How To Do Reconciliation In Quickbooks

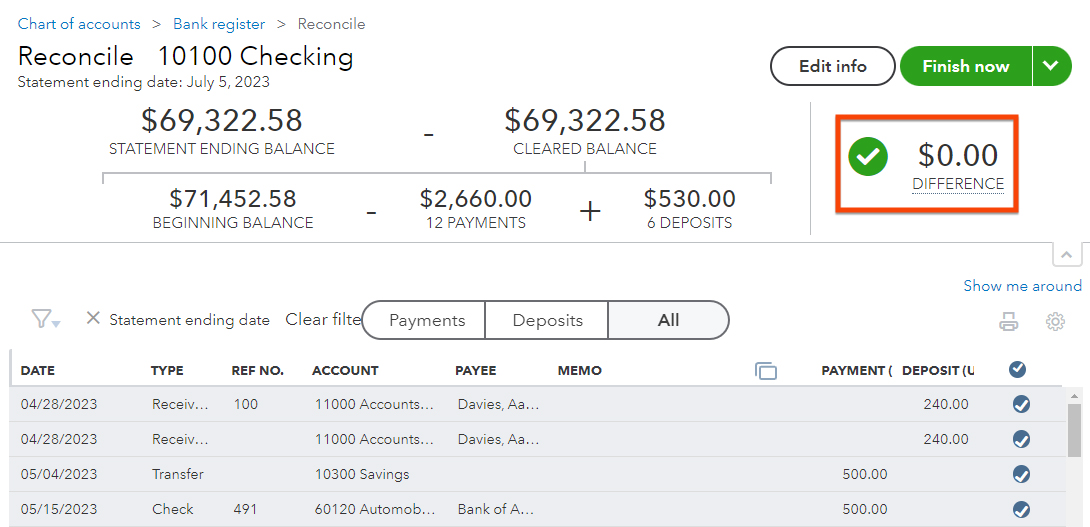

How To Do Reconciliation In Quickbooks - This step ensures that every transaction, whether it’s a deposit, expense, or. A bank reconciliation is a process of matching the balances in a business’s accounting records to the corresponding information on a bank statement. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. Learn how to reconcile your accounts so they always match your bank and credit card statements. Just like balancing your checkbook, you need to review your accounts in quickbooks to make sure they match your bank. Learn how to reconcile your accounts so they match your bank and credit card statements. The goal of the bank reconciliation process is to find out if. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. Here are some practical tips to enhance the efficiency of the reconciliation process.

Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. Learn how to reconcile your accounts so they match your bank and credit card statements. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. A bank reconciliation is a process of matching the balances in a business’s accounting records to the corresponding information on a bank statement. Here are some practical tips to enhance the efficiency of the reconciliation process. This step ensures that every transaction, whether it’s a deposit, expense, or. Just like balancing your checkbook, you need to review your accounts in quickbooks to make sure they match your bank. Learn how to reconcile your accounts so they always match your bank and credit card statements. The goal of the bank reconciliation process is to find out if.

Just like balancing your checkbook, you need to review your accounts in quickbooks to make sure they match your bank. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. The goal of the bank reconciliation process is to find out if. A bank reconciliation is a process of matching the balances in a business’s accounting records to the corresponding information on a bank statement. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. This step ensures that every transaction, whether it’s a deposit, expense, or. Learn how to reconcile your accounts so they always match your bank and credit card statements. Learn how to reconcile your accounts so they match your bank and credit card statements. Here are some practical tips to enhance the efficiency of the reconciliation process.

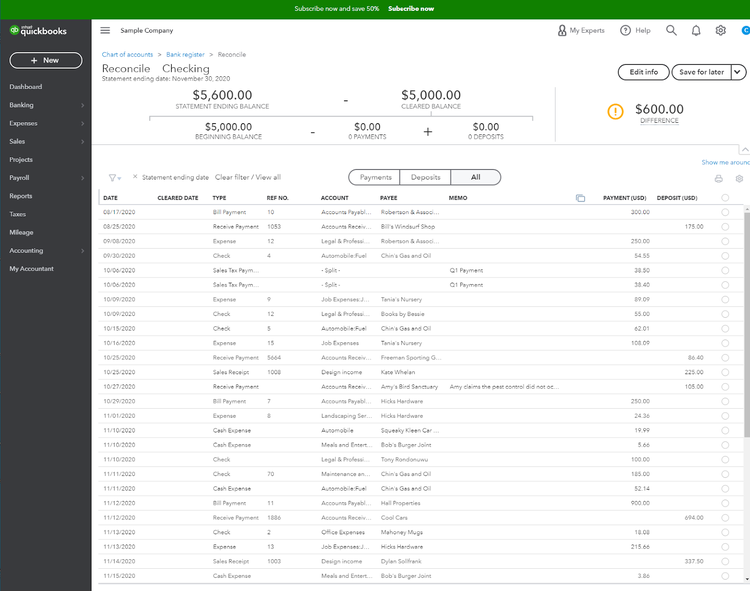

How to Reconcile Your Bank Statements in QuickBooks Online

Here are some practical tips to enhance the efficiency of the reconciliation process. Learn how to reconcile your accounts so they match your bank and credit card statements. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. This step ensures that every transaction, whether it’s a deposit, expense,.

