How To Enter Tax Refund In Quickbooks

How To Enter Tax Refund In Quickbooks - Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales, or vat). To enter a tax refund in quickbooks, follow these steps: Login to your quickbooks account : Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Log in to your quickbooks account. To enter a tax refund in quickbooks, follow these steps: In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds.

In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales, or vat). Log in to your quickbooks account. To enter a tax refund in quickbooks, follow these steps: To enter a tax refund in quickbooks, follow these steps: Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. Login to your quickbooks account :

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. To enter a tax refund in quickbooks, follow these steps: Login to your quickbooks account : In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. To enter a tax refund in quickbooks, follow these steps: Log in to your quickbooks account. Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales, or vat).

How To Enter A Refund From A Vendor QuickBooks Tutorial YouTube

To enter a tax refund in quickbooks, follow these steps: To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. In quickbooks online, tax refunds should be categorized under specific income accounts.

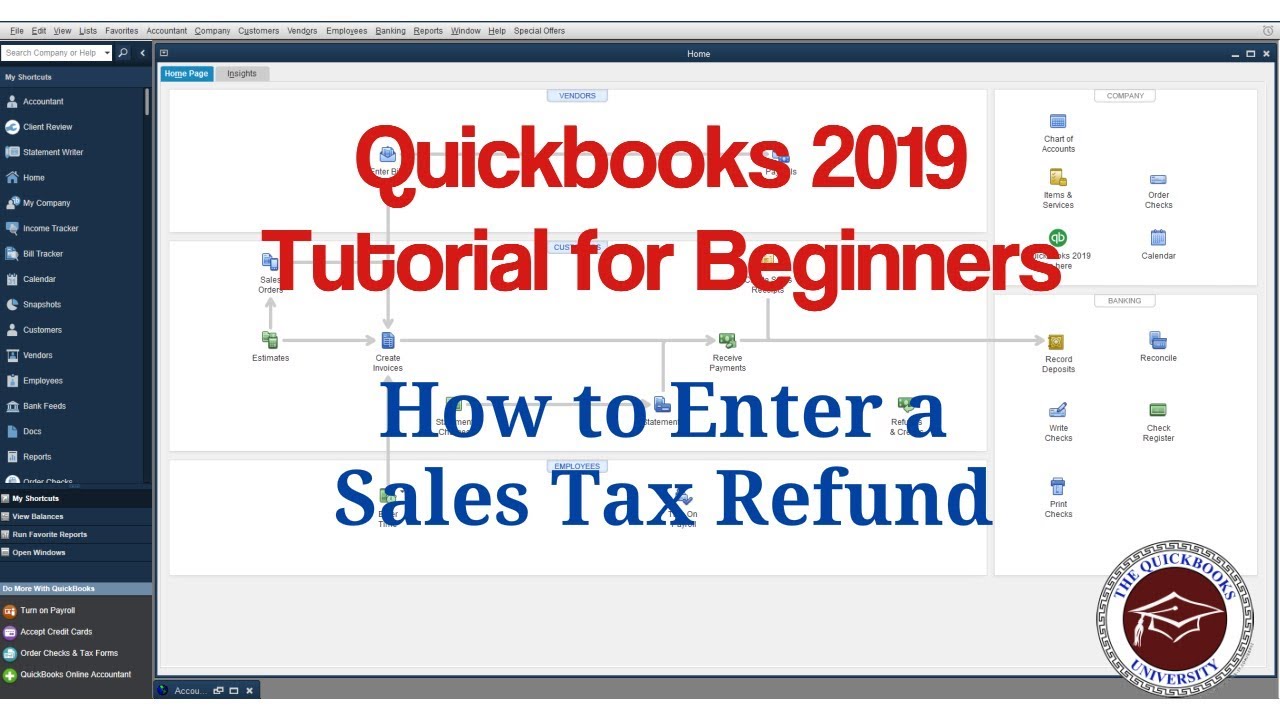

Quickbooks 2019 Tutorial for Beginners How to Enter a Sales Tax

To enter a tax refund in quickbooks, follow these steps: To enter a tax refund in quickbooks, follow these steps: Login to your quickbooks account : Log in to your quickbooks account. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds.

Tax Refund करदात्यांना मिळतोय ITR रिफंड, असे चेक करा स्टेट्स TV9

Log in to your quickbooks account. Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. To enter a tax refund in quickbooks, follow these steps: Login to your quickbooks account : Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales,.

Tax Refund UPDATES Where's My Refund Deposit Dates taxrefund money

To enter a tax refund in quickbooks, follow these steps: Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Log in to your quickbooks account. In quickbooks online, tax refunds should.

