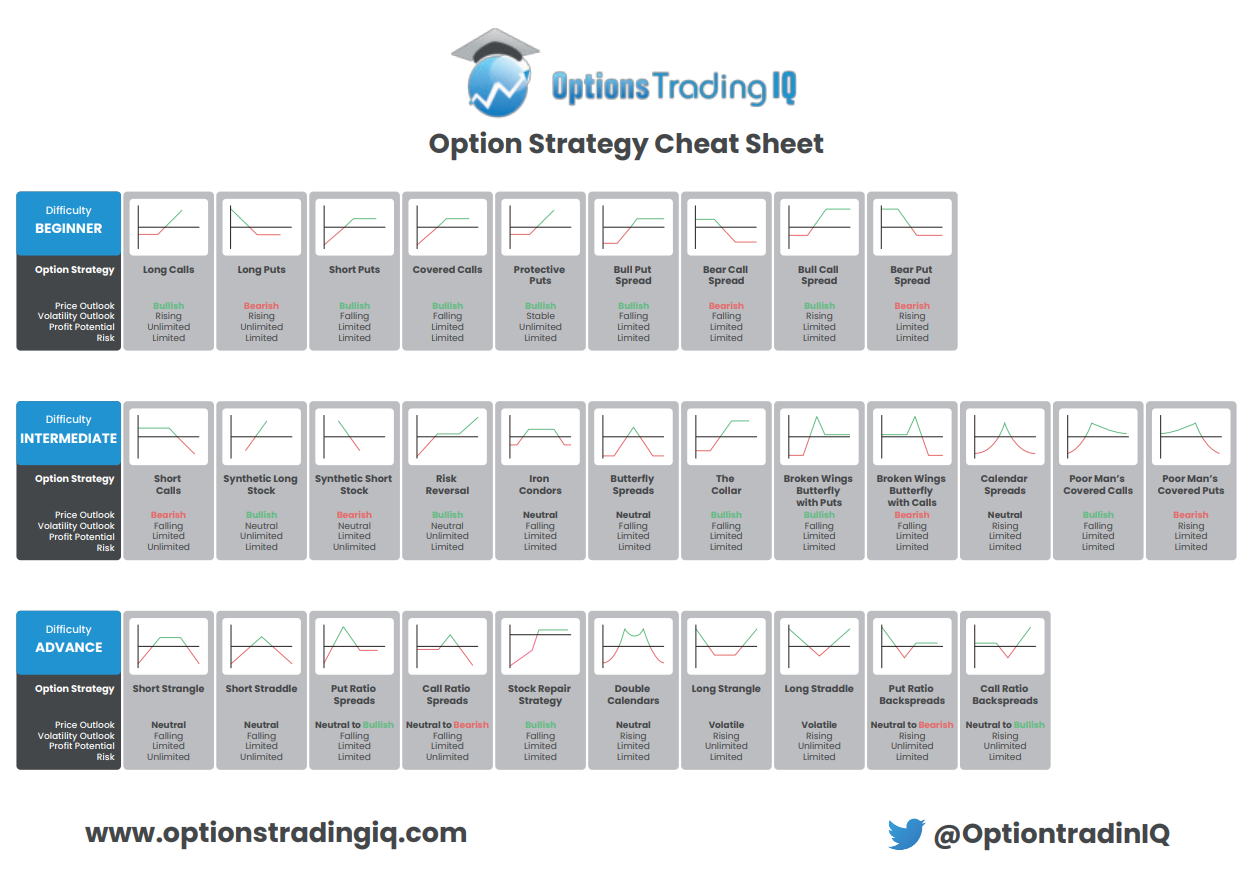

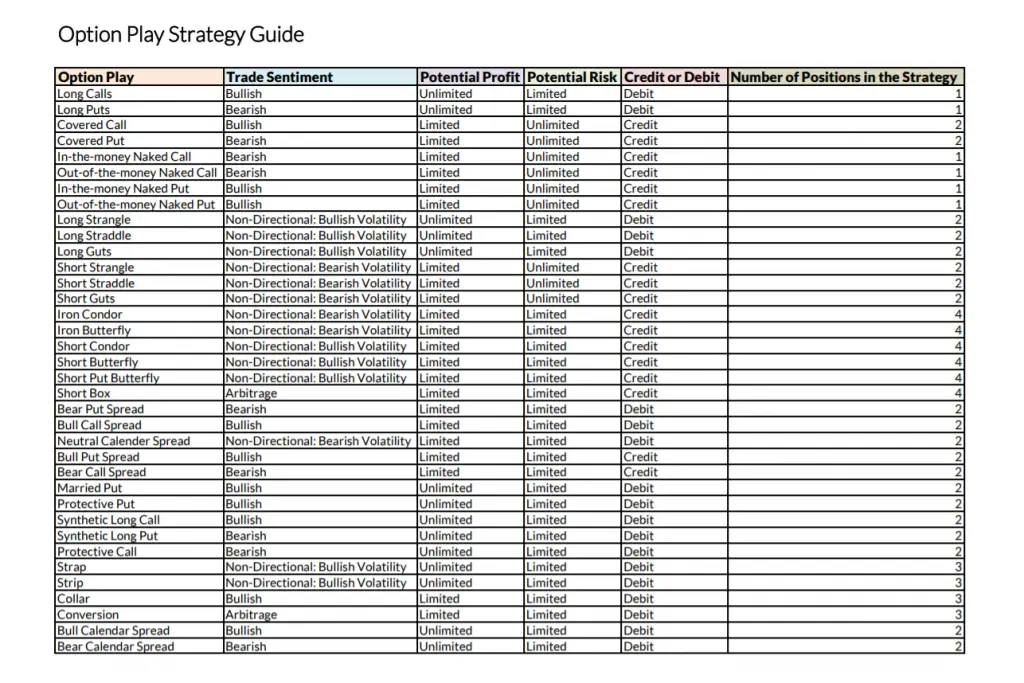

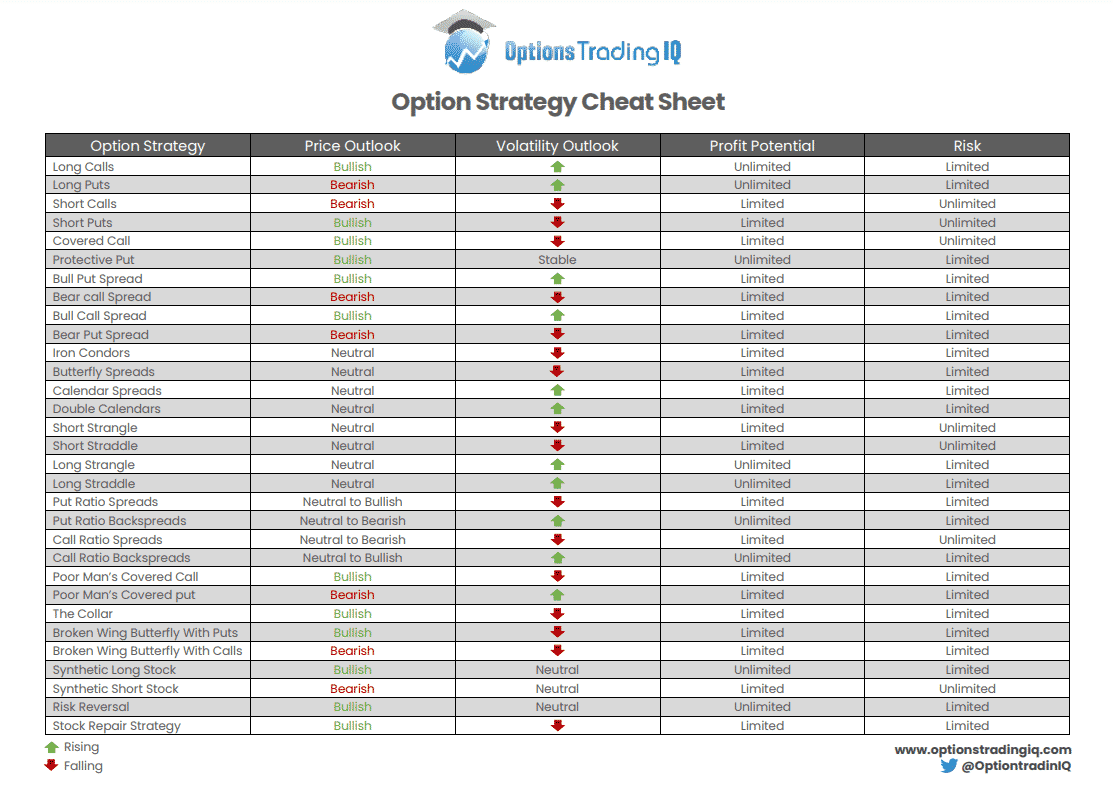

Options Strategy Cheat Sheet

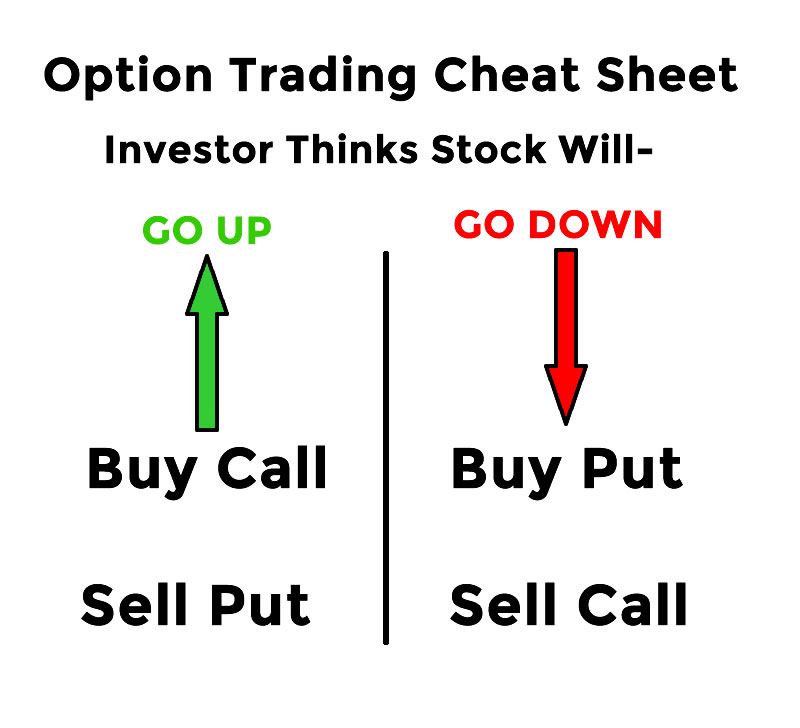

Options Strategy Cheat Sheet - A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Buying a put option makes it a ‘long put’. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’.

Investing

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

Design Patterns Cheat Sheet Pdf everassistant

Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price.

Options Strategies Cheat Sheet [FREE Download] How to Trade

Buying a put option makes it a ‘long put’. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Options Strategies Cheatsheet. Here is a ready referral to Option… by

Buying a put option makes it a ‘long put’. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Option Strategies Cheat Sheet New Trader U

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

Option Strategies Cheat Sheet New Trader U

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

Option Strategy cheatsheet Trader Journal Options, Equities, and

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

Option Strategy Cheat Sheet Two Free Downloads

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. Buying a put option makes it a ‘long put’.

the greeks option trading risk guide vega, gamma, theta, delta

Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’.

Basic Options Strategies Explained The Options Bro Stock Options

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’. Options are contracts that grant the right, but not the obligation to buy or sell an underlying asset at a set price on or before a certain date.

Options Are Contracts That Grant The Right, But Not The Obligation To Buy Or Sell An Underlying Asset At A Set Price On Or Before A Certain Date.

A bull call spread is a vertical spread created by buying a call option (long call) at a lower strike price. Buying a put option makes it a ‘long put’.

![Options Strategies Cheat Sheet [FREE Download] How to Trade](https://howtotrade.com/wp-content/uploads/2023/02/options-strategy-cheat-sheet-1170x827.png)