How Do I Reconcile A Bank Statement In Quickbooks Online Bank Western

Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. Just like balancing your checkbook, you need to review your accounts in quickbooks to make sure they match your bank. Learn how to reconcile your accounts so they match your bank and credit card statements. The goal of the bank reconciliation process.

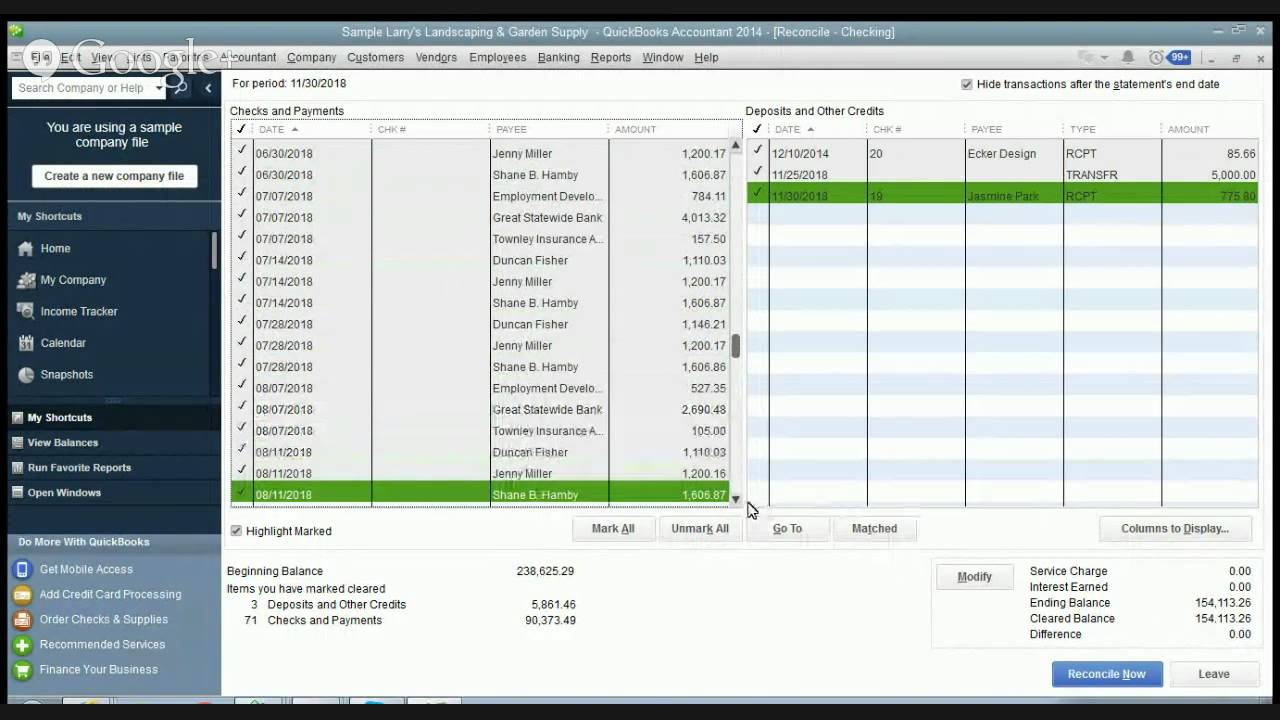

How to Do the Reconciliation in QuickBooks?

Here are some practical tips to enhance the efficiency of the reconciliation process. Just like balancing your checkbook, you need to review your accounts in quickbooks to make sure they match your bank. The goal of the bank reconciliation process is to find out if. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or.

Do bookkeeping, quotation, invoicing, reconciliation in quickbooks by

This step ensures that every transaction, whether it’s a deposit, expense, or. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. Here are some practical tips to enhance the efficiency of the reconciliation process. The goal of the bank reconciliation process is to find out if. Learn how to reconcile your.

How to Undo a Previous Bank Reconciliation in Quickbooks Online YouTube

Here are some practical tips to enhance the efficiency of the reconciliation process. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. Learn how to reconcile your accounts so they match your bank and credit card statements. Learn how to reconcile your accounts so they always match your.

How Do You Undo A Reconciliation In Quickbooks Online

The goal of the bank reconciliation process is to find out if. A bank reconciliation is a process of matching the balances in a business’s accounting records to the corresponding information on a bank statement. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. Quickbooks offers a robust set of tools.

