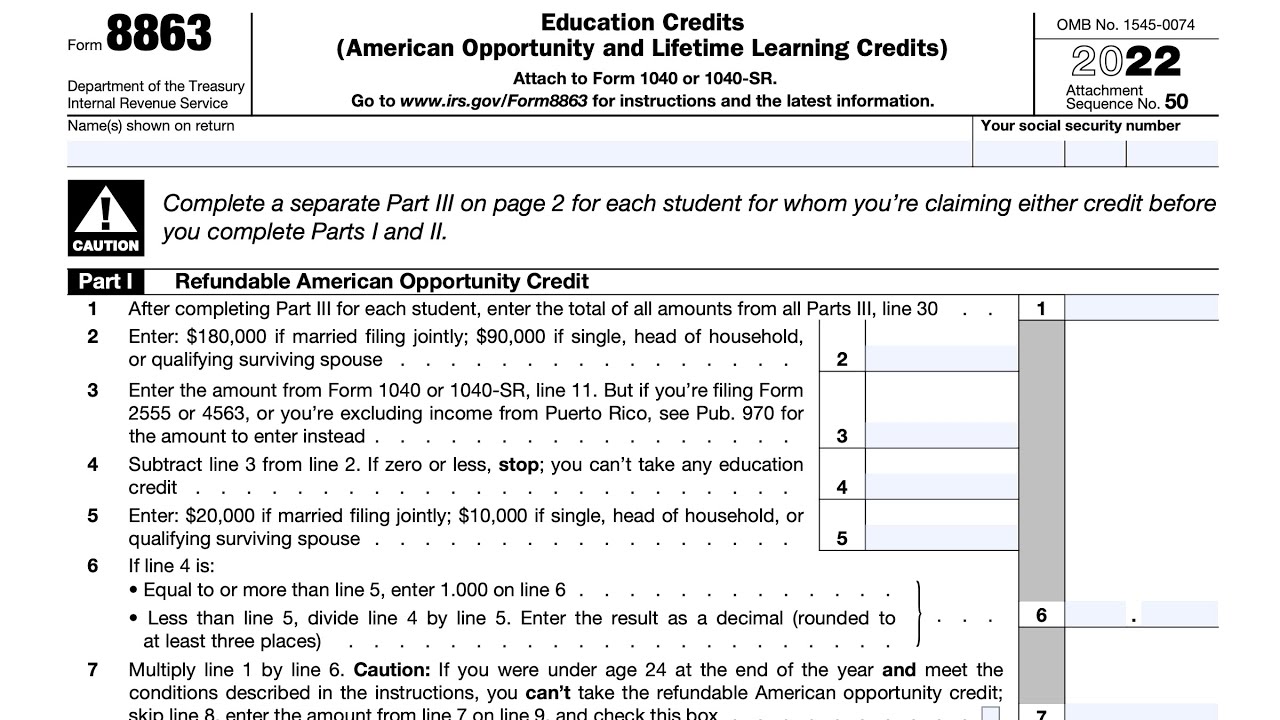

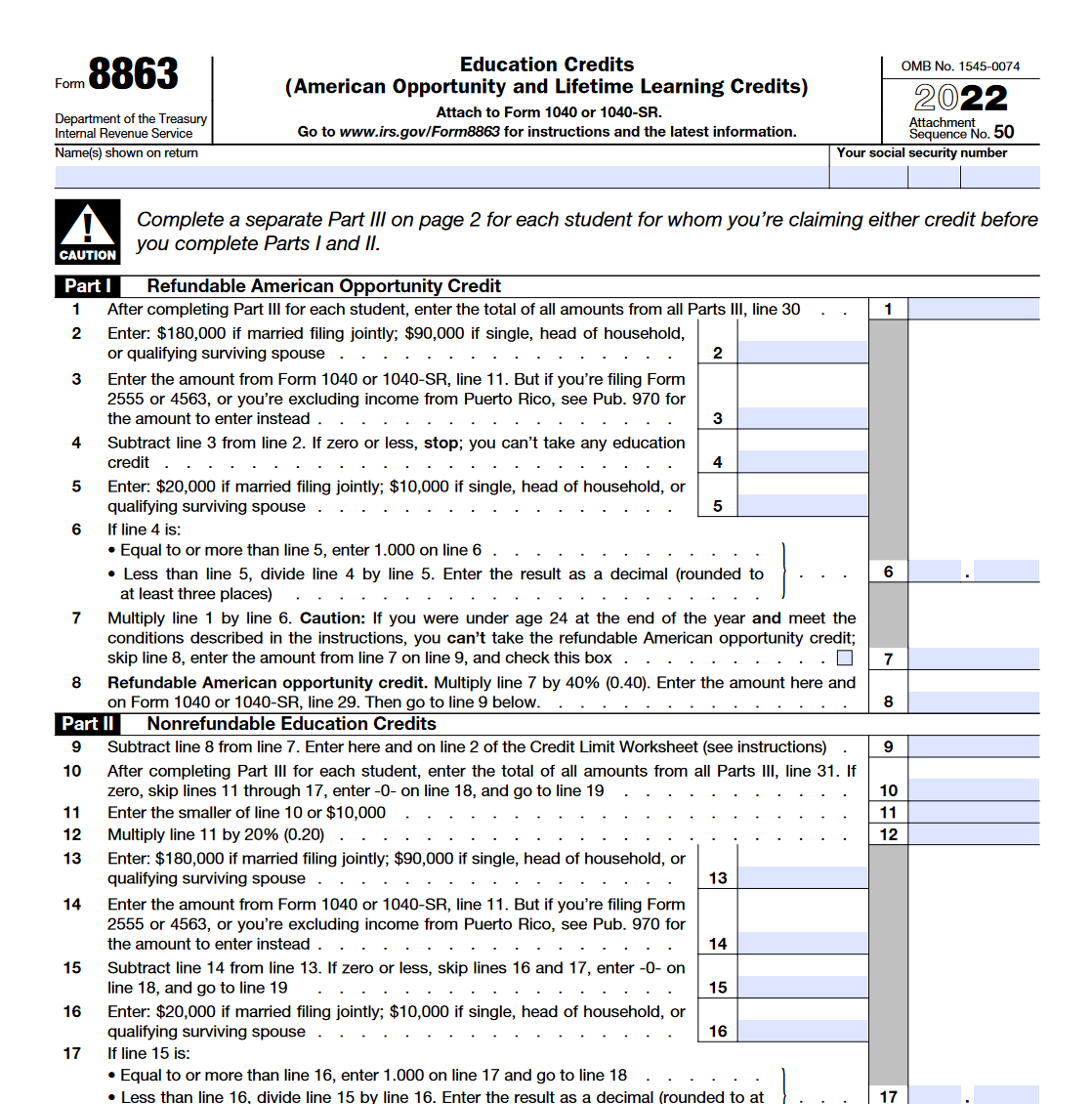

IRS Form 8863 Instructions

Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. The american opportunity credit and the lifetime. Irs form 8863 allows taxpayers to claim two.

Printable Form 8863

The american opportunity credit and the lifetime. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Form 8863, education credits, is used to determine eligibility and figure each credit. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and.

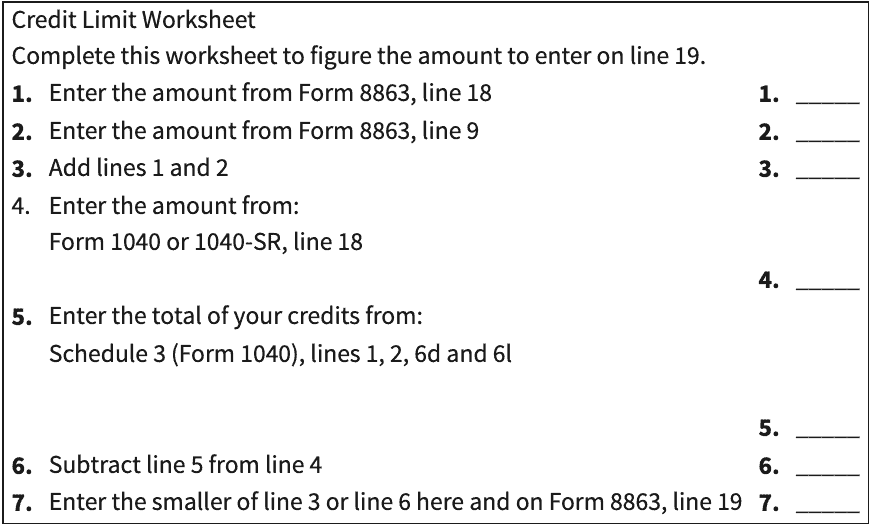

Form 8863 Credit Limit Worksheet 2023

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. The american opportunity credit and the lifetime. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Learn how to use form 8863 to calculate.

8863 Education Credits UltimateTax Solution Center

Irs form 8863 allows taxpayers to claim two primary education tax credits: The american opportunity credit and the lifetime. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Form 8863, education credits, is used to determine eligibility and figure each credit. Enter the amount from line 7.

IRS Form 8863 walkthrough (Education Credits) YouTube

Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Form 8863, education credits, is used to determine eligibility and figure each credit. Enter the.

Blank Form 8863 Fill Out and Print PDFs

Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Enter the amount from line 7 of the credit limit worksheet (see instructions) here.

IRS Form 8863. Education Credits Forms Docs 2023

