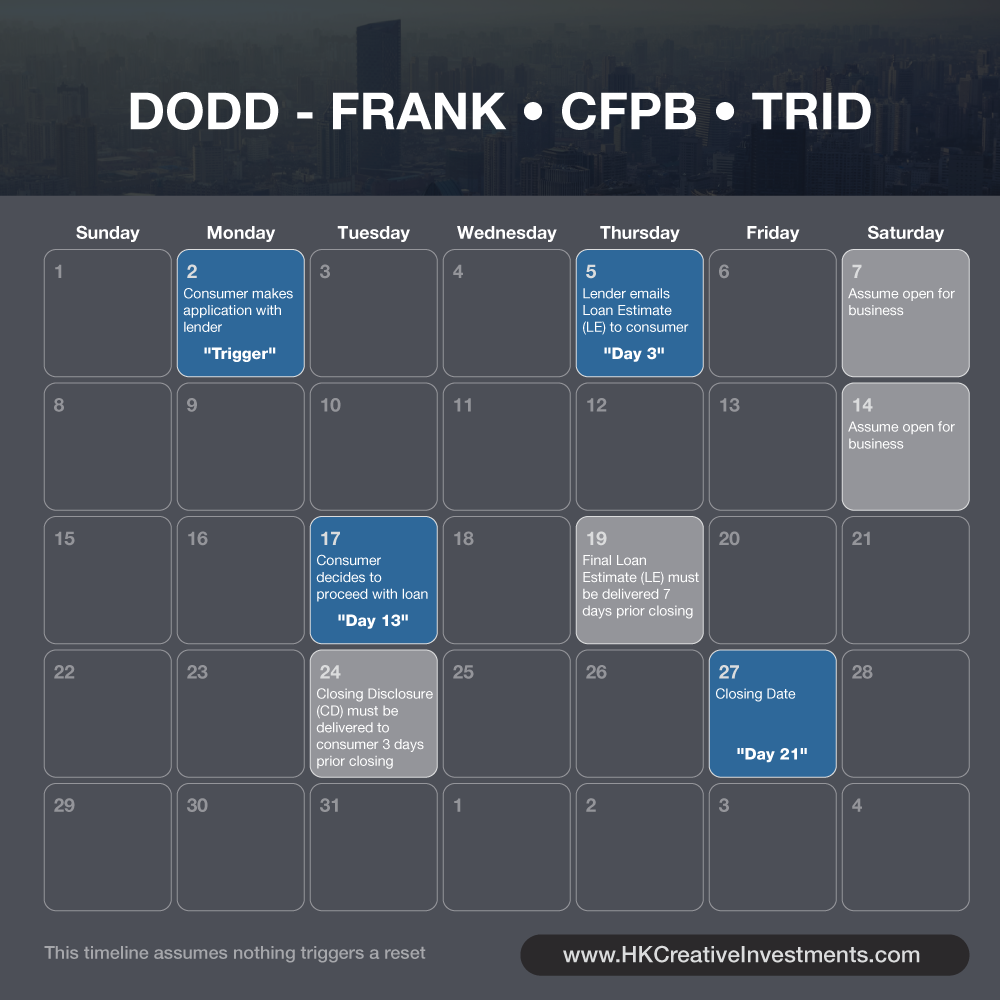

Loan Estimate 3 Day Rule Calendar

