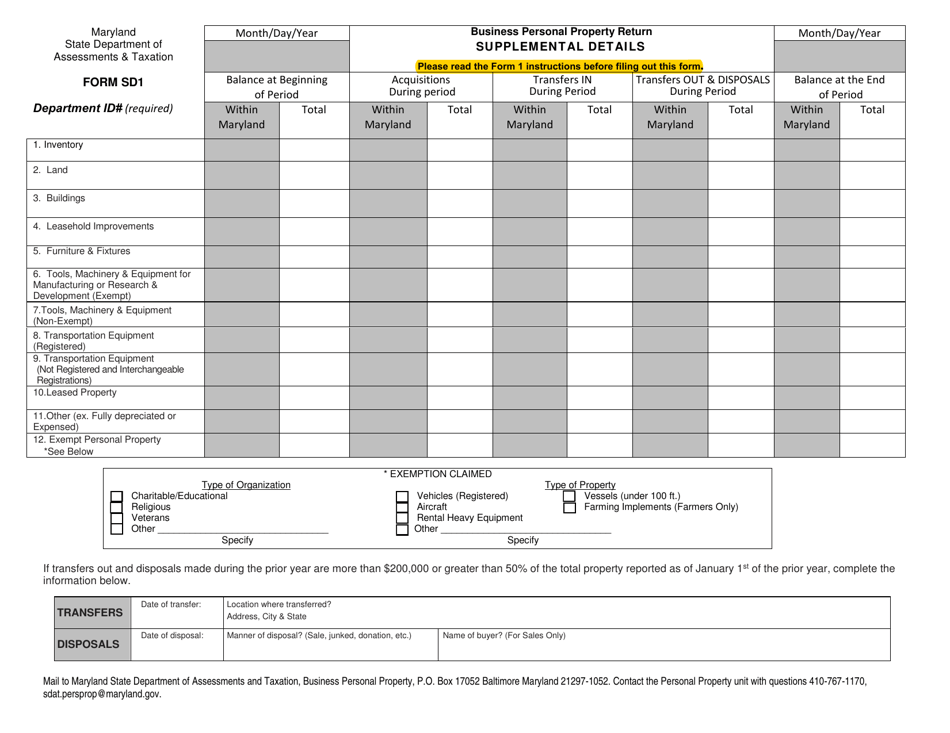

Form Sd 1 Maryland

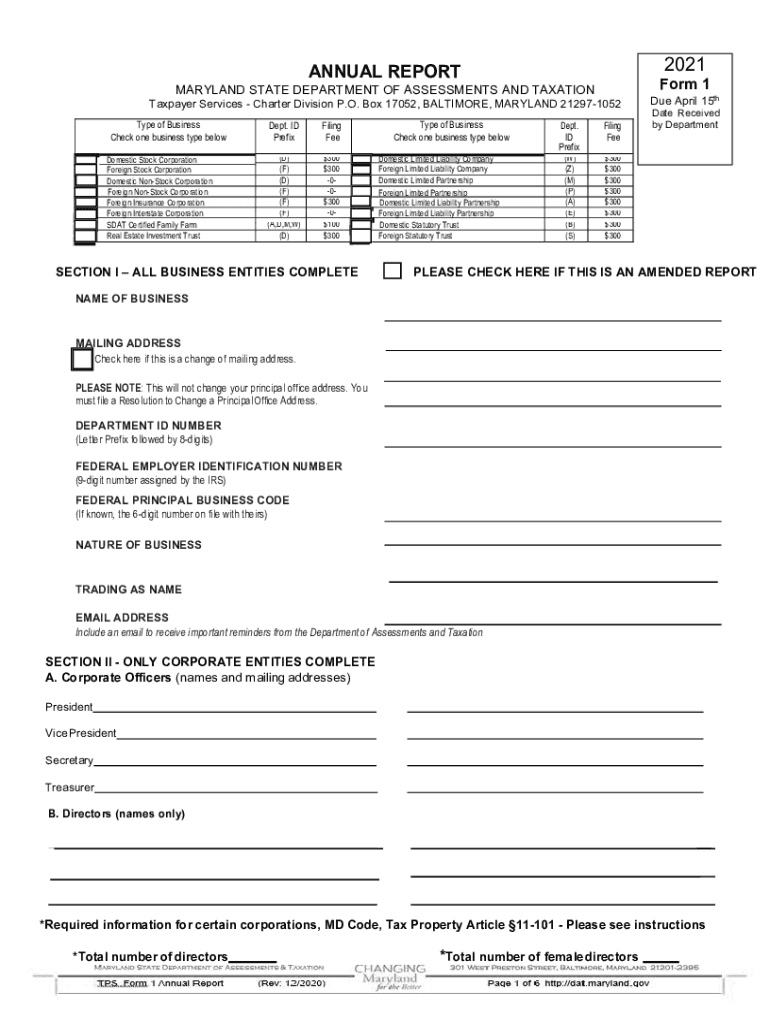

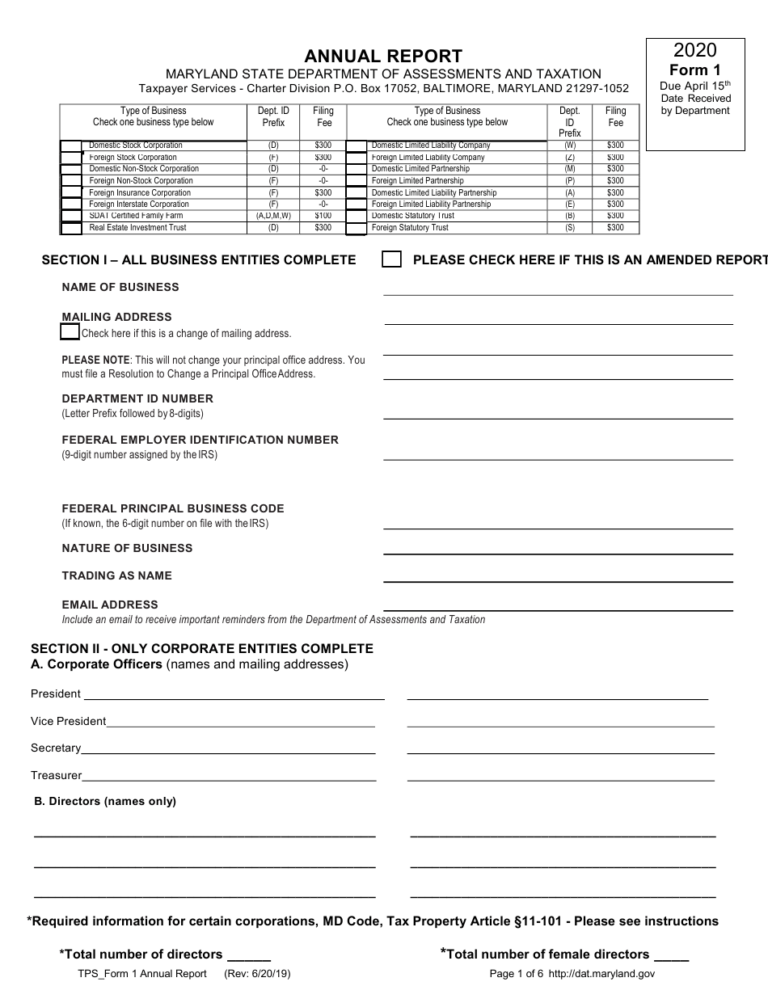

Form Sd 1 Maryland - Log into maryland business express at any time to check registration or order status. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Nonprofit organizations (called “nonstock corporations” in maryland) must. Easy online tool to enable maryland residents to. Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. Form 1, annual report & business personal property return. What is the form my nonprofit organization must complete? An annual report must be filed by all business entities formed, qualified or.

Log into maryland business express at any time to check registration or order status. Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. An annual report must be filed by all business entities formed, qualified or. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Form 1, annual report & business personal property return. Nonprofit organizations (called “nonstock corporations” in maryland) must. What is the form my nonprofit organization must complete? Easy online tool to enable maryland residents to.

