Schedule R Instructions Form 990

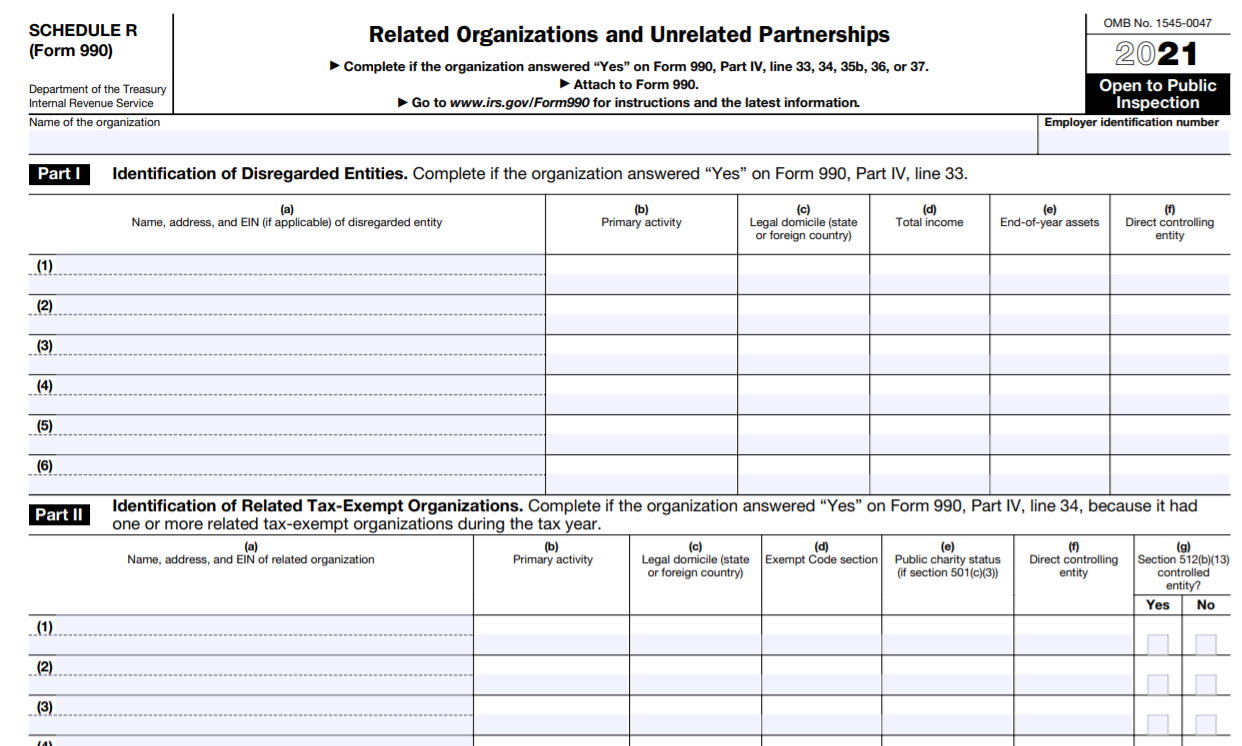

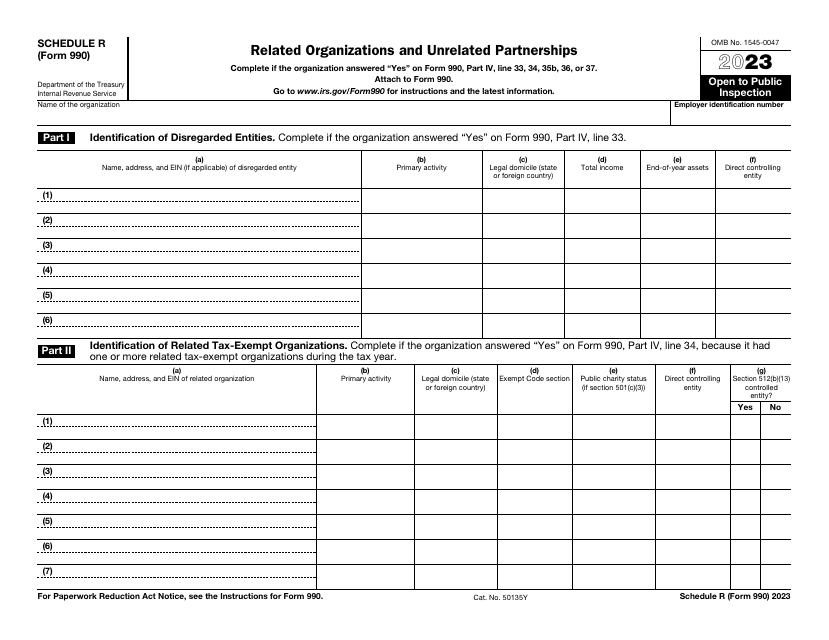

Schedule R Instructions Form 990 - Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Nonresident alien income tax return :

Instruction 990 (schedule r) instructions for. Nonresident alien income tax return : Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions.

