New Mexico Tax Exempt Form

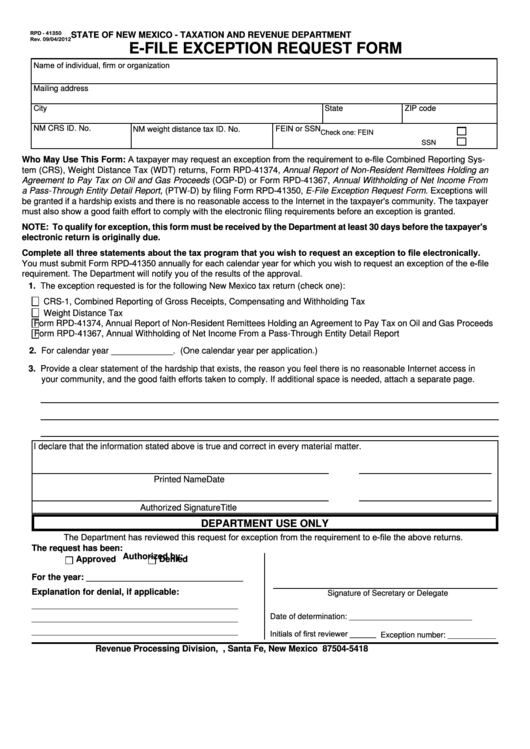

New Mexico Tax Exempt Form - No forms are required, however the federal. An nttc is the only documentation trd can. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. The folders on this page contain everything from returns and instructions to payment vouchers for both. Centrally billed accounts (cba) may be exempt from the gross receipts tax. Welcome to the new mexico taxation and revenue department’s forms & publications page. After registering with taxation and revenue and receiving a new mexico business tax identification number (nmbtin), you may obtain an nttc online through the taxpayer access point (tap). Need help recognizing a card or telling if a card is an iba or cba?

After registering with taxation and revenue and receiving a new mexico business tax identification number (nmbtin), you may obtain an nttc online through the taxpayer access point (tap). Need help recognizing a card or telling if a card is an iba or cba? An nttc is the only documentation trd can. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. No forms are required, however the federal. The folders on this page contain everything from returns and instructions to payment vouchers for both. Welcome to the new mexico taxation and revenue department’s forms & publications page. Centrally billed accounts (cba) may be exempt from the gross receipts tax.

Centrally billed accounts (cba) may be exempt from the gross receipts tax. No forms are required, however the federal. An nttc is the only documentation trd can. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. The folders on this page contain everything from returns and instructions to payment vouchers for both. Need help recognizing a card or telling if a card is an iba or cba? After registering with taxation and revenue and receiving a new mexico business tax identification number (nmbtin), you may obtain an nttc online through the taxpayer access point (tap). Welcome to the new mexico taxation and revenue department’s forms & publications page.

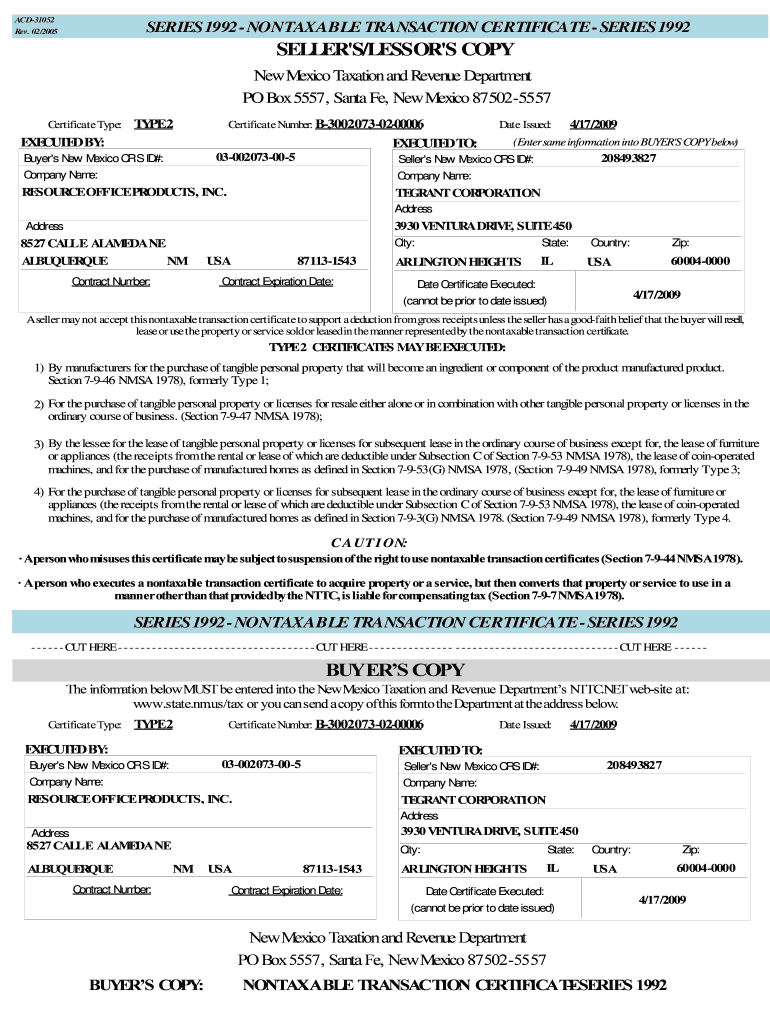

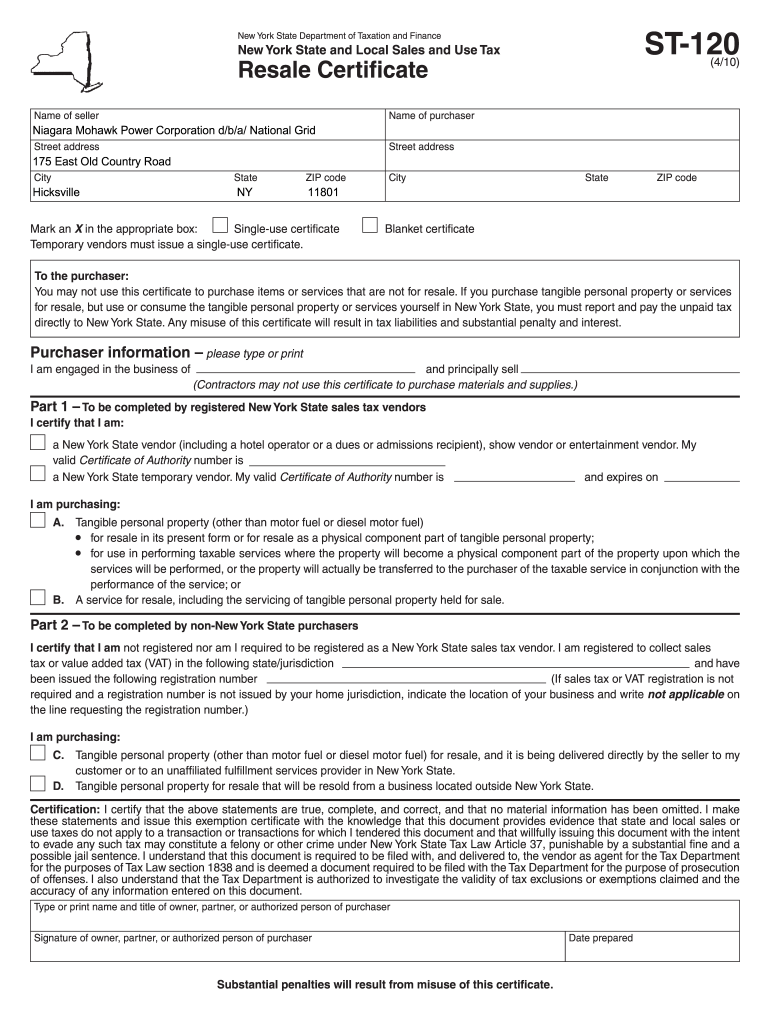

NM ACD31052 20052022 Fill out Tax Template Online US Legal Forms

If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. The folders on this page contain everything from returns and instructions to payment vouchers for both. An nttc is the only documentation trd can. Need help recognizing a card or telling if a.

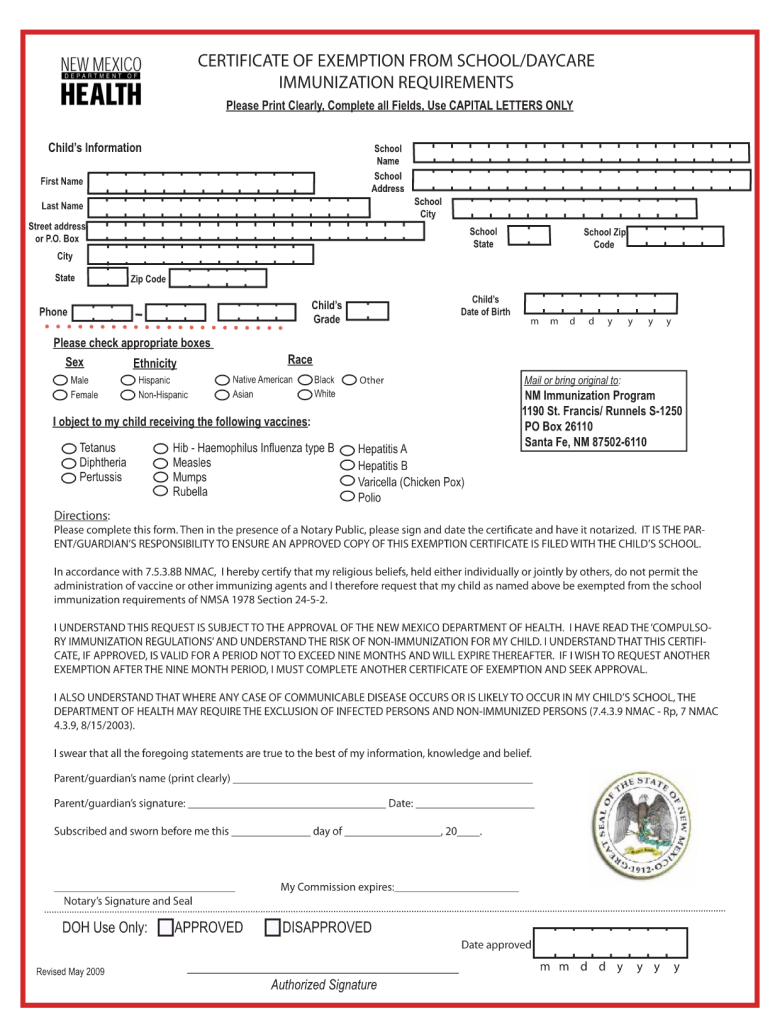

Certificate of Exemption New Mexico Form Fill Out and Sign Printable

Centrally billed accounts (cba) may be exempt from the gross receipts tax. The folders on this page contain everything from returns and instructions to payment vouchers for both. No forms are required, however the federal. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross.

Tax Exempt Form 20202021 Fill and Sign Printable Template Online

The folders on this page contain everything from returns and instructions to payment vouchers for both. Welcome to the new mexico taxation and revenue department’s forms & publications page. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. Centrally billed accounts (cba).

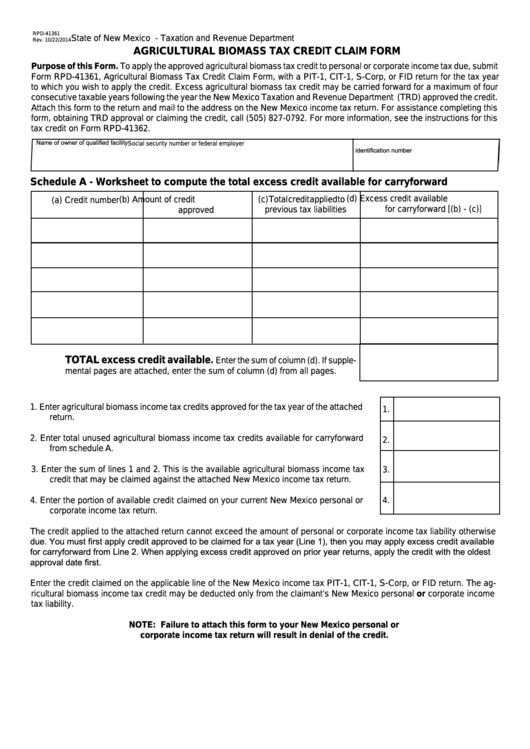

New Mexico Agricultural Tax Exempt Form

Need help recognizing a card or telling if a card is an iba or cba? The folders on this page contain everything from returns and instructions to payment vouchers for both. Welcome to the new mexico taxation and revenue department’s forms & publications page. After registering with taxation and revenue and receiving a new mexico business tax identification number (nmbtin),.

Fillable Online Property Tax Exemption Form New Mexico Department of

Need help recognizing a card or telling if a card is an iba or cba? An nttc is the only documentation trd can. The folders on this page contain everything from returns and instructions to payment vouchers for both. Centrally billed accounts (cba) may be exempt from the gross receipts tax. After registering with taxation and revenue and receiving a.

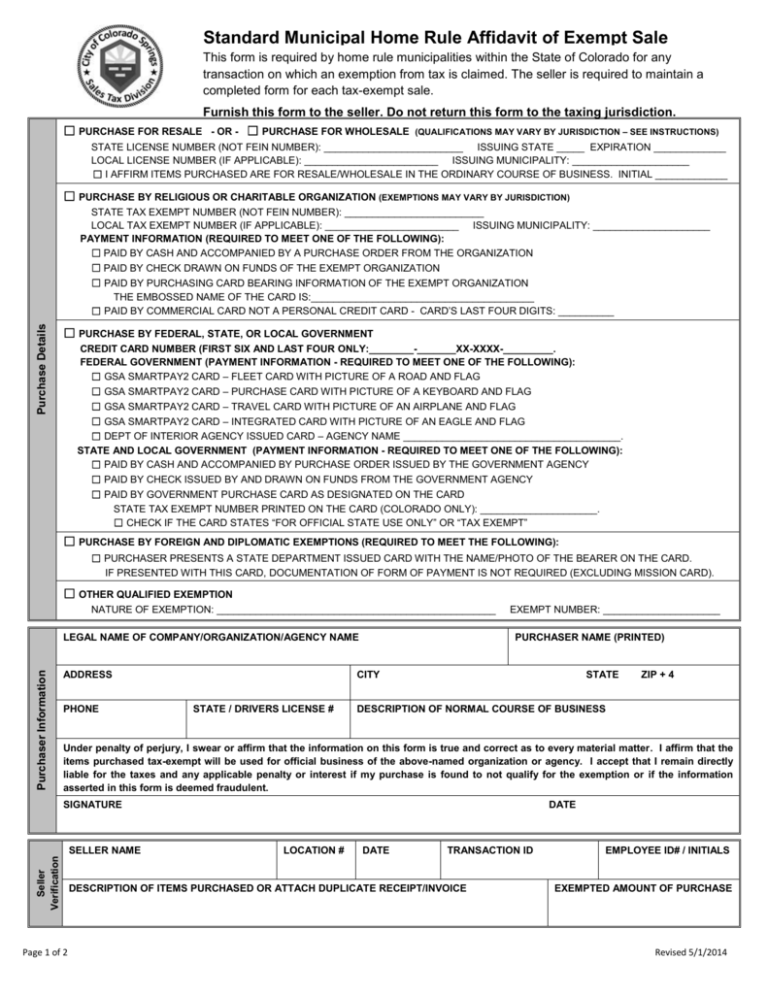

New Tax Exempt Form

No forms are required, however the federal. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. Need help recognizing a card or telling if a card is an iba or cba? After registering with taxation and revenue and receiving a new mexico.

Tax Exempt Form Fill Online, Printable, Fillable, Blank pdfFiller

Welcome to the new mexico taxation and revenue department’s forms & publications page. No forms are required, however the federal. The folders on this page contain everything from returns and instructions to payment vouchers for both. Need help recognizing a card or telling if a card is an iba or cba? Centrally billed accounts (cba) may be exempt from the.

Top 10 New Mexico Tax Exempt Form Templates free to download in PDF format

After registering with taxation and revenue and receiving a new mexico business tax identification number (nmbtin), you may obtain an nttc online through the taxpayer access point (tap). Need help recognizing a card or telling if a card is an iba or cba? Centrally billed accounts (cba) may be exempt from the gross receipts tax. No forms are required, however.

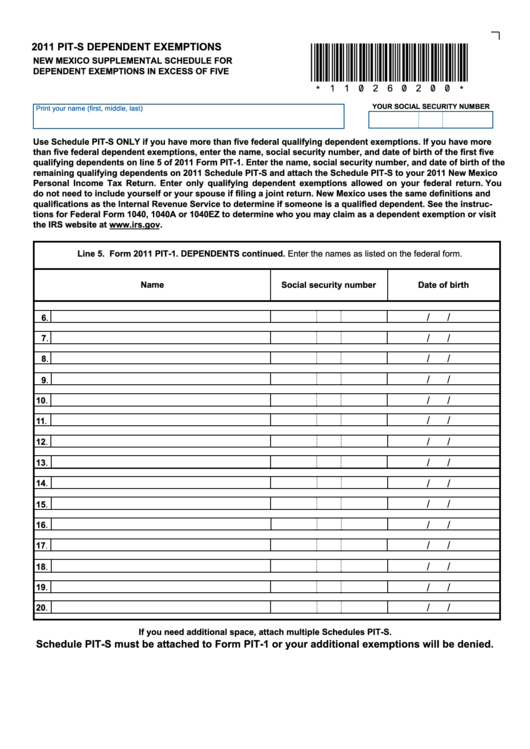

Form PitS New Mexico Supplemental Schedule For Dependent Exemptions

Need help recognizing a card or telling if a card is an iba or cba? No forms are required, however the federal. An nttc is the only documentation trd can. After registering with taxation and revenue and receiving a new mexico business tax identification number (nmbtin), you may obtain an nttc online through the taxpayer access point (tap). The folders.

Ky Sales Tax Exemption Certificate prntbl.concejomunicipaldechinu.gov.co

The folders on this page contain everything from returns and instructions to payment vouchers for both. Welcome to the new mexico taxation and revenue department’s forms & publications page. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. Centrally billed accounts (cba).

After Registering With Taxation And Revenue And Receiving A New Mexico Business Tax Identification Number (Nmbtin), You May Obtain An Nttc Online Through The Taxpayer Access Point (Tap).

No forms are required, however the federal. If your customer obtains an nttc from trd and executes it to you as seller or lessor, you may exempt your customer from paying gross receipts tax. Need help recognizing a card or telling if a card is an iba or cba? The folders on this page contain everything from returns and instructions to payment vouchers for both.

Centrally Billed Accounts (Cba) May Be Exempt From The Gross Receipts Tax.

Welcome to the new mexico taxation and revenue department’s forms & publications page. An nttc is the only documentation trd can.