What is the form my nonprofit organization must complete? Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. An annual report must be filed by all business entities formed, qualified or. Log into maryland business express at any time to check registration or order status. Easy online tool to enable maryland residents to. Nonprofit organizations (called “nonstock corporations” in maryland) must. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Form 1, annual report & business personal property return.

Math SD (16) PDF Multiplication Academic Term

Easy online tool to enable maryland residents to. Nonprofit organizations (called “nonstock corporations” in maryland) must. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. An annual report must be filed by all business entities formed, qualified or. Log into maryland business express at any time to check.

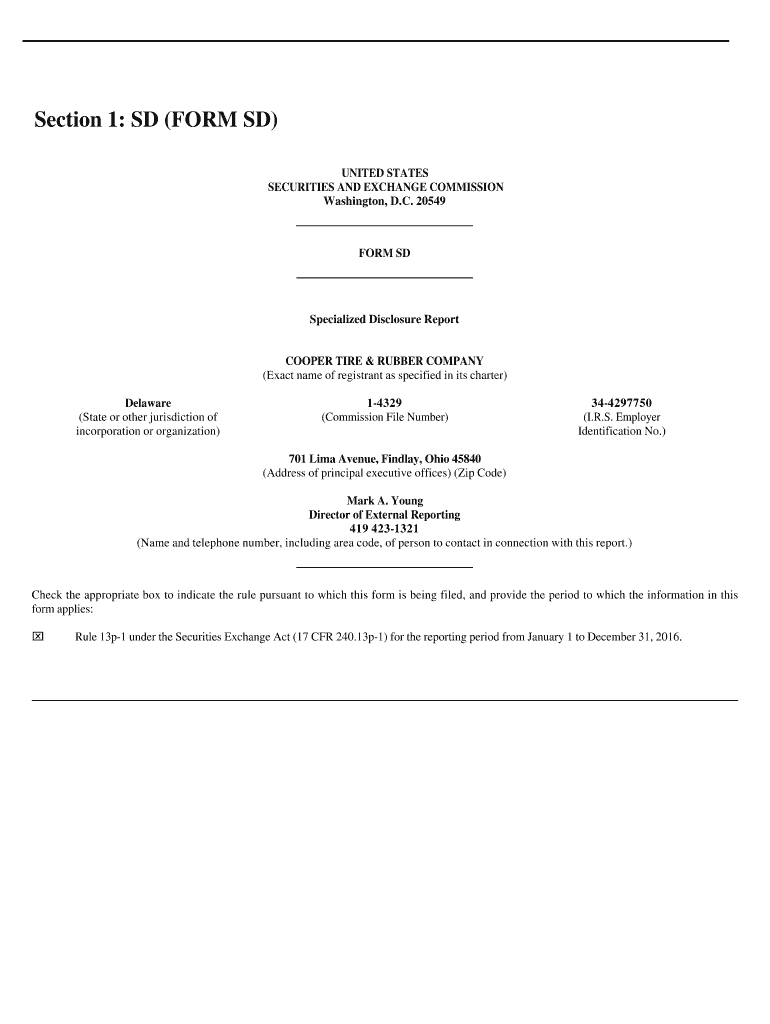

Fillable Online Section 1 SD (FORM SD) Fax

Form 1, annual report & business personal property return. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. An annual report must be filed by all business entities formed, qualified or. Nonprofit organizations (called “nonstock corporations” in maryland) must. What is the form my nonprofit organization must complete?