How to Do the Reconciliation in QuickBooks?

This step ensures that every transaction, whether it’s a deposit, expense, or. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. Learn how to reconcile your accounts so they match.

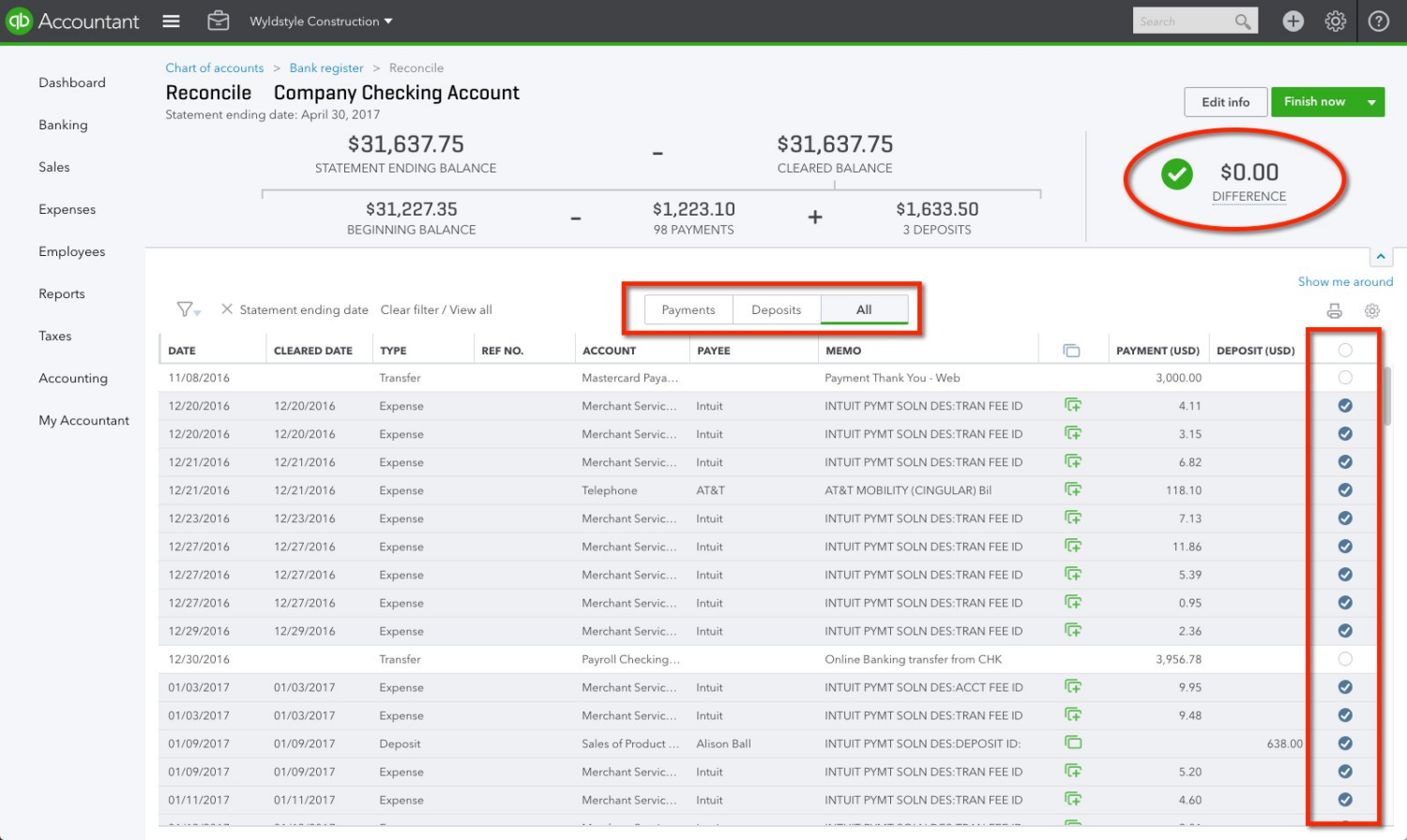

How to Reconcile in Quickbooks

Learn how to reconcile your accounts so they always match your bank and credit card statements. This step ensures that every transaction, whether it’s a deposit, expense, or. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. A bank reconciliation is a process of matching the balances in.

How to Fix a Reconciled Transaction in QuickBooks LedgerBox

Learn how to reconcile your accounts so they always match your bank and credit card statements. This step ensures that every transaction, whether it’s a deposit, expense, or. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. Here are some practical tips to enhance the efficiency of the.