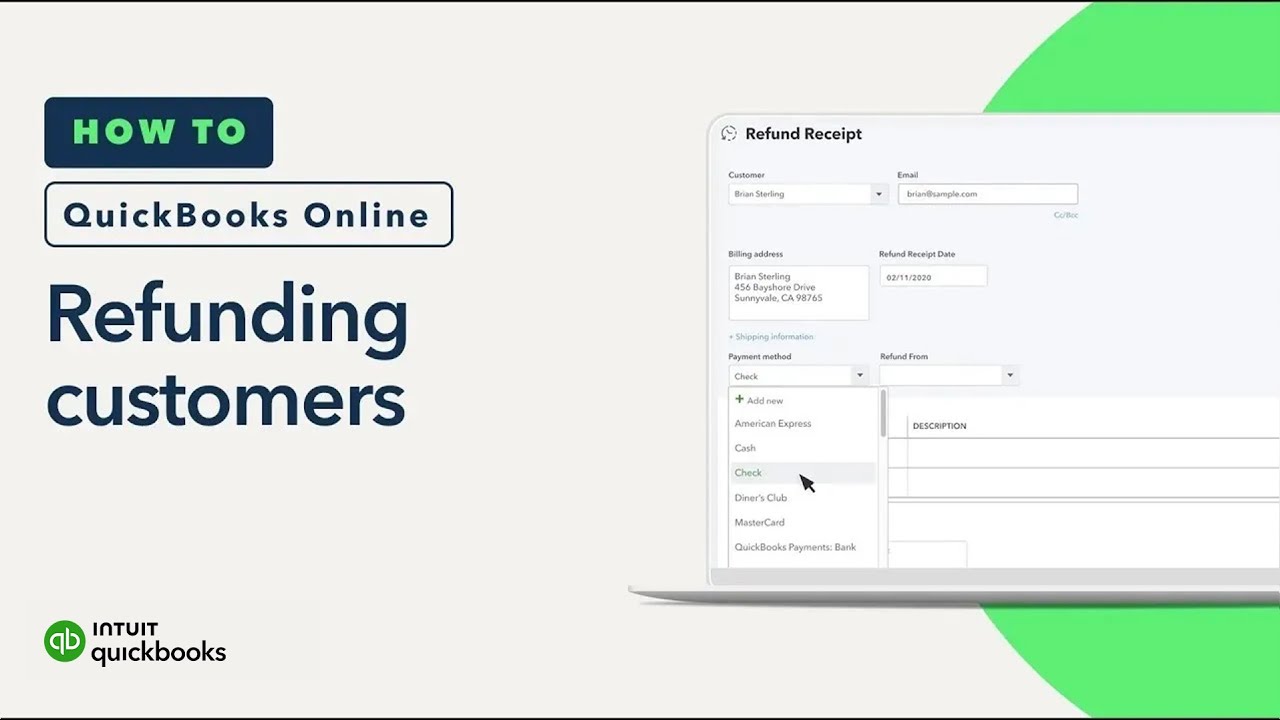

How to record customer refunds in QuickBooks Online YouTube

Log in to your quickbooks account. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Login.

PPT Enter Previous Tax Payments in QuickBooks PowerPoint Presentation

Log in to your quickbooks account. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Login to your quickbooks account : To enter a tax refund in quickbooks, follow these steps: Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu.

How do I enter a vendor refund to my credit card? QBO keeps changing

Log in to your quickbooks account. To enter a tax refund in quickbooks, follow these steps: Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales, or vat). In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. To enter a tax refund in.

Solved How to enter a refund charge on credit card for returned items?

Login to your quickbooks account : Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. Log in to your quickbooks account. In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds. Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the.

Tax Refund Payment How long does it take for tax refund to show in

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. To enter a tax refund in quickbooks, follow these steps: Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales, or vat). To enter a tax refund in.

How To Enter a Credit Card Refund in QuickBooks Online

To enter a tax refund in quickbooks, follow these steps: Log in to your quickbooks account. To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. To enter a tax refund in quickbooks, follow these steps: Learn how to record a payroll liability refund check in quickbooks enterprise suite.

Log In To Your Quickbooks Account.

To record tax refunds in quickbooks, businesses need to follow specific steps to ensure accurate representation of income, expenses, and tax. Learn how to record a payroll liability refund check in quickbooks enterprise suite from the employees menu. To enter a tax refund in quickbooks, follow these steps: In quickbooks online, tax refunds should be categorized under specific income accounts designated for refunds.

To Enter A Tax Refund In Quickbooks, Follow These Steps:

Login to your quickbooks account : Learn how to categorize and record tax refunds in quickbooks online and desktop, depending on the type of tax (income, sales, or vat).