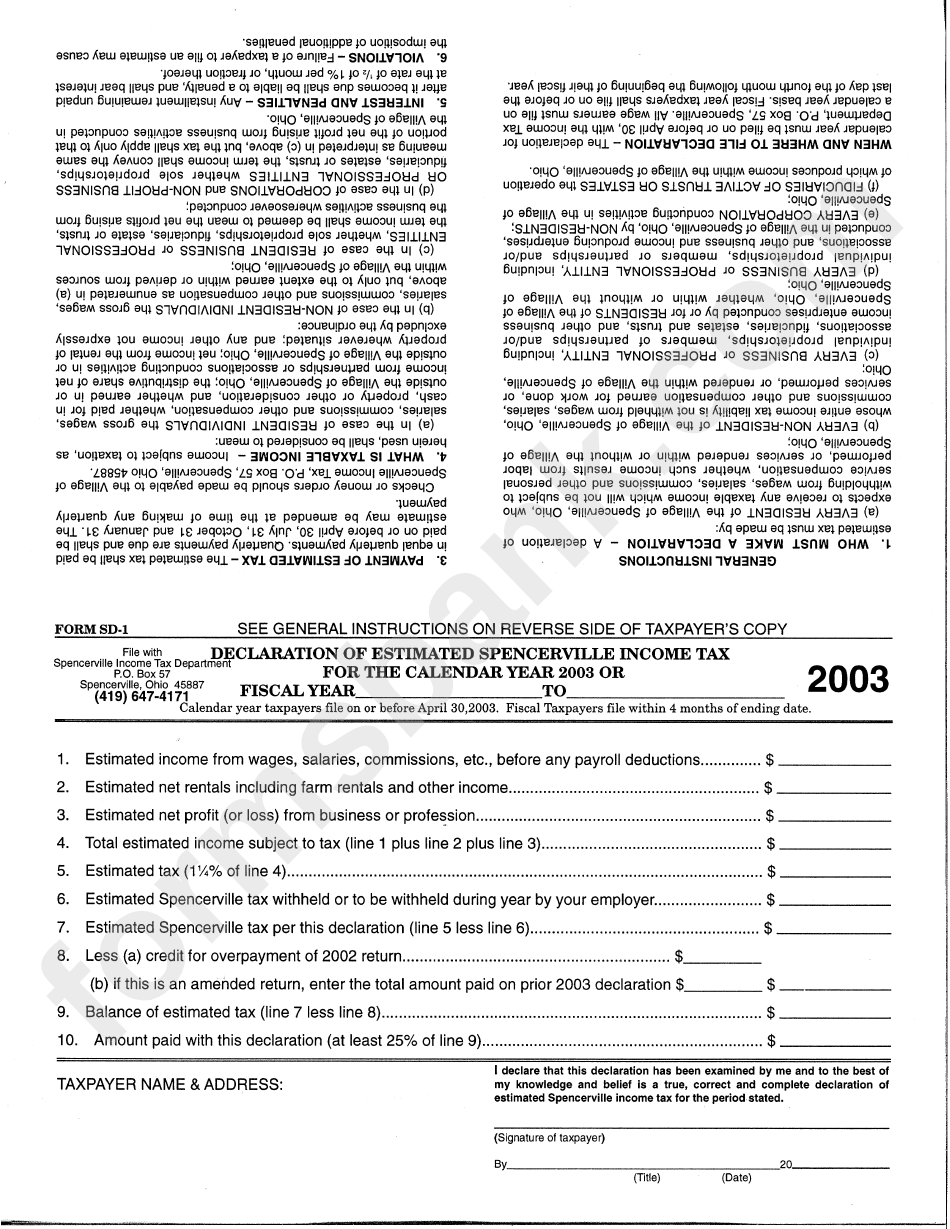

Form Sd1 Declaration Of Estimated Spencerville Tax For The

Form 1, annual report & business personal property return. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Log into maryland business express at any time to check registration or order status. An annual report must be filed by all business entities formed, qualified or. What is the.

Sd 100 form Fill out & sign online DocHub

Log into maryland business express at any time to check registration or order status. Form 1, annual report & business personal property return. Nonprofit organizations (called “nonstock corporations” in maryland) must. What is the form my nonprofit organization must complete? The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax.

Fillable Online Form SD 2021 As filed Fax Email Print pdfFiller

The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. An annual report must be filed by all business entities formed, qualified or. Nonprofit organizations (called “nonstock corporations” in maryland) must. Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. Form.

Ohio Form Sd 101 ≡ Fill Out Printable PDF Forms Online

The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Form 1, annual report & business personal property return. Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. An annual report must be filed by all business entities formed, qualified or..

Maryland Form Sd 1 2023 Printable Forms Free Online

The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. Nonprofit organizations (called “nonstock corporations” in maryland) must. An annual report must be filed by all business entities formed, qualified or. Form.

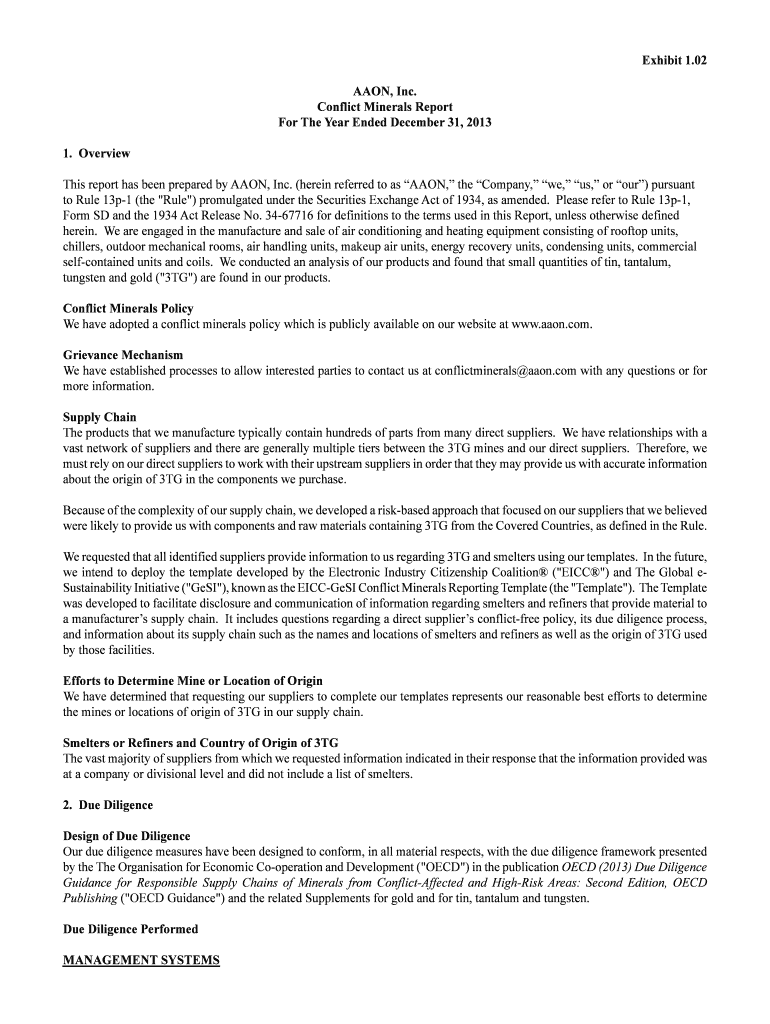

Fillable Online 2013 Form SD AAON, Inc. Fax Email Print pdfFiller

The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. What is the form my nonprofit organization must complete? Log into maryland business express at any time to check registration or order status. Form 1, annual report & business personal property return. Easy online tool to enable maryland residents.

2023 Md Form 1 Printable Forms Free Online

Nonprofit organizations (called “nonstock corporations” in maryland) must. What is the form my nonprofit organization must complete? Log into maryland business express at any time to check registration or order status. Form 1, annual report & business personal property return. Easy online tool to enable maryland residents to.

2022 Form 1 Annual Report Maryland

Form 1, annual report & business personal property return. The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. What is the form my nonprofit organization must complete? Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. Log into maryland business.

An Annual Report Must Be Filed By All Business Entities Formed, Qualified Or.

The personal property division information page of the sdat web site contains links to forms and instructions, brochures, exemptions, tax rate. Nonprofit organizations (called “nonstock corporations” in maryland) must. Log into maryland business express at any time to check registration or order status. Form 1, annual report & business personal property return.

Easy Online Tool To Enable Maryland Residents To.

Please mail completed forms to maryland state department of assessments and taxation, business personal property, 700 e. What is the form my nonprofit organization must complete?