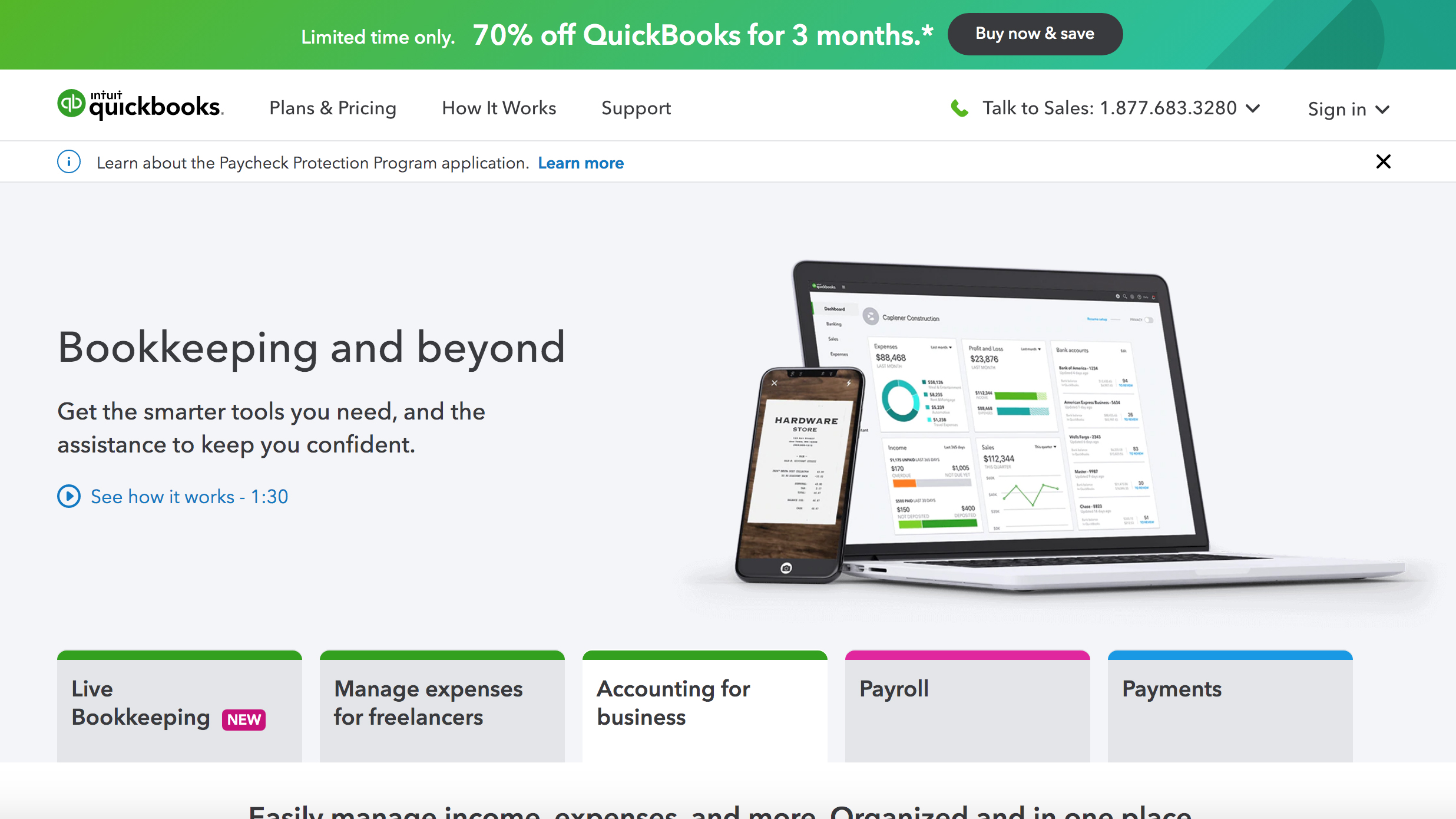

Quickbooks Cares

Quickbooks Cares - We take care of your books for you, so you can get back to the job of running your business and generating profits. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. First, you'll need to process an adjustment to zero. Let me help you in recording the washington cares fund payroll tax refund.

Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. We take care of your books for you, so you can get back to the job of running your business and generating profits. First, you'll need to process an adjustment to zero. The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. Let me help you in recording the washington cares fund payroll tax refund. With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee.

First, you'll need to process an adjustment to zero. The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. We take care of your books for you, so you can get back to the job of running your business and generating profits. With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. Let me help you in recording the washington cares fund payroll tax refund.

QuickBooks TechRadar

The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. First, you'll need to process an adjustment to zero. Let me help you in recording the washington cares fund payroll tax refund. We take care.

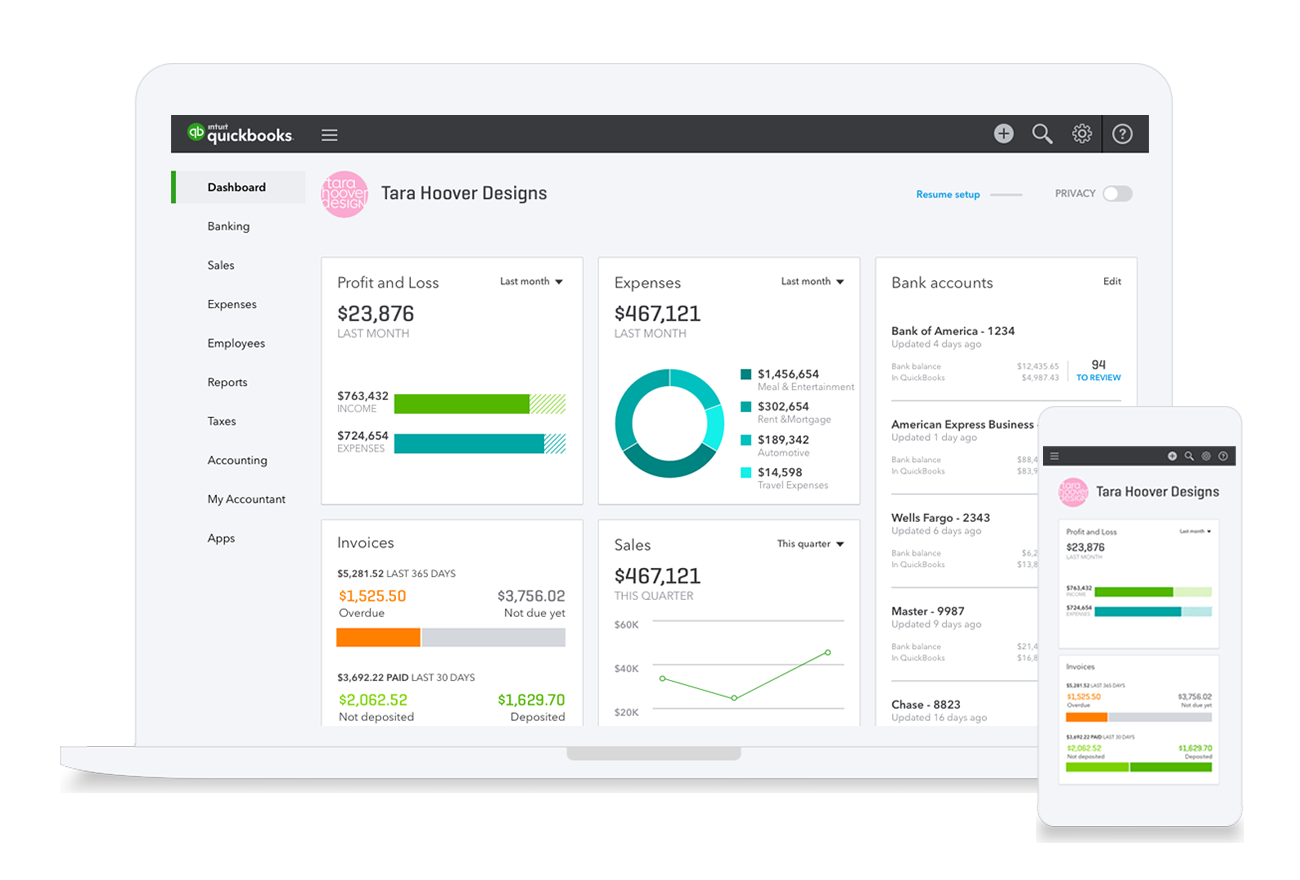

QuickBooks Online Educator Registration Form Intuit for Education

With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. First, you'll need to process an adjustment to zero. Let me help you in recording the washington cares fund payroll tax refund. We take care of your books for you, so you can get back to the.

Bookkeeping QuickBooks Desktop Fundamentals Skill Success

With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. First, you'll need to process an adjustment to zero. We take care of your books for you, so you can.

