Quickbooks Pci Compliance Reddit

Quickbooks Pci Compliance Reddit - Work with intuit support to figure out. And, while the pci security. Qb is pci compliant, but they are only a part of your company profile (so to speak). No, merchant compliance is not determined or enforced by the government. They are your third party service provider. Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral fees) to confirm that. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. The links below give you access to. Is pci compliance required by law?

No, merchant compliance is not determined or enforced by the government. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. Work with intuit support to figure out. Is pci compliance required by law? Qb is pci compliant, but they are only a part of your company profile (so to speak). And, while the pci security. Intuit’s accounting offerings are pci compliant and allow you to collect card payments from your customers. Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral fees) to confirm that. They are your third party service provider.

Is pci compliance required by law? Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral fees) to confirm that. The links below give you access to. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). Qb is pci compliant, but they are only a part of your company profile (so to speak). Intuit’s accounting offerings are pci compliant and allow you to collect card payments from your customers. You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. Work with intuit support to figure out. No, merchant compliance is not determined or enforced by the government. They are your third party service provider.

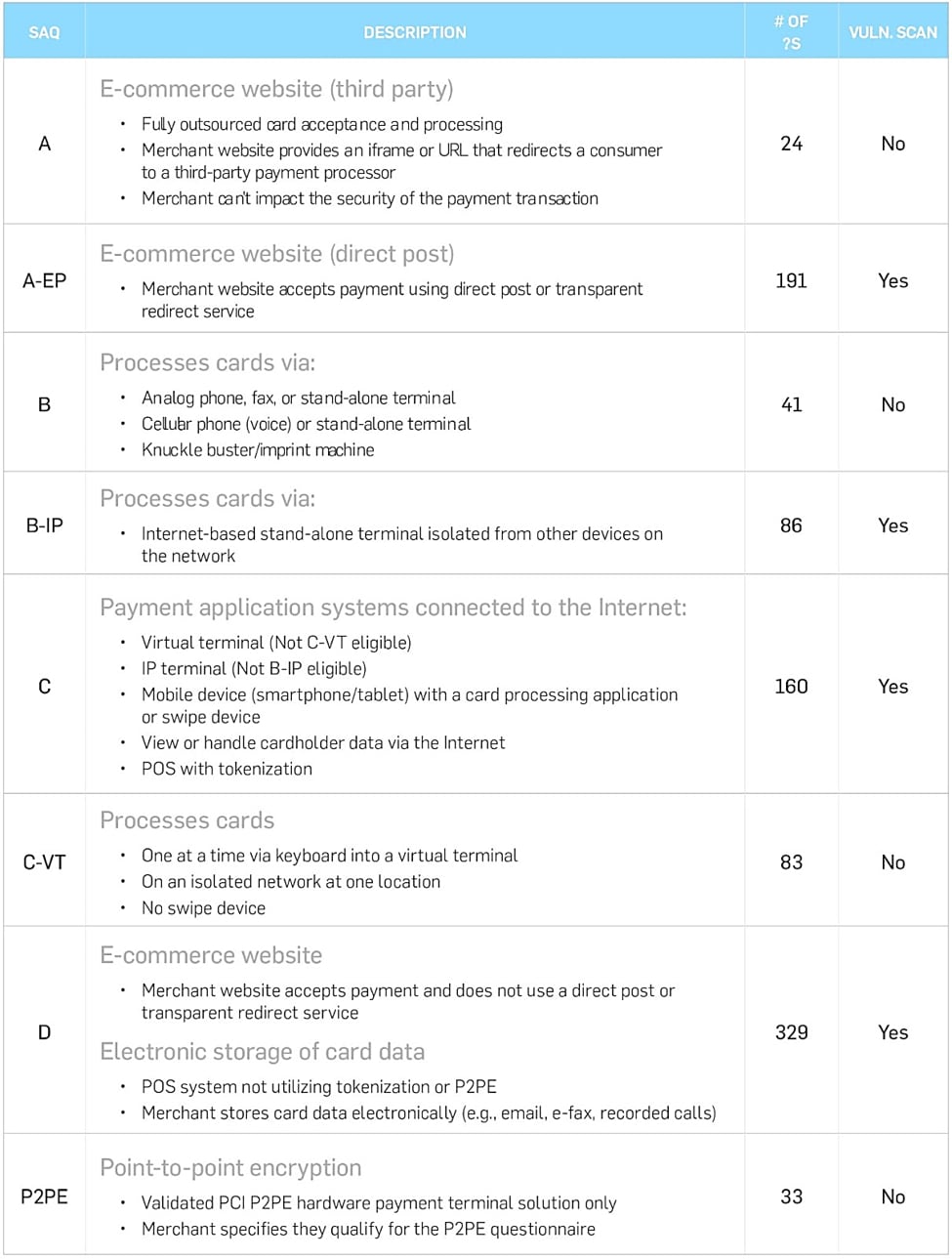

PCI Compliance Full Guide — GoMage Blog

To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). Qb is pci compliant, but they are only a part of your company profile (so to speak). They are your third party service provider. You can continue to accept credit cards if you're not pci compliant, but your card processor.

Why Is Quickbooks Online So Slow

No, merchant compliance is not determined or enforced by the government. Qb is pci compliant, but they are only a part of your company profile (so to speak). You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. Short answer — chances are that you don’t.