Irs form 8863 allows taxpayers to claim two primary education tax credits: Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. Learn how to use form 8863 to calculate and claim your education credits, such as the american opportunity credit and the lifetime learning. Form 8863,.

Form 8863 Education Credits (American Opportunity and Lifetime

Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. The american opportunity credit and the lifetime. Form 8863, education credits, is used to determine eligibility and figure each credit. Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education.

Understanding Form 8863 Complete Guide on Unlocking Education Credits

Irs form 8863 allows taxpayers to claim two primary education tax credits: The american opportunity credit and the lifetime. Enter the amount from line 7 of the credit limit worksheet (see instructions) here and on schedule 3 (form 1040),. Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc).

Learn How To Use Form 8863 To Calculate And Claim Your Education Credits, Such As The American Opportunity Credit And The Lifetime Learning.

Irs form 8863, titled “education credits,” is a vital document for taxpayers seeking to claim the american opportunity tax credit (aotc) and the. The american opportunity credit and the lifetime. Irs form 8863 allows taxpayers to claim two primary education tax credits: Use form 8863 to figure and claim your education credits, which are based on adjusted qualified education expenses paid to an eligible.

Enter The Amount From Line 7 Of The Credit Limit Worksheet (See Instructions) Here And On Schedule 3 (Form 1040),.

Form 8863, education credits, is used to determine eligibility and figure each credit.