This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Nonresident alien income tax return : Instruction 990 (schedule r) instructions for. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions.

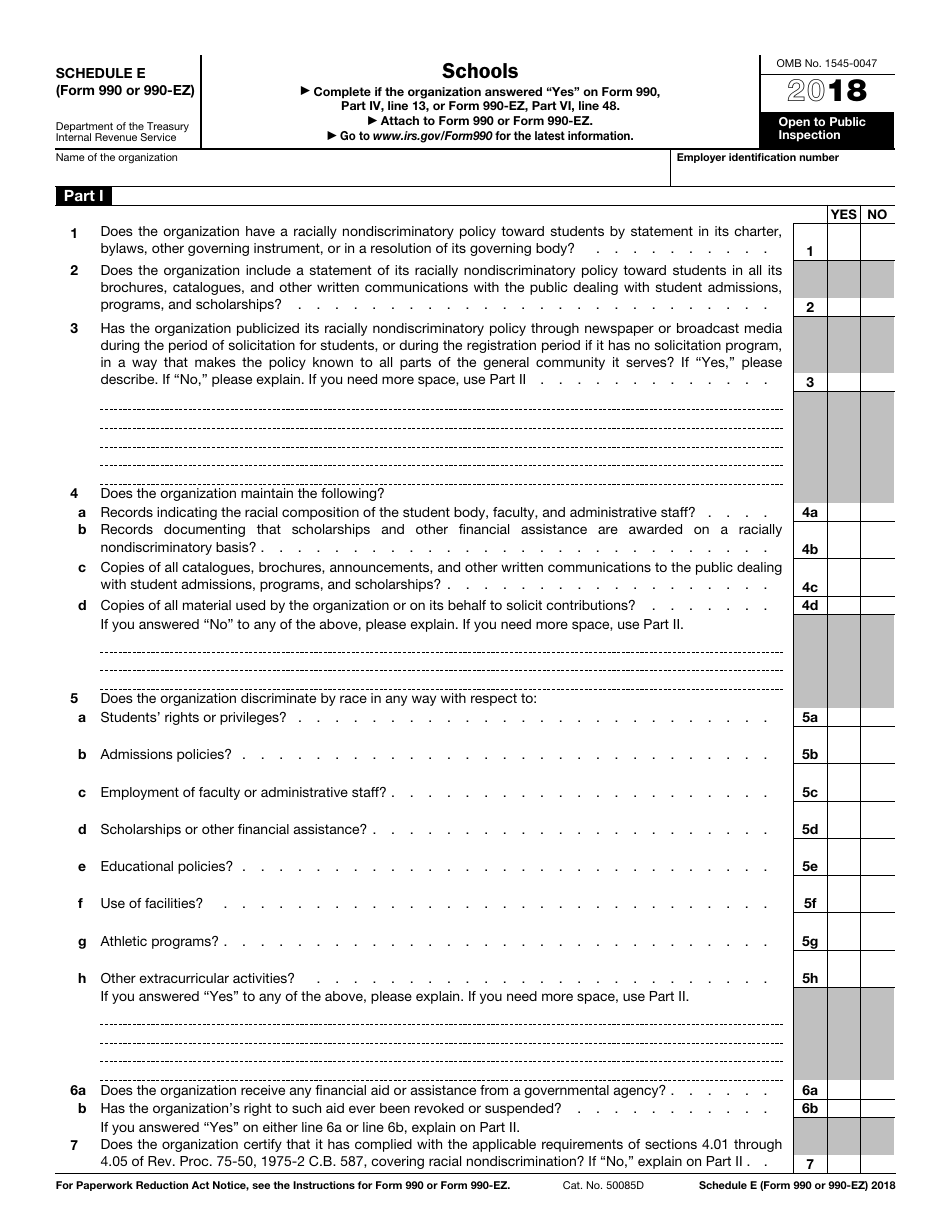

IRS Form 990 (990EZ) Schedule E 2018 Fill Out, Sign Online and

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Instruction 990 (schedule r) instructions for. Nonresident alien income tax return : Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. This document provides guidelines for completing schedule.