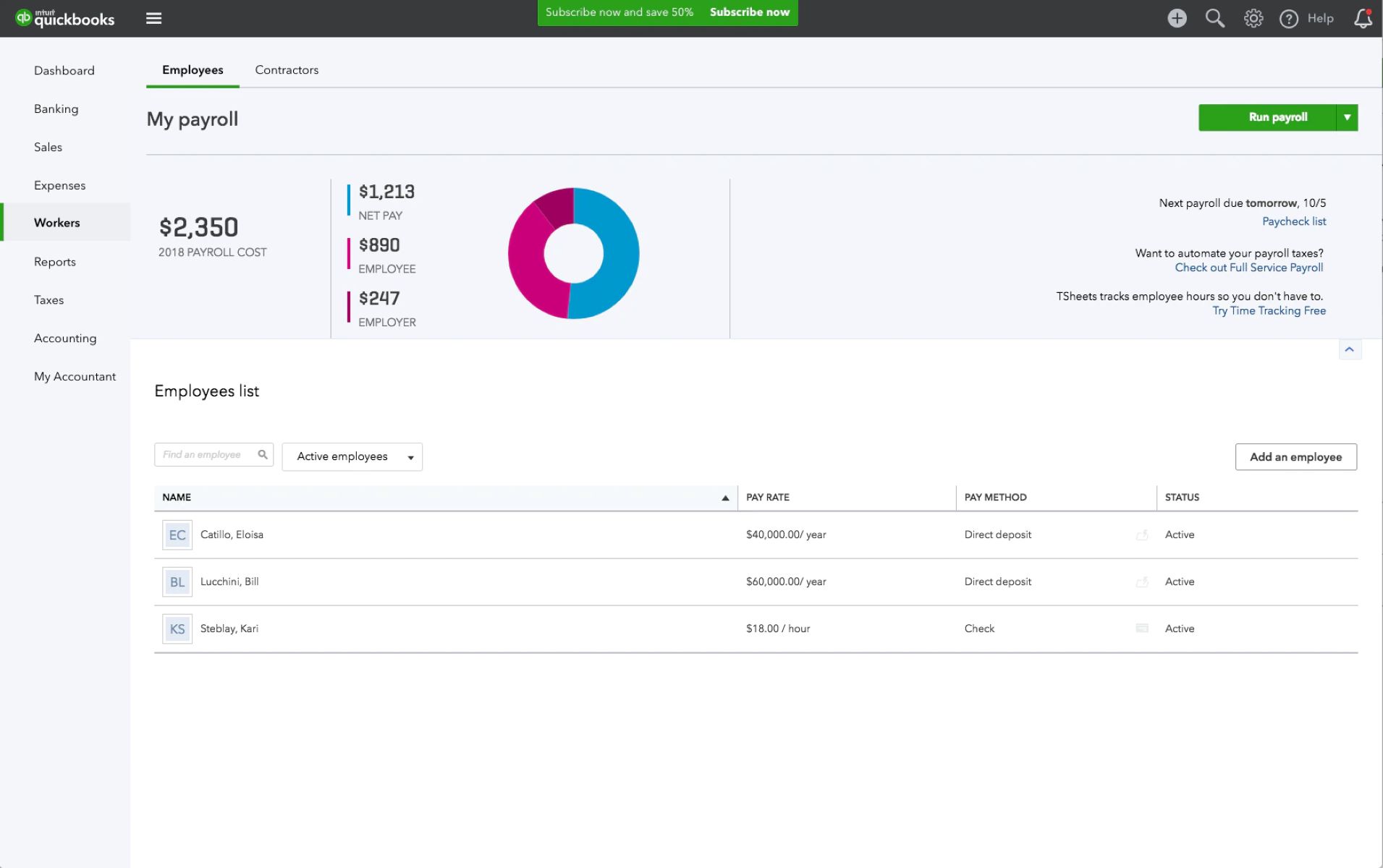

What Is Quickbooks Workforce

The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. We take care of your books for you, so you can get back to the job of running your business and generating profits. First, you'll need to process an adjustment to zero. Let me help you in recording the washington cares fund.

Solved How do I issue a credit card refund in Quickbooks 2020 for Mac?

Let me help you in recording the washington cares fund payroll tax refund. The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. We take care of your books for you, so you can get.

QuickBooks and QuickBooks Online Merging for Home Care Software

First, you'll need to process an adjustment to zero. Let me help you in recording the washington cares fund payroll tax refund. We take care of your books for you, so you can get back to the job of running your business and generating profits. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in.

Comparison QuickBooks Vs. QuickBooks Enterprise Aenten US

First, you'll need to process an adjustment to zero. Let me help you in recording the washington cares fund payroll tax refund. We take care of your books for you, so you can get back to the job of running your business and generating profits. Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in.

How to Use QuickBooks StepbyStep Guide

We take care of your books for you, so you can get back to the job of running your business and generating profits. Let me help you in recording the washington cares fund payroll tax refund. With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. The.

Account CaresInstant Solutions for QuickBooks Payroll Issues ppt

With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. We take care of your books for you, so you can get back to the job of running your business and generating profits. Let me help you in recording the washington cares fund payroll tax refund. Automatically.

QuickBooks Premier Hosting Solutions by Trained Professionals by

Automatically contribute 0.58% of your paycheck to the fund during your working years, starting in july 2023. Let me help you in recording the washington cares fund payroll tax refund. First, you'll need to process an adjustment to zero. We take care of your books for you, so you can get back to the job of running your business and.

Automatically Contribute 0.58% Of Your Paycheck To The Fund During Your Working Years, Starting In July 2023.

The coronavirus aid, relief, and economic security (cares) act is the federal stimulus package that includes the payroll. With the new cares act, employers can pay up to $5,250 toward student loans and this amount is tax free to the employee. First, you'll need to process an adjustment to zero. We take care of your books for you, so you can get back to the job of running your business and generating profits.