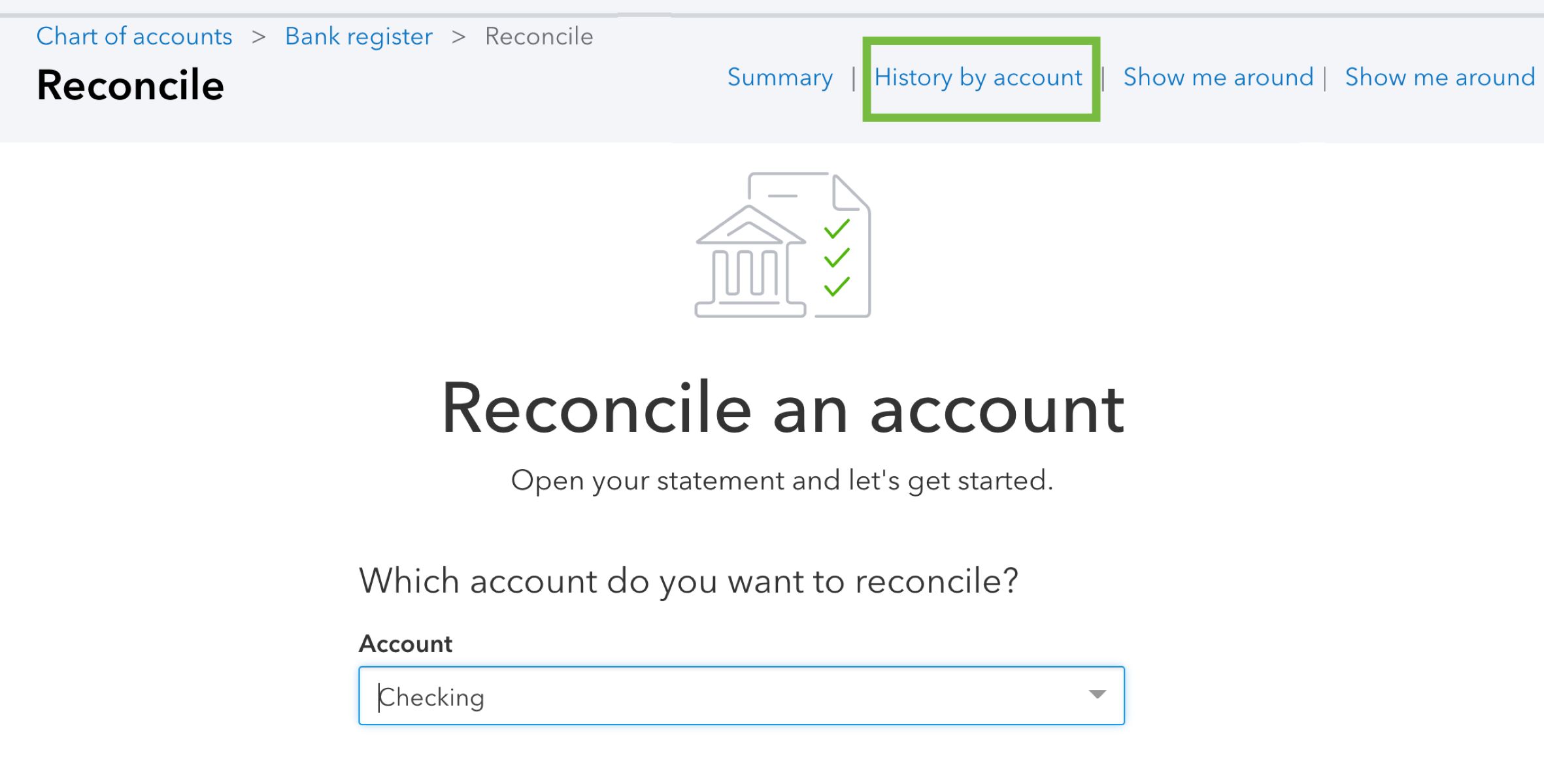

How Do I Undo A Reconciliation In QuickBooks Online?

The goal of the bank reconciliation process is to find out if. Learn how to reconcile your accounts so they always match your bank and credit card statements. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. Here are some practical tips to enhance the efficiency of the reconciliation process. Learn.

A Bank Reconciliation Is A Process Of Matching The Balances In A Business’s Accounting Records To The Corresponding Information On A Bank Statement.

Learn how to reconcile your accounts so they match your bank and credit card statements. Quickbooks offers a robust set of tools to streamline the process of reconciling your accounts, ensuring accuracy and timely financial insights. Just like balancing your checkbook, you need to review your accounts in quickbooks to make sure they match your bank. Here are some practical tips to enhance the efficiency of the reconciliation process.

The Goal Of The Bank Reconciliation Process Is To Find Out If.

Learn how to reconcile your accounts so they always match your bank and credit card statements. Reconciliation is the process of matching your financial transactions in quickbooks with your bank or credit card statements. This step ensures that every transaction, whether it’s a deposit, expense, or.