How To Record Insurance Claim Payment In Quickbooks

How To Record Insurance Claim Payment In Quickbooks - The steps are easy to follow. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the accounting. To record the payment, let’s create an account to track the entry and then make a deposit. Recording insurance claim payments in quickbooks is important for several reasons: The settlement should be recorded to an other income account called 'gain from insurance proceeds' at the time of receipt, even. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. Go to chart of accounts. It helps you keep track of the payments you have. To record an insurance claim payment in quickbooks, you need to create a new credit memo.

To record an insurance claim payment in quickbooks, you need to create a new credit memo. The steps are easy to follow. To record the payment, let’s create an account to track the entry and then make a deposit. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: The settlement should be recorded to an other income account called 'gain from insurance proceeds' at the time of receipt, even. Recording insurance claim payments in quickbooks is important for several reasons: Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the accounting. Go to chart of accounts. It helps you keep track of the payments you have. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking.

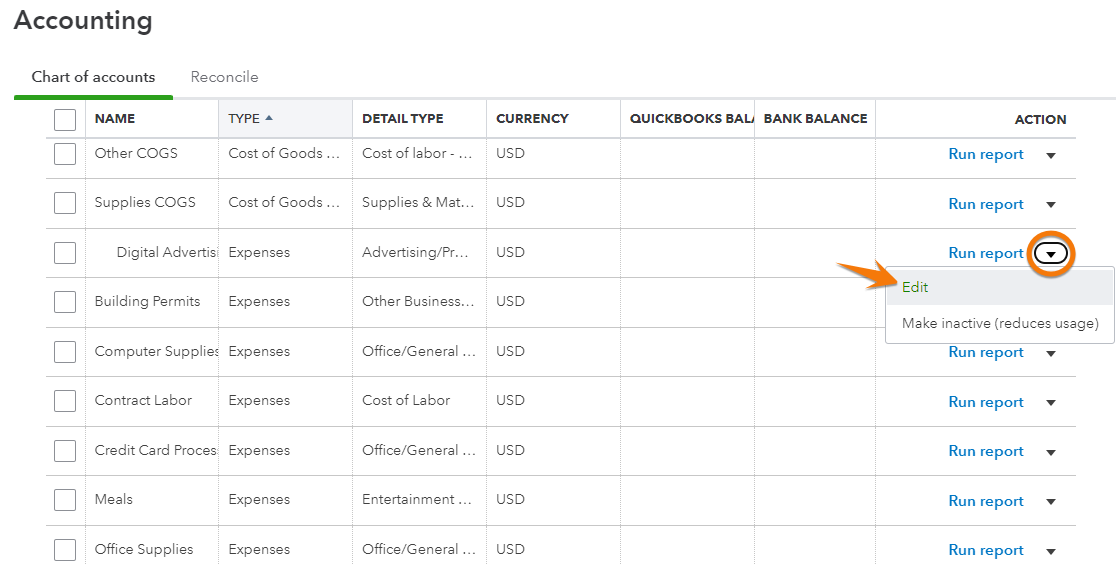

To record an insurance claim payment in quickbooks, you need to create a new credit memo. To record the payment, let’s create an account to track the entry and then make a deposit. The steps are easy to follow. Go to chart of accounts. The settlement should be recorded to an other income account called 'gain from insurance proceeds' at the time of receipt, even. Recording insurance claim payments in quickbooks is important for several reasons: It helps you keep track of the payments you have. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the accounting. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking.

Spreadsheet For Insurance Claim Financial Report

Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. Go to chart of accounts. The steps are easy to follow. It helps you keep track of the payments you have. Categorizing insurance claim payments in quickbooks involves a few straightforward steps:

Easy Way To Record Insurance QuickBooks YouTube

Recording insurance claim payments in quickbooks is important for several reasons: Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the accounting. Go to chart of accounts. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. It helps you keep track of the payments you have.

How do I set up a Payment received for a insurance claim?

Go to chart of accounts. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. To record an insurance claim payment in quickbooks, you need to create a new credit memo. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: It helps you keep track of the payments you have.

