How To Categorize Tax Refund In Quickbooks

How To Categorize Tax Refund In Quickbooks - Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. I have just the steps that'll help you record the liability refund. If you want to know. The steps below will guide you through the process: Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks.

To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. The steps below will guide you through the process: In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. If you want to know. I have just the steps that'll help you record the liability refund. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks.

How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. The steps below will guide you through the process: I have just the steps that'll help you record the liability refund. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. If you want to know. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds.

How To Categorize a Tax Refund In QuickBooks

I have just the steps that'll help you record the liability refund. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks..

How To Categorize a Tax Refund In QuickBooks

Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. The steps below will guide you through the process: To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. Categorizing tax refunds in quickbooks involves specific steps to.

How to Categorize a Tax Refund in QuickBooks Online

I have just the steps that'll help you record the liability refund. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks. Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. The steps below will guide you through the process:.

How To Categorize A Refund In Quickbooks

How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks. The steps below will guide you through the process: If you want to know. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. I have just the steps that'll help you record the liability refund.

How To Categorize a Tax Refund In QuickBooks

To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. If you want to know. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks. In quickbooks.

How To Categorize a Tax Refund In QuickBooks

In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks. If you want to know. I have just the steps that'll help you record the liability refund. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate.

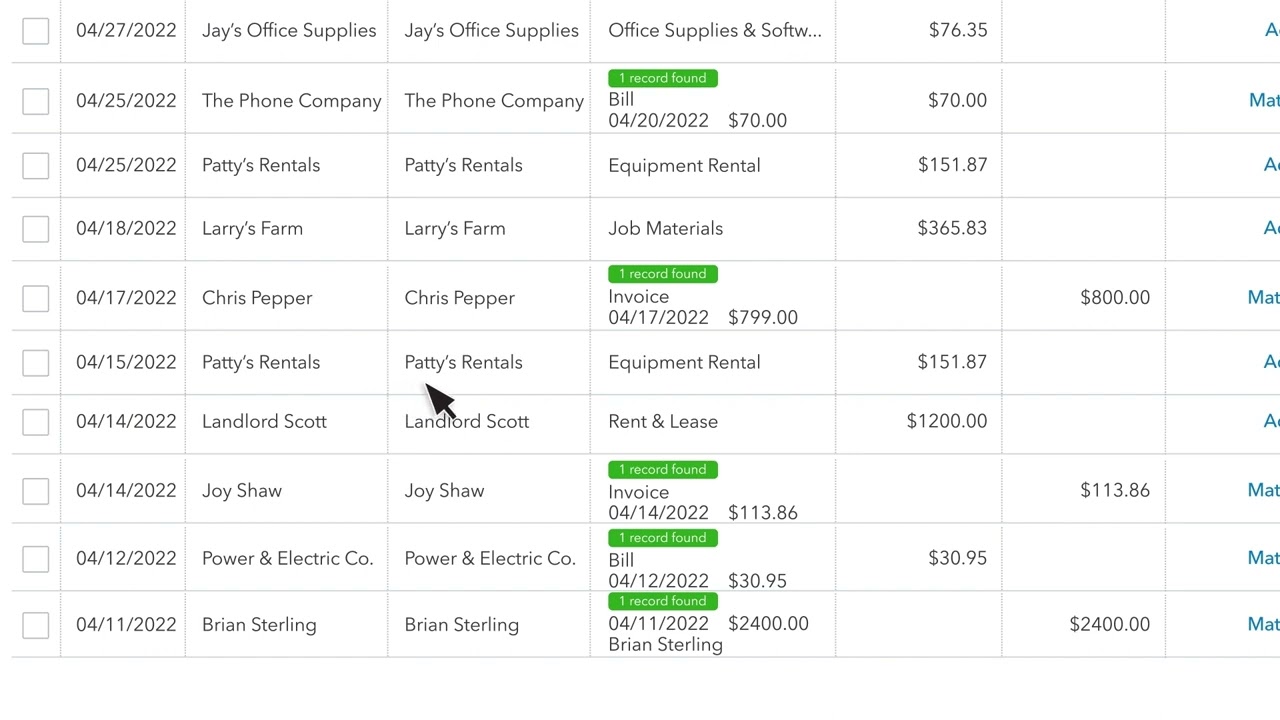

How to Categorise Transactions in QuickBooks Online Introduction to

If you want to know. The steps below will guide you through the process: Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. In quickbooks online, tax refunds should be categorized.

How To Categorize a Tax Refund In QuickBooks

If you want to know. Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. I have just the steps that'll help you record the liability refund. The.

How To Categorize a Tax Refund In QuickBooks

To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Learn how to record tax refunds in quickbooks online and desktop, and choose the appropriate income account for different types of refunds. The steps below.

How to Categorize a Tax Refund in QuickBooks Online

I have just the steps that'll help you record the liability refund. Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. The steps below will guide you through the process: To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system. How to categorize.

Learn How To Record Tax Refunds In Quickbooks Online And Desktop, And Choose The Appropriate Income Account For Different Types Of Refunds.

The steps below will guide you through the process: If you want to know. I have just the steps that'll help you record the liability refund. To categorize a refund in quickbooks, start by creating a refund receipt to accurately record the transaction within the system.

In Quickbooks Online, Tax Refunds Should Be Categorized Under Specific Income Accounts Designated For Refunds.

Categorizing tax refunds in quickbooks involves specific steps to ensure accurate representation of income and expenses. How to categorize refunds in quickbooksin this video we show you how to categorize refunds in quickbooks.