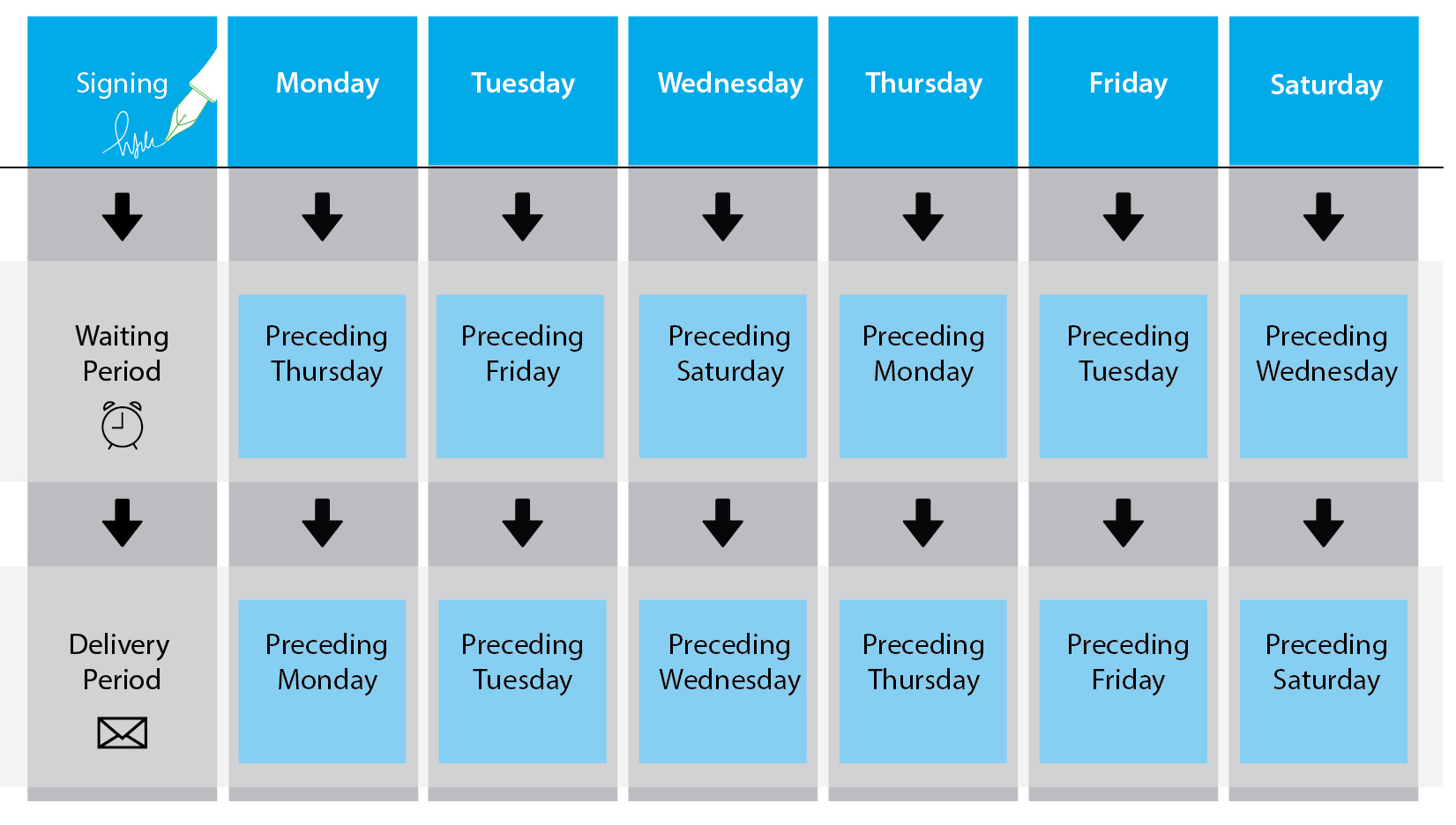

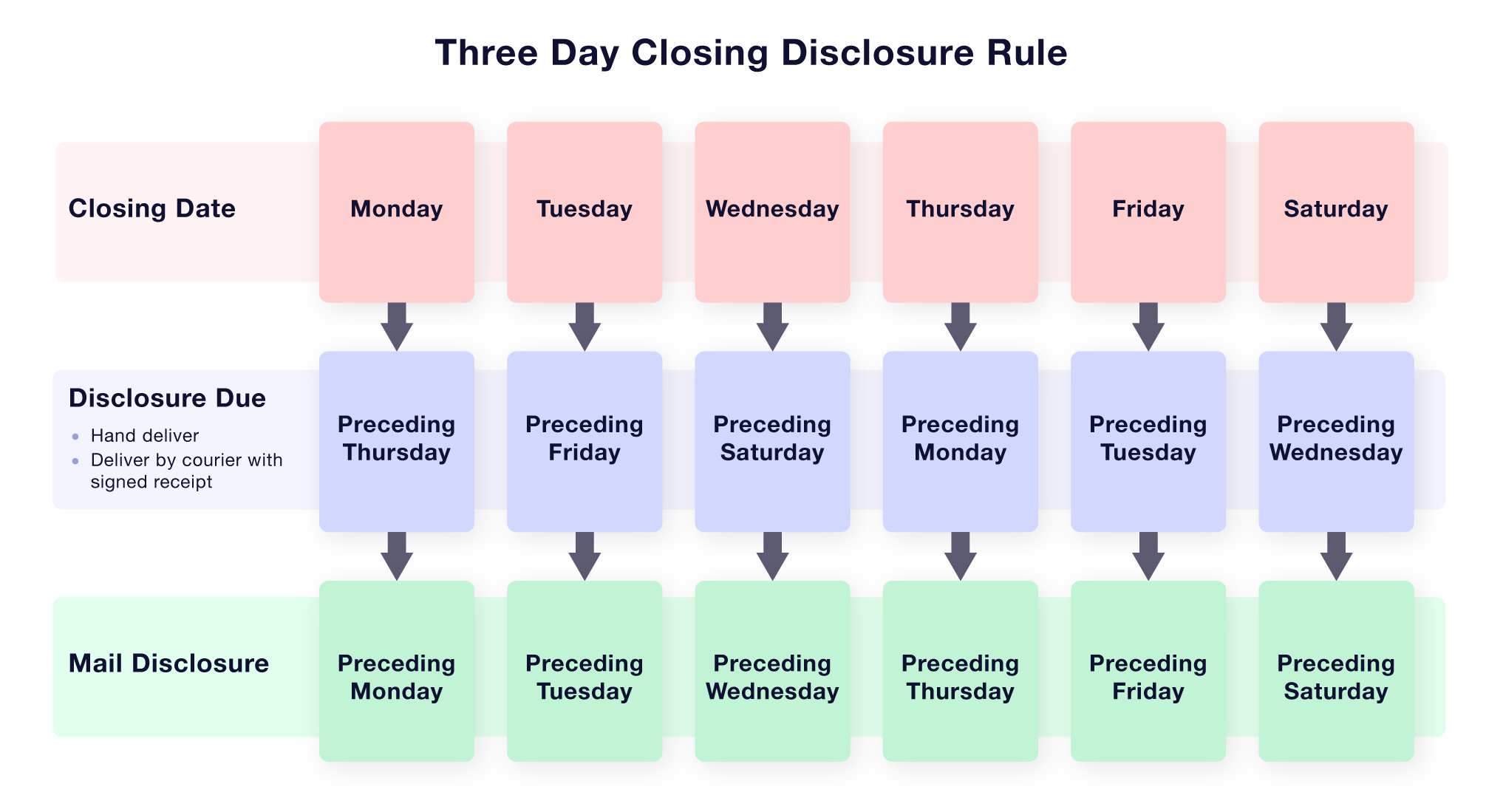

Loan Estimate 3 Day Rule Calendar - The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