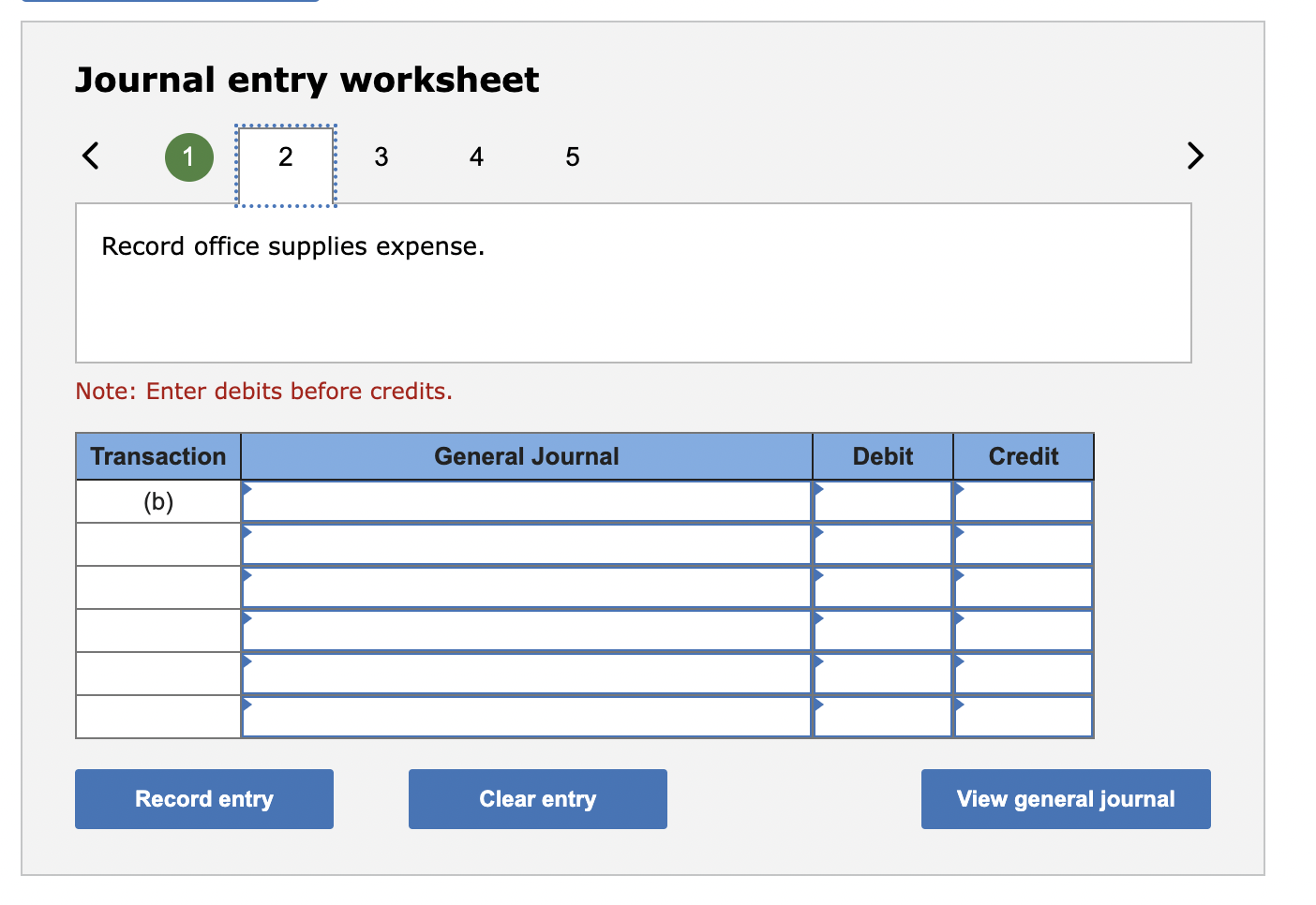

Solved Journal entry worksheet Record insurance expense for

It helps you keep track of the payments you have. To record the payment, let’s create an account to track the entry and then make a deposit. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the.

QuickBooks Guide Record Credit Card Payments Bestarion

To record the payment, let’s create an account to track the entry and then make a deposit. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the accounting. It helps you keep track of the payments you have. The settlement should.

How to record a payment QuickBooks UK

Recording insurance claim payments in quickbooks is important for several reasons: To record an insurance claim payment in quickbooks, you need to create a new credit memo. It helps you keep track of the payments you have. The settlement should be recorded to an other income account called 'gain from insurance proceeds' at the time of receipt, even. To record.

How To Record A Credit Card Payment In Quickbooks Online LiveWell

The steps are easy to follow. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. To record the payment, let’s create an account to track the entry and then make a deposit. Recording insurance claim payments in quickbooks is important for several reasons: The settlement should be recorded to an other income account called.

QuickBooks for Insurance Agency Record Insurance Premium and

Go to chart of accounts. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: It helps you keep track of the payments you have. To record the payment, let’s create an account to track the entry and then make a deposit. Recording insurance claim payments in quickbooks is important for several reasons:

Insurance coverage Declare What Are They? Hitspinner

It helps you keep track of the payments you have. Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. Go to chart of accounts. The steps are easy to follow. Categorizing insurance claim payments in quickbooks involves a few straightforward steps:

Quickbooks Chart Of Accounts Excel Template

Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. To record an insurance claim payment in quickbooks, you need to create a new credit memo. The steps are easy to follow. Recording insurance claim payments in quickbooks is important for several reasons: The settlement should be recorded to an other income account called 'gain.

The Settlement Should Be Recorded To An Other Income Account Called 'Gain From Insurance Proceeds' At The Time Of Receipt, Even.

Recording insurance claim payments in quickbooks involves creating bills, generating journal entries, and accurately tracking. The steps are easy to follow. To record the payment, let’s create an account to track the entry and then make a deposit. Today, we'll navigate the treacherous waters of recording your insurance payment in quickbooks without getting sucked into the accounting.

It Helps You Keep Track Of The Payments You Have.

Recording insurance claim payments in quickbooks is important for several reasons: Go to chart of accounts. To record an insurance claim payment in quickbooks, you need to create a new credit memo. Categorizing insurance claim payments in quickbooks involves a few straightforward steps: