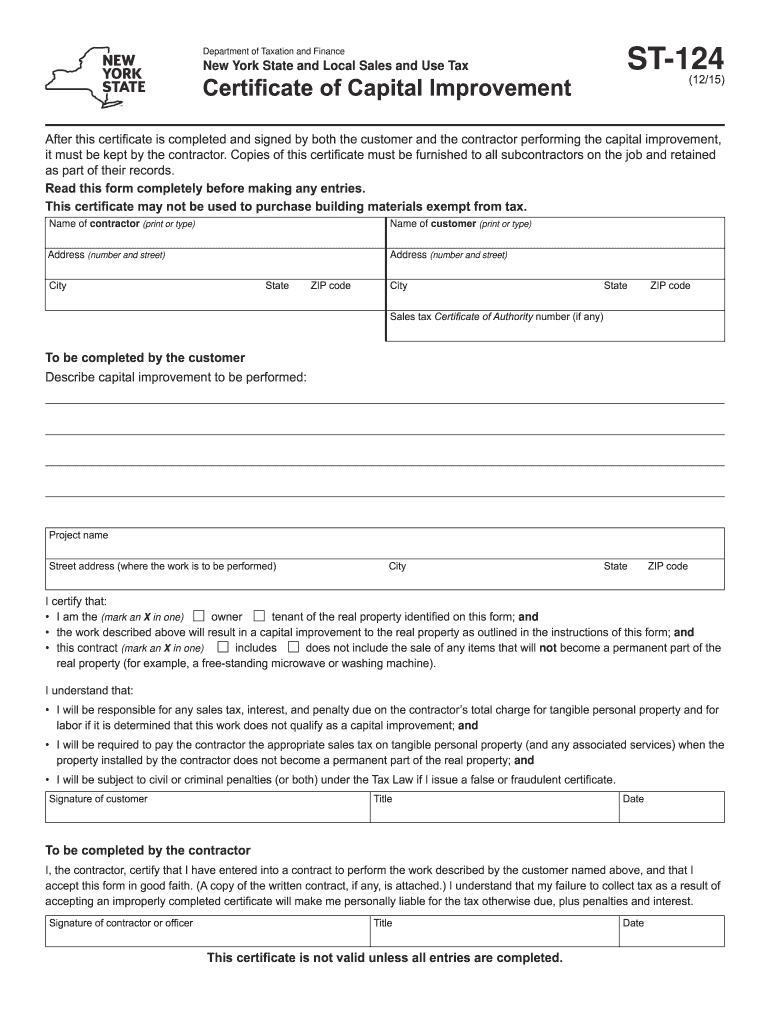

New York Capital Improvement Form

New York Capital Improvement Form - If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons. It must be completed by.

This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. It must be completed by. Additional information for contractors and repair persons. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of.

If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. It must be completed by. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons.

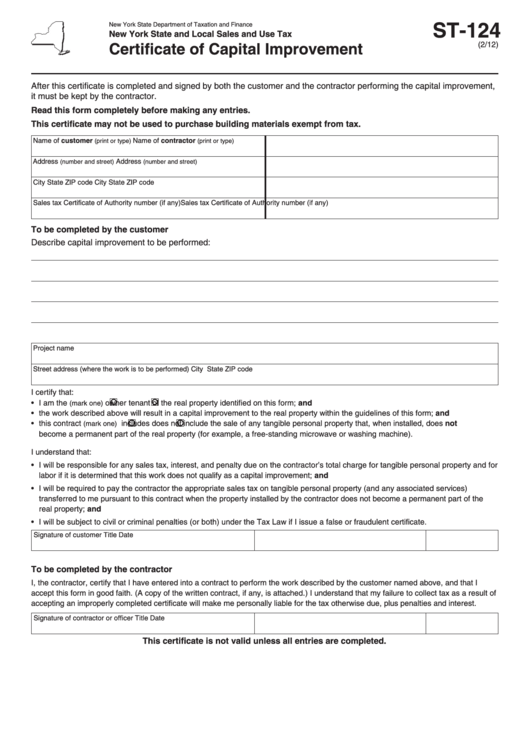

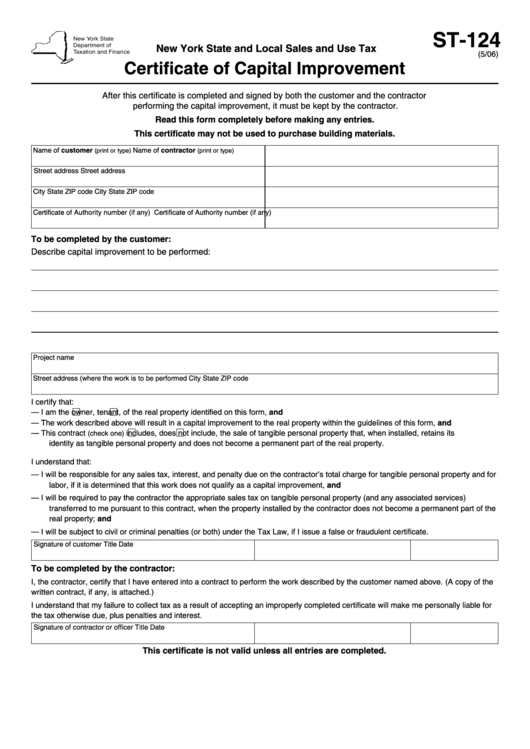

Fillable Form St124 (5/06) Certificate Of Capital Improvement

It must be completed by. Additional information for contractors and repair persons. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of.

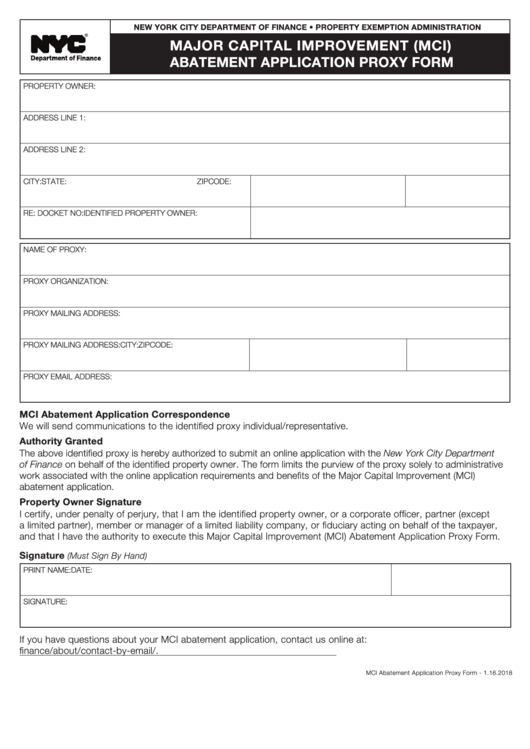

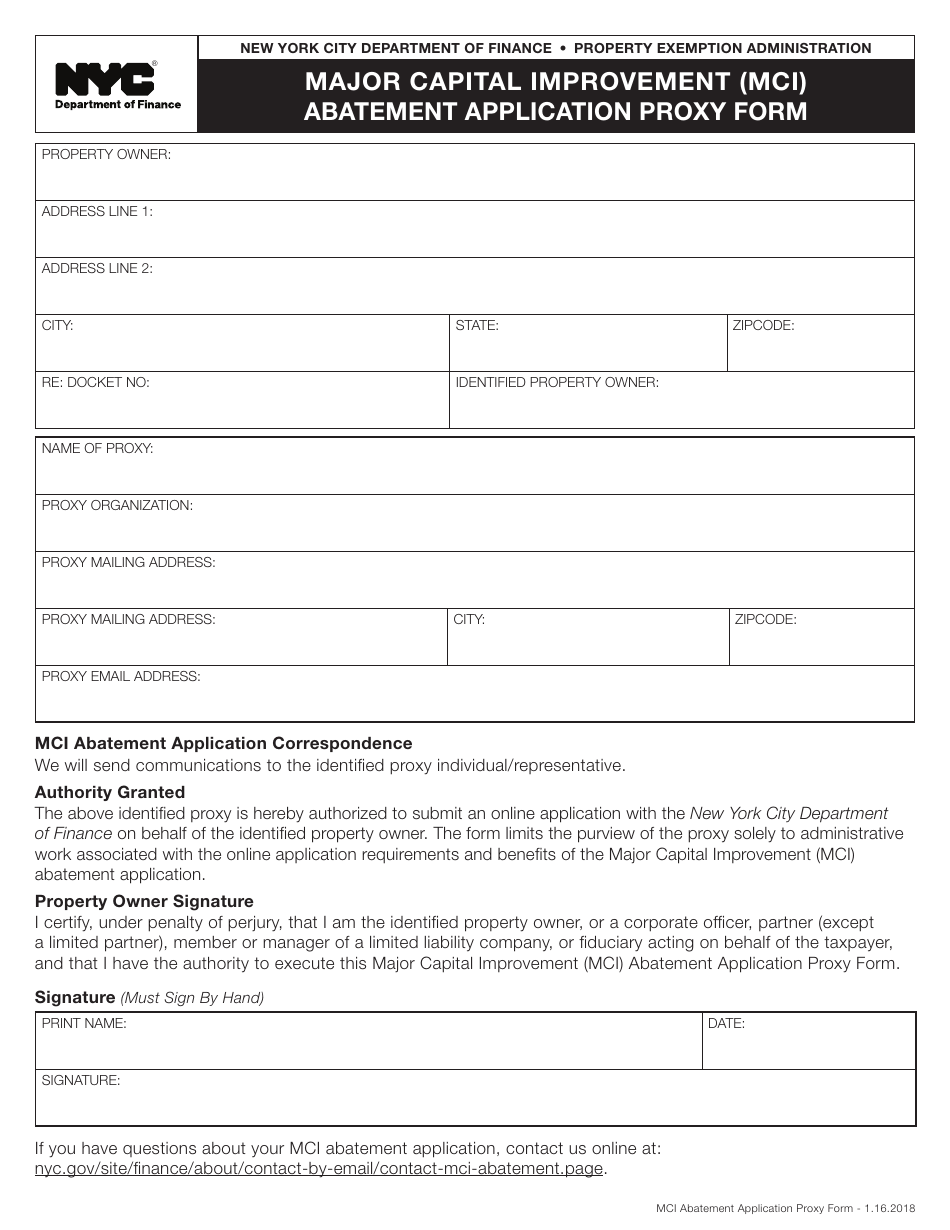

New York City Major Capital Improvement (Mci) Abatement Application

If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. It must be completed by. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons.

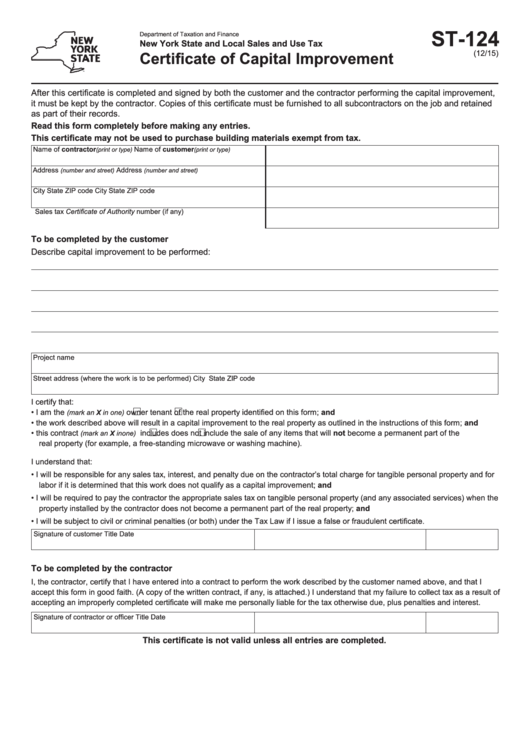

Fillable Form St124 Certificate Of Capital Improvement printable pdf

It must be completed by. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. Additional information for contractors and repair persons.

What Is a CIP Capital Improvement Plans 101 [New for 2024]

Additional information for contractors and repair persons. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. It must be completed by. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable.

New York City Home Improvement Contract Requirements Yoars Law

This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. It must be completed by.

Major Capital Improvement (Mci) Abatement Application Proxy Form New

This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. It must be completed by.

New York Home Improvement Contractor License Bond

It must be completed by. Additional information for contractors and repair persons. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of.

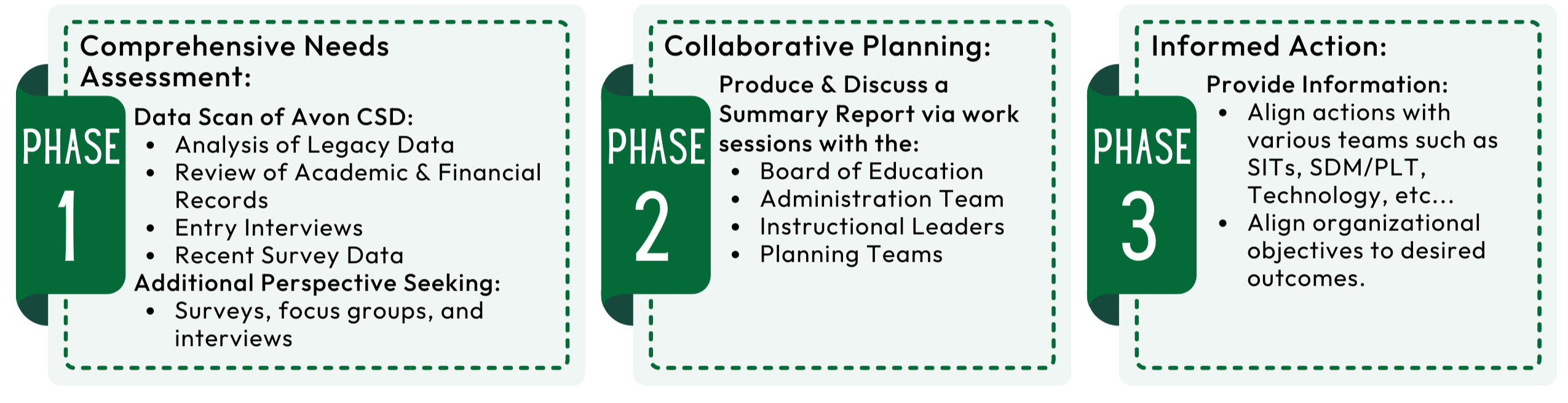

Capital Improvement Project 2022 Avon Central Schools

It must be completed by. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of.

Certificate Of Capital Improvement St124 printable pdf download

This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons. It must be completed by. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of.

20152024 Form NY DTF ST124 Fill Online, Printable, Fillable, Blank

It must be completed by. If a contractor performs work that constitutes a capital improvement, the contractor must pay tax on the purchase of. Additional information for contractors and repair persons. This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable.

If A Contractor Performs Work That Constitutes A Capital Improvement, The Contractor Must Pay Tax On The Purchase Of.

This form is used to certify that a contractor will perform a capital improvement to real property that is not taxable. Additional information for contractors and repair persons. It must be completed by.

![What Is a CIP Capital Improvement Plans 101 [New for 2024]](https://opengov.com/wp-content/uploads/0201/09/Capital-Improvement-Plans-e1642618635668.jpg)