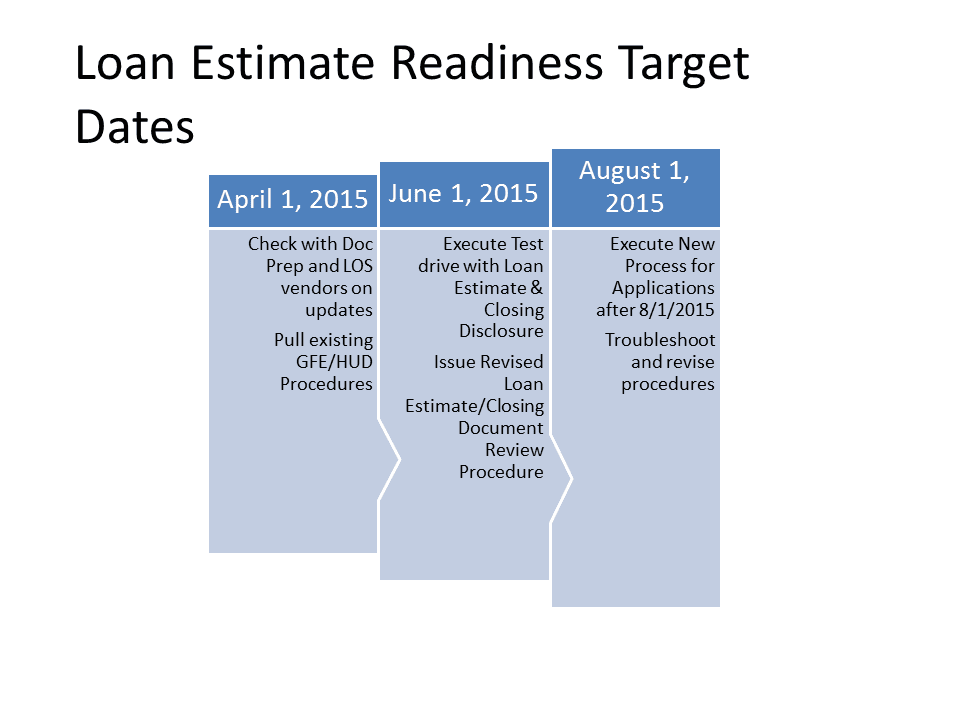

Trid Form Fillable Settlement Statement With Calculator Totals

Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates.

