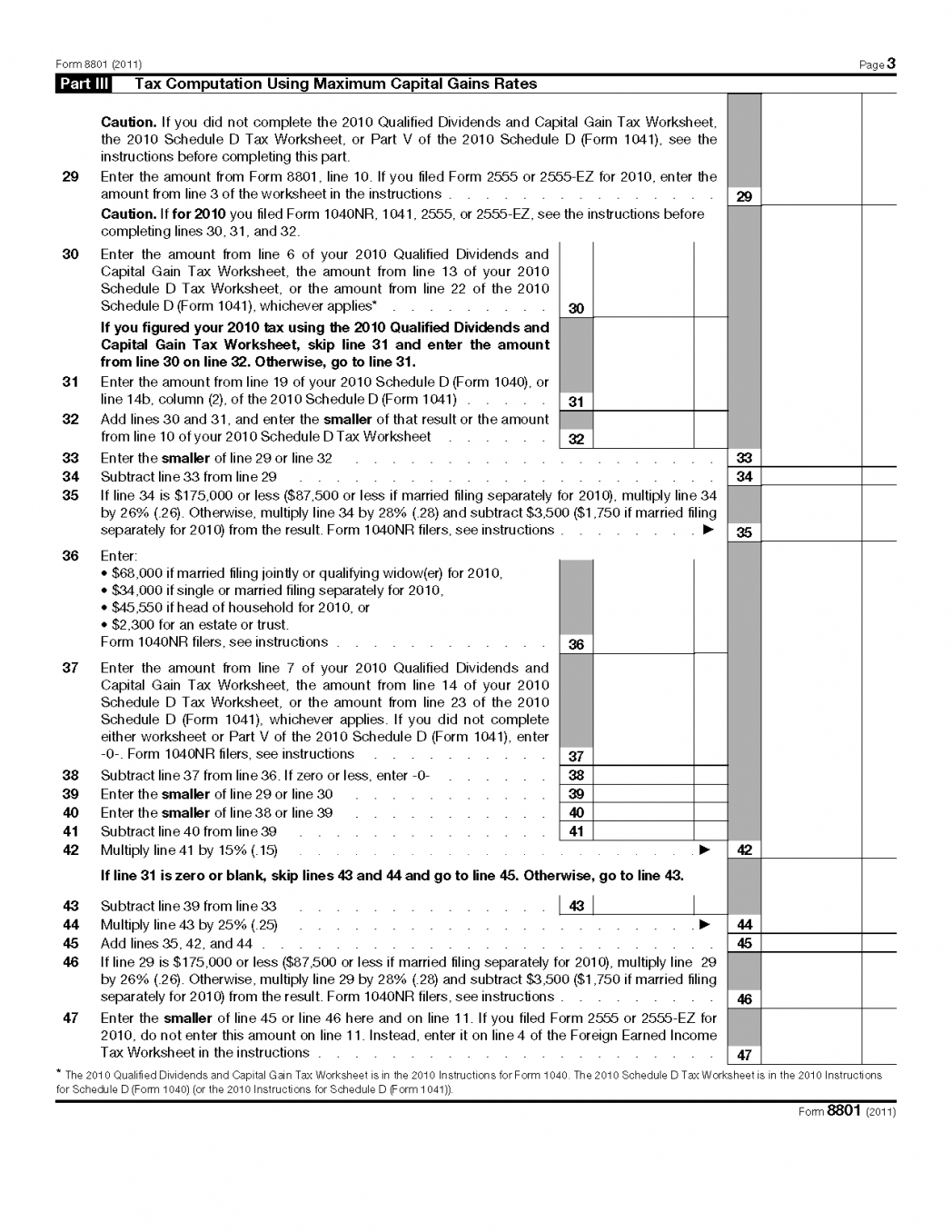

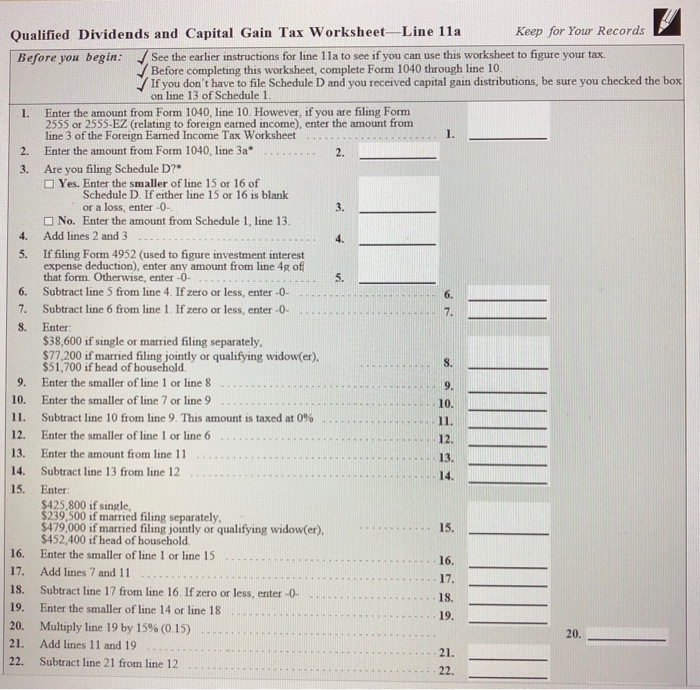

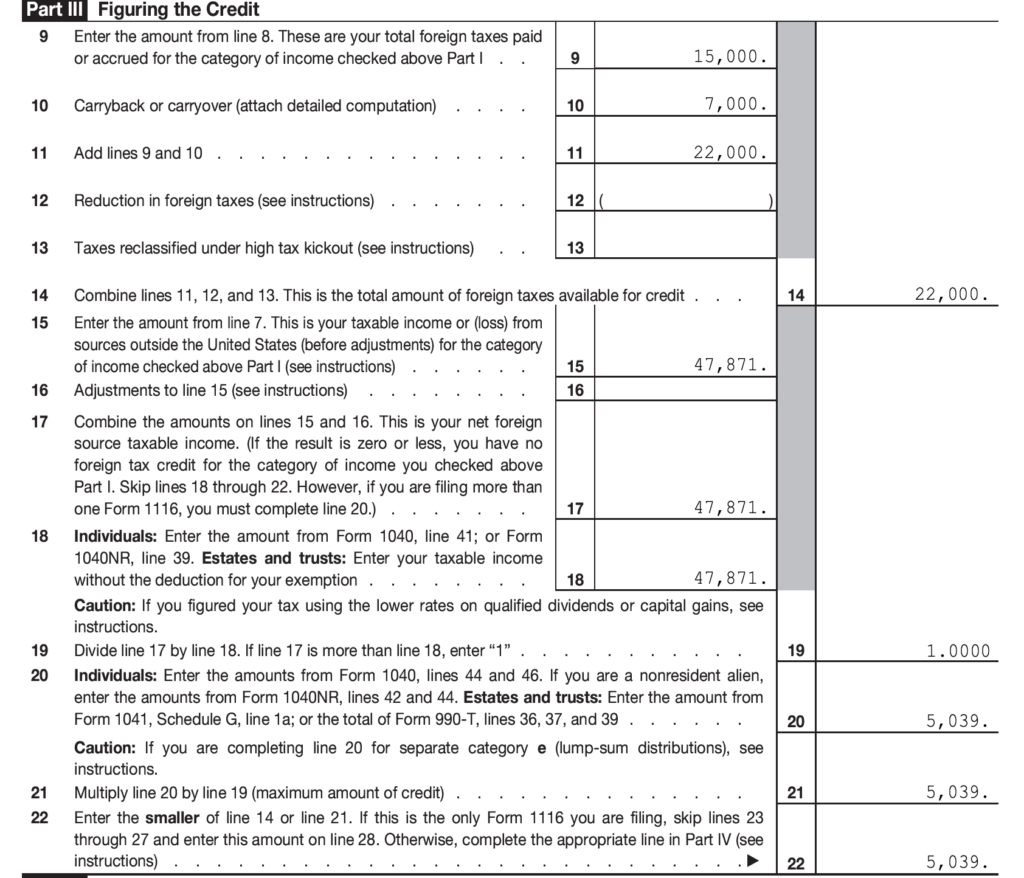

Qualified Dividends And Capital Gain Tax Worksheet Line 16

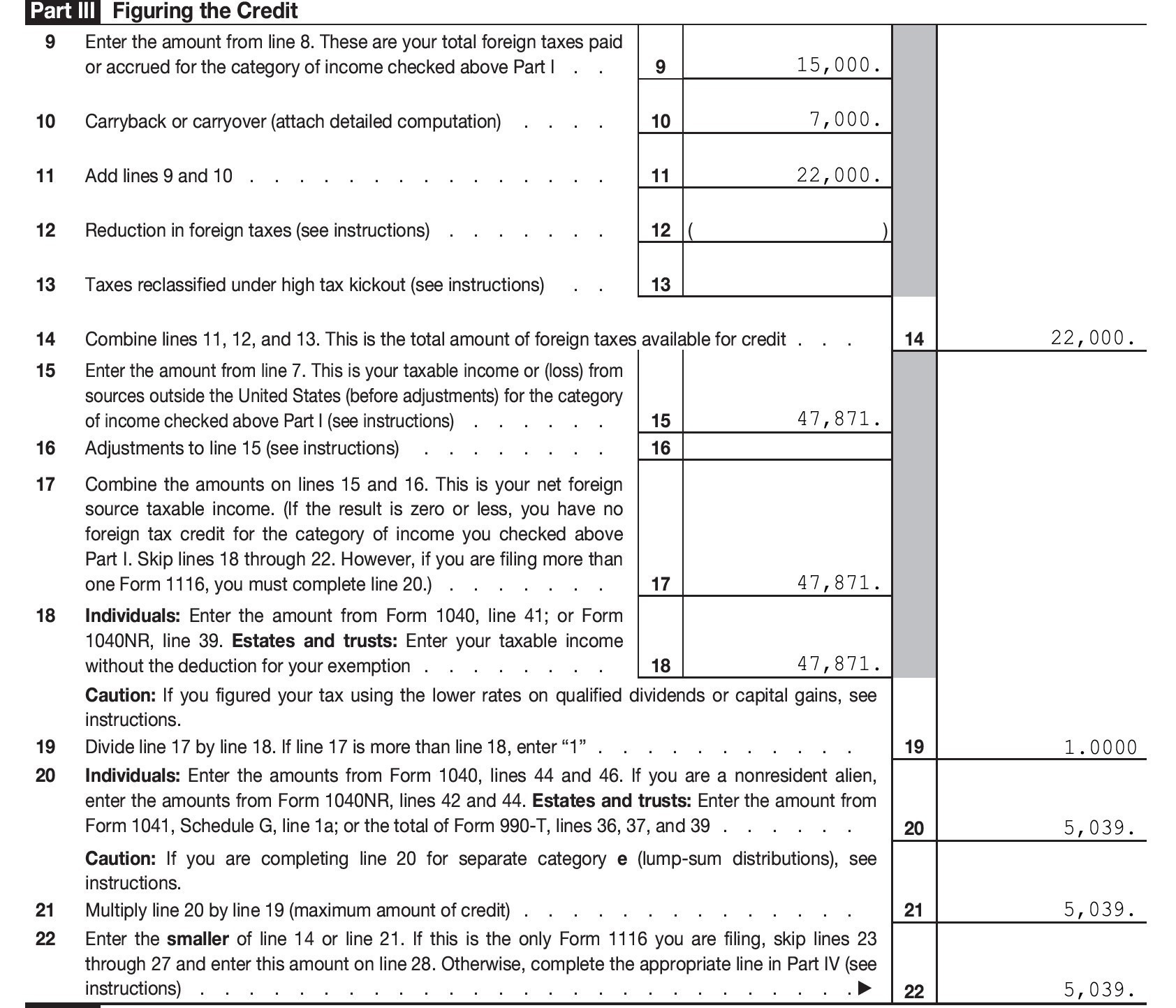

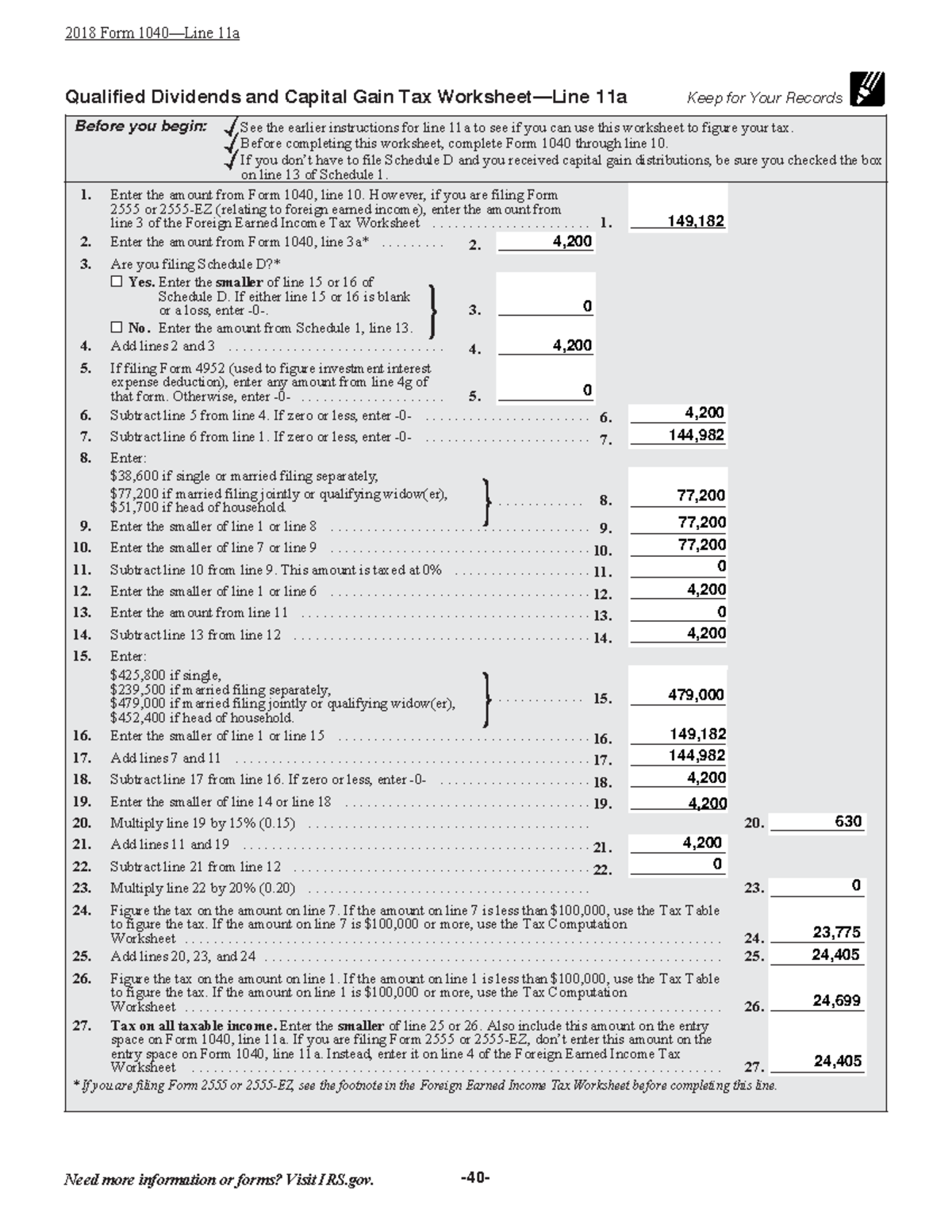

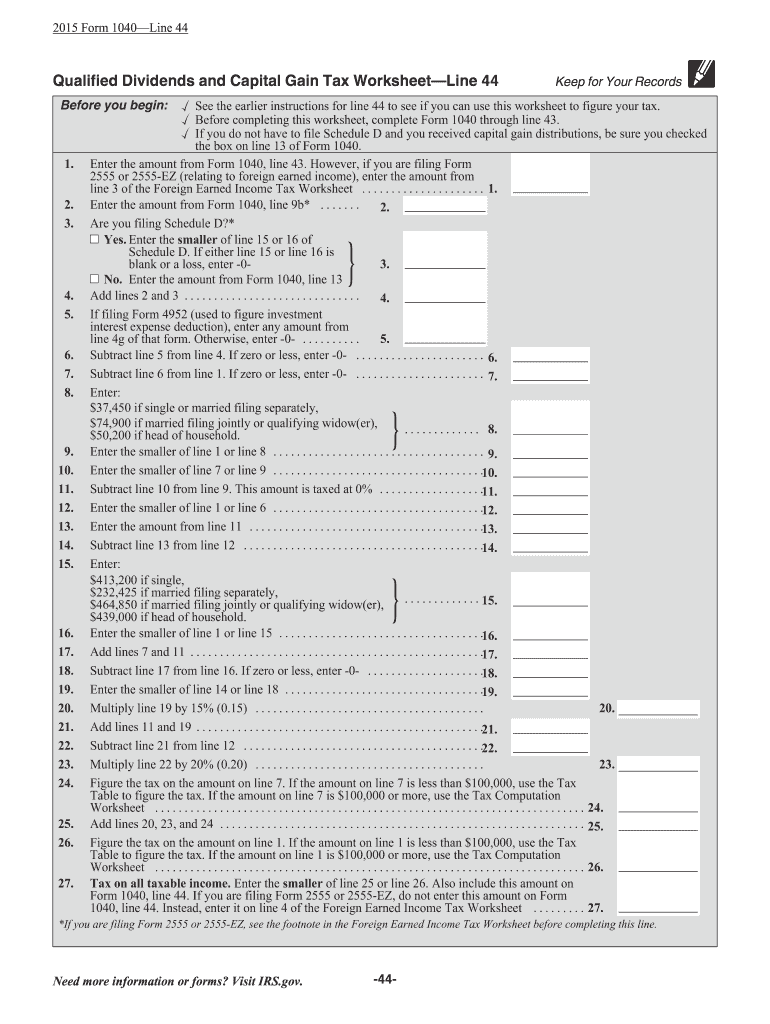

Qualified Dividends And Capital Gain Tax Worksheet Line 16 - See when to use form 8949, form. • if line 16 is a Then, go to line 17 below. V / if you do not have. Use 1 of the following methods to calculate the tax for line 16 of form 1040. Use the tax tables in the form 1040 instructions. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. In the online version you need to save your return as a pdf file and include all worksheets to see it. For the desktop version you can switch to.