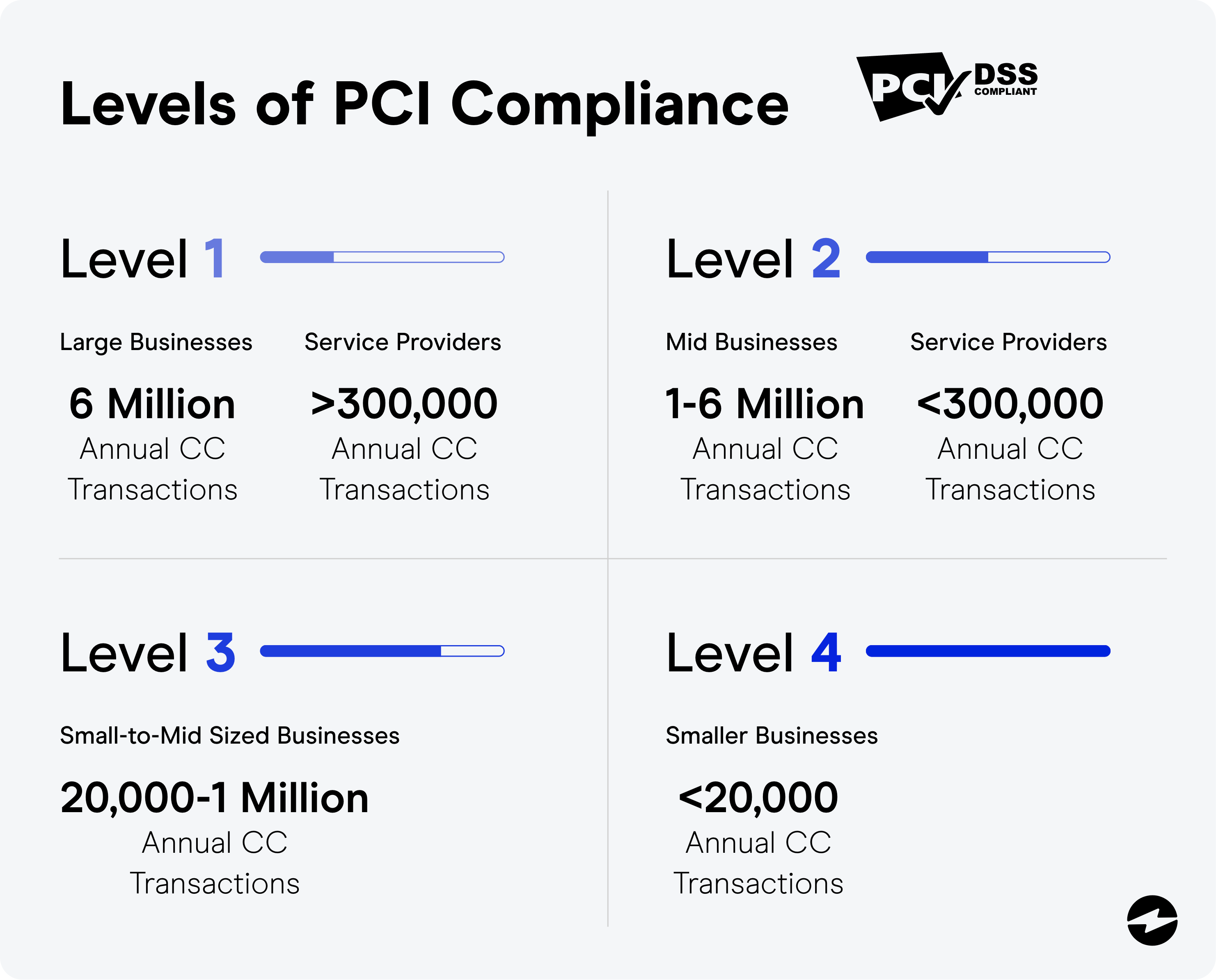

PCI Compliance For Small Businesses Jeremy Eveland

They are your third party service provider. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). Is pci compliance required by law? No, merchant compliance is not determined or enforced by the government. The links below give you access to.

Learn about QuickBooks PCI Compliance

To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). And, while the pci security. Intuit’s accounting offerings are pci compliant and allow you to collect card payments from your customers. You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you.

Pci Compliance

And, while the pci security. You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). They are your third party service provider. Work with intuit support.

Why Am I Getting So Many Emails About QuickBooks PCI Compliance?

You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). They are your third party service provider. The links below give you access to. Qb is.

Intuit QuickBooks Online Review PCMag

And, while the pci security. Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral fees) to confirm that. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). They are your third party service provider. No, merchant compliance is not.

PCI Compliance Email from QuickBooks BigOrange.Marketing

And, while the pci security. You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. Is pci compliance required by law? Qb is pci compliant, but they are only a part of your company profile (so to speak). Short answer — chances are that you don’t.

Wednesday QuickBooks Connect Recap & PCI Compliance YouTube

Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral fees) to confirm that. To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). They are your third party service provider. Work with intuit support to figure out. Intuit’s accounting offerings.

PCI Compliance and EMV Impacting Small Business QuickBooks Integr

No, merchant compliance is not determined or enforced by the government. You can continue to accept credit cards if you're not pci compliant, but your card processor will charge you a monthly fee of $25. Is pci compliance required by law? Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral.

You Can Continue To Accept Credit Cards If You're Not Pci Compliant, But Your Card Processor Will Charge You A Monthly Fee Of $25.

Qb is pci compliant, but they are only a part of your company profile (so to speak). To start with, intuit has a pci service provider to help our quickbooks payments subscribers meet data security standard (dss). And, while the pci security. They are your third party service provider.

Intuit’s Accounting Offerings Are Pci Compliant And Allow You To Collect Card Payments From Your Customers.

No, merchant compliance is not determined or enforced by the government. Short answer — chances are that you don’t need to pay their “partner” (aka intuit is likely receiving referral fees) to confirm that. Work with intuit support to figure out. Is pci compliance required by law?