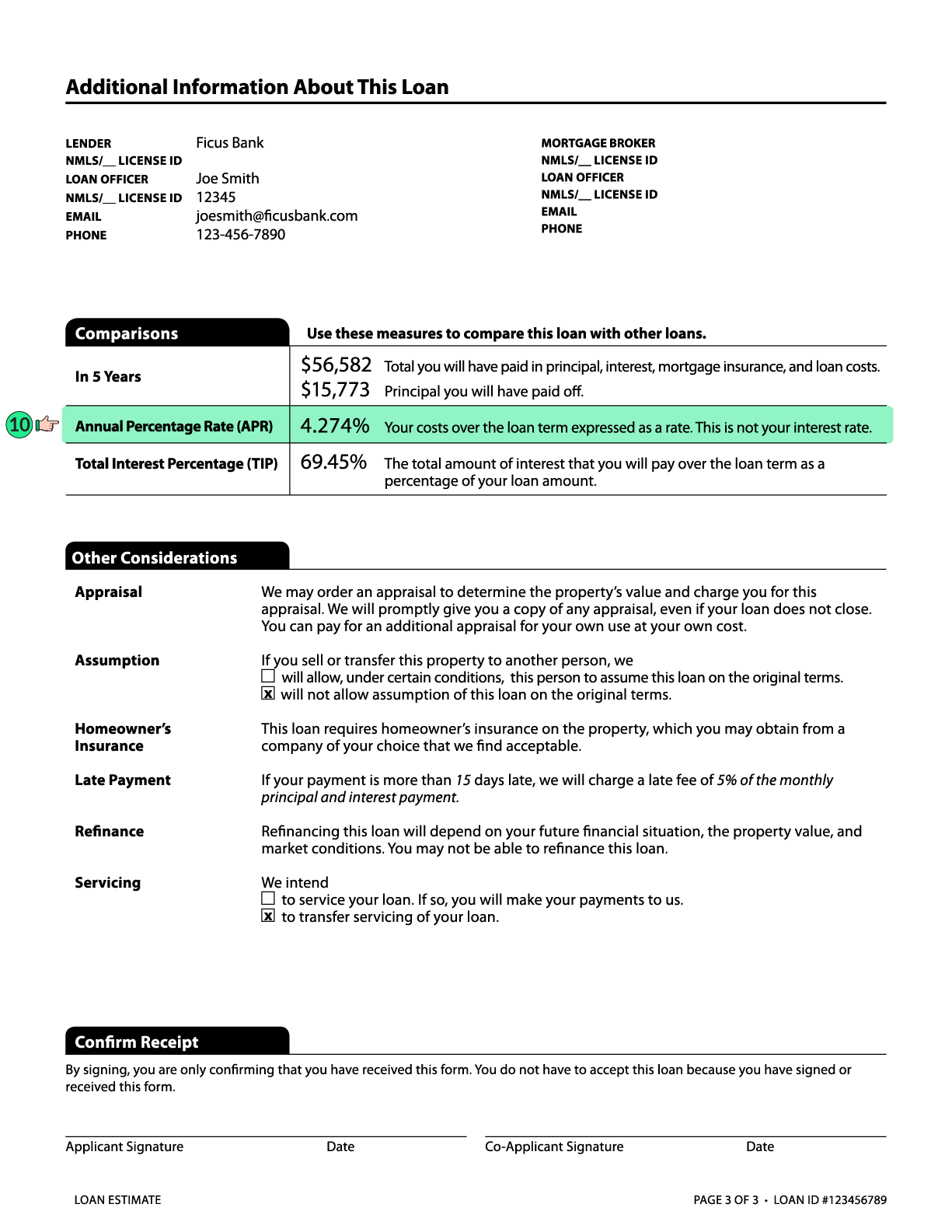

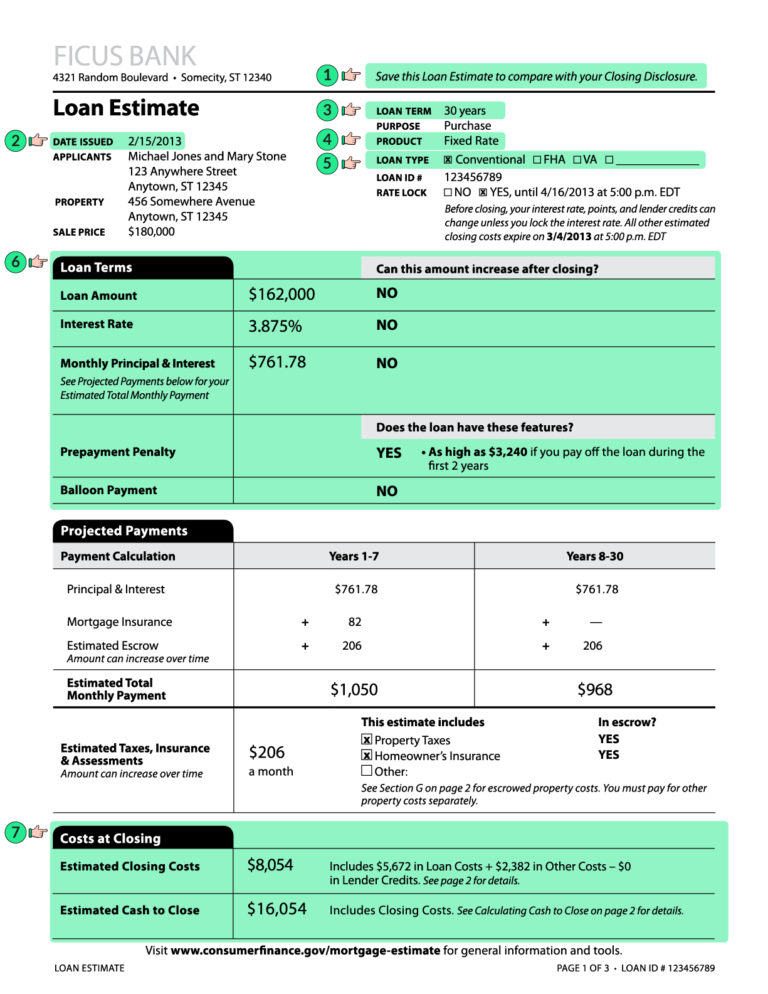

What is a Loan Estimate? How to Read and What to Look For

Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates.