In the online version you need to save your return as a pdf file and include all worksheets to see it. Then, go to line 17 below. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V / if you do not have. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. • if line 16 is a Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. For the desktop version you can switch to. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. See when to use form 8949, form.

Then, go to line 17 below. • if line 16 is a Use 1 of the following methods to calculate the tax for line 16 of form 1040. See when to use form 8949, form. For the desktop version you can switch to. V / if you do not have. Use the tax tables in the form 1040 instructions. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. In the online version you need to save your return as a pdf file and include all worksheets to see it.

The Qualified Dividends & Capital Gain Tax Worksheet White Coat

Use 1 of the following methods to calculate the tax for line 16 of form 1040. V / if you do not have. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. • if line 16 is a Use the tax tables in the form 1040.

Capital Gain Tax Worksheet Line 16

Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. For the desktop version you can switch to. • if line 16 is a Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. V/ see the instructions for line.

Qualified Dividends And Capital Gains Worksheet Line 16

See when to use form 8949, form. Then, go to line 17 below. • if line 16 is a V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Use the tax tables in the form 1040 instructions.

Qualified Dividends And Capital Gains Sheet

• if line 16 is a For the desktop version you can switch to. V / if you do not have. See when to use form 8949, form. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg.

Qualified Dividends And Capital Gain Tax Worksheet Line 16

Use the tax tables in the form 1040 instructions. Then, go to line 17 below. V / if you do not have. See when to use form 8949, form. For the desktop version you can switch to.

Qualified Dividends And Capital Gain Tax Worksheet 2020

In the online version you need to save your return as a pdf file and include all worksheets to see it. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. See when to use form 8949, form. • if line 16 is a For the desktop version.

Capital Gains And Qualified Dividends Worksheet

V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. V / if you do not have. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions. Use the tax tables in the form 1040 instructions. Then, go to line 17.

Qualified Dividends And Capital Gain Tax Worksheetline 16

• if line 16 is a Then, go to line 17 below. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. Use 1 of the following methods to calculate the tax for line 16 of form 1040. In the online version you need to save your.

Qualified Dividends And Capital Gain Tax Worksheet Line 16 2

See when to use form 8949, form. V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. In the online version you need to save.

Use The Tax Tables In The Form 1040 Instructions.

• if line 16 is a Line 9 tells you the amount in the 0% qualified dividend/ltcg bracket, line 18 tells you the amount in the 15% qualified dividend/ltcg. See when to use form 8949, form. Learn how to complete schedule d (form 1040) to report capital gains and losses from various transactions.

In The Online Version You Need To Save Your Return As A Pdf File And Include All Worksheets To See It.

V/ see the instructions for line 16 in the instructions to see if you can use this worksheet to figure your tax. Then, go to line 17 below. Use 1 of the following methods to calculate the tax for line 16 of form 1040. V / if you do not have.