Confusing Residential Real Estate Rule Is Now Law

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

Trid 3 Day Rule Calendar Feb 2023 Calendar Themes

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

Threeday disclosure chart Mortgage marketing, Reverse mortgage

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

Mortgage News Digest TRID It's Not Just a Disclosure, it's a Process

Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates.

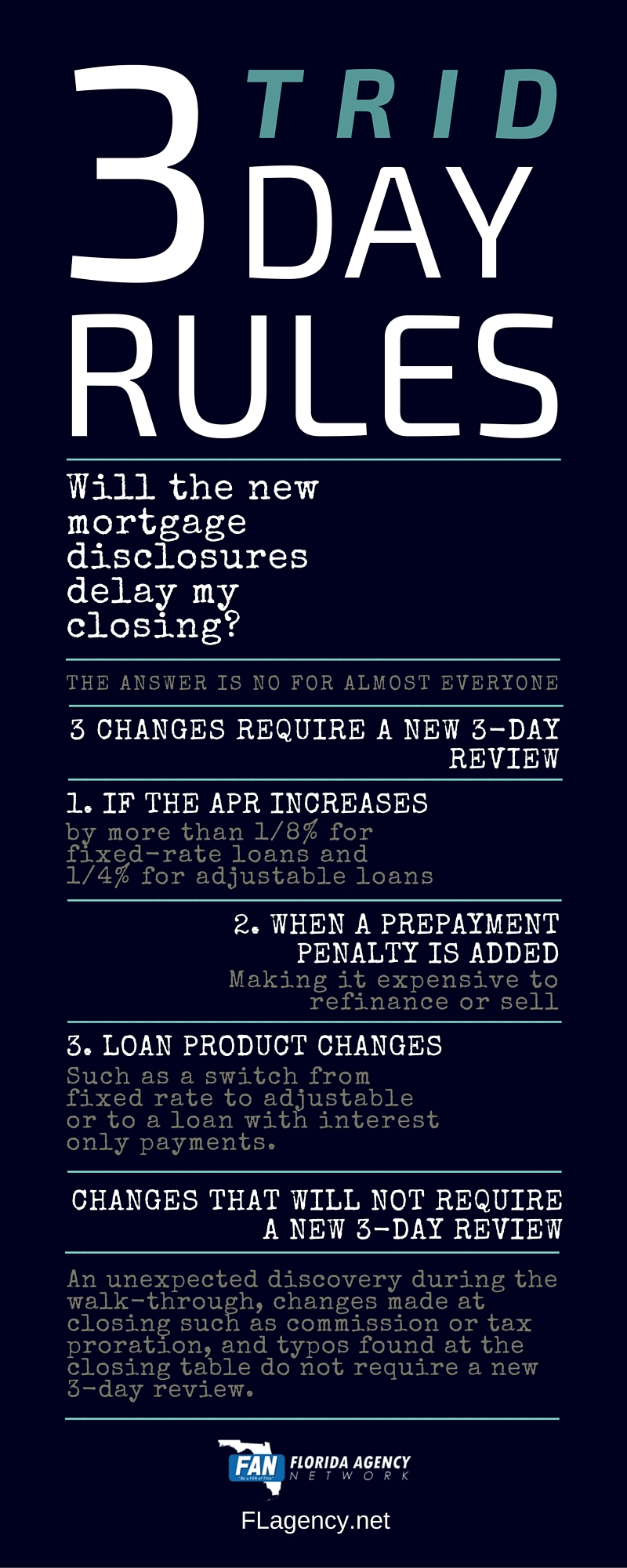

Can the TRID 3day rule possibly delay your closing? Florida Agency

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

Loan Estimate Template

Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing. The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates.

What is the 3 day rule for closing? Leia aqui What is the 3 day wait

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

What is a Closing Disclosure and How Do You Read it? Elko Title

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates. Thus, disclosure must be delivered three days before closing, and not 72 hours prior to closing.

Thus, Disclosure Must Be Delivered Three Days Before Closing, And Not 72 Hours Prior To Closing.

The wfg trid calendar is provided as an estimate for clients to determine approximate delivery of the closing disclosure and consummation dates.