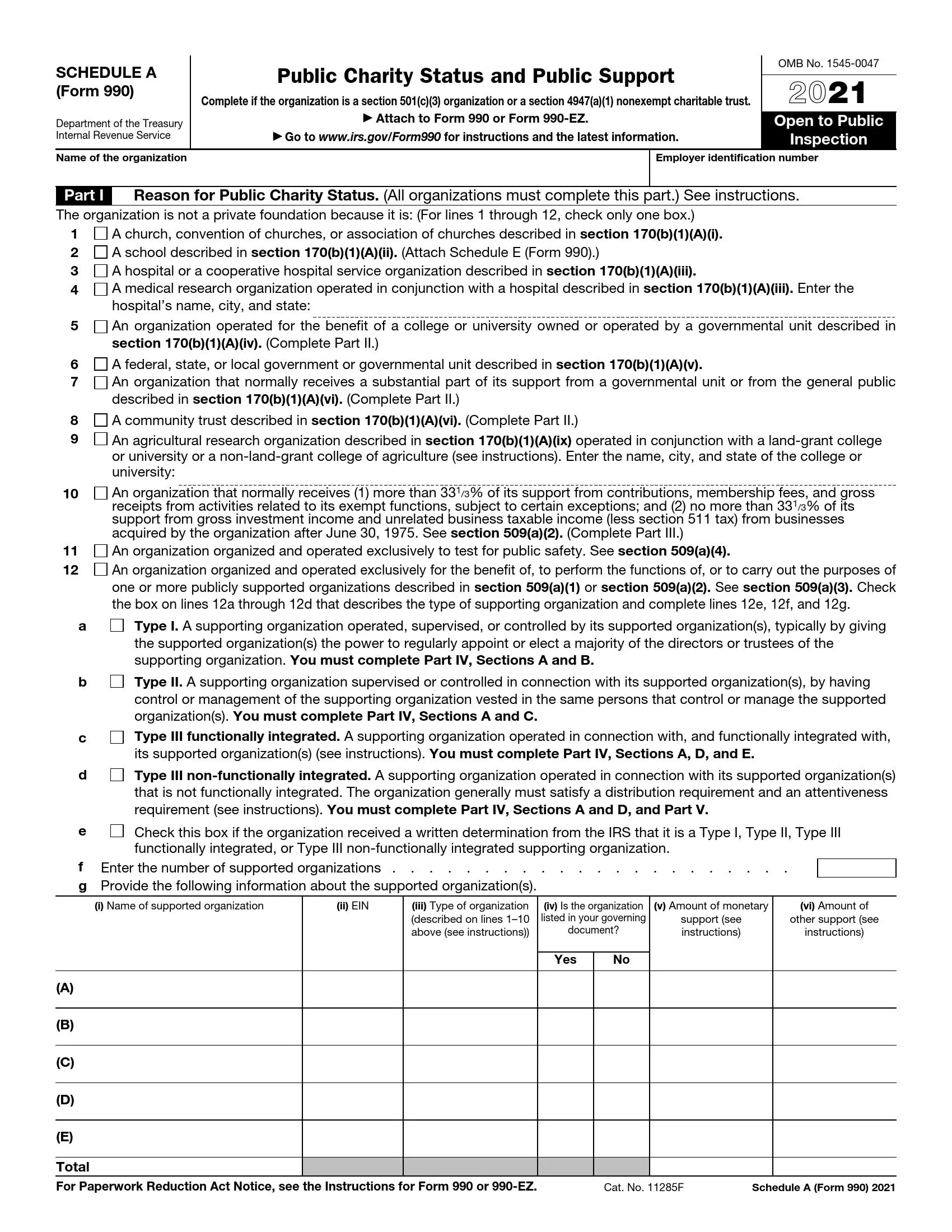

IRS Instructions Schedule A (990 Or 990EZ) 20202022 Fill out Tax

Instruction 990 (schedule r) instructions for. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Report each type of transaction for which you had $50,000 or more with.

2021 IRS Form 990 by Ozarks Food Harvest Issuu

Nonresident alien income tax return : Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Instruction 990 (schedule r) instructions for. Schedule r is filed by the organization with form.

990 schedule b instructions Fill online, Printable, Fillable Blank

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Nonresident alien income tax return : Instruction 990 (schedule r) instructions for. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r is filed by the organization with form.

IRS Schedule A Form 990 or 990EZ ≡ Fill Out Printable PDF Forms Online

Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Nonresident alien income tax return : Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. Report each type of transaction for which.

990 schedule r instructions Fill out & sign online DocHub

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Nonresident alien income tax return : Instruction 990 (schedule r) instructions for. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Schedule r (form 990) is used by an organization.

IRS Form 990 Schedule R Instructions Related Organizations and

Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Instruction 990 (schedule r) instructions for. Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990.

IRS Form 990 Schedule R Download Fillable PDF or Fill Online Related

Instruction 990 (schedule r) instructions for. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. This document provides guidelines for completing schedule r of form 990, detailing related organizations and unrelated partnerships. Report each type of transaction for which you had $50,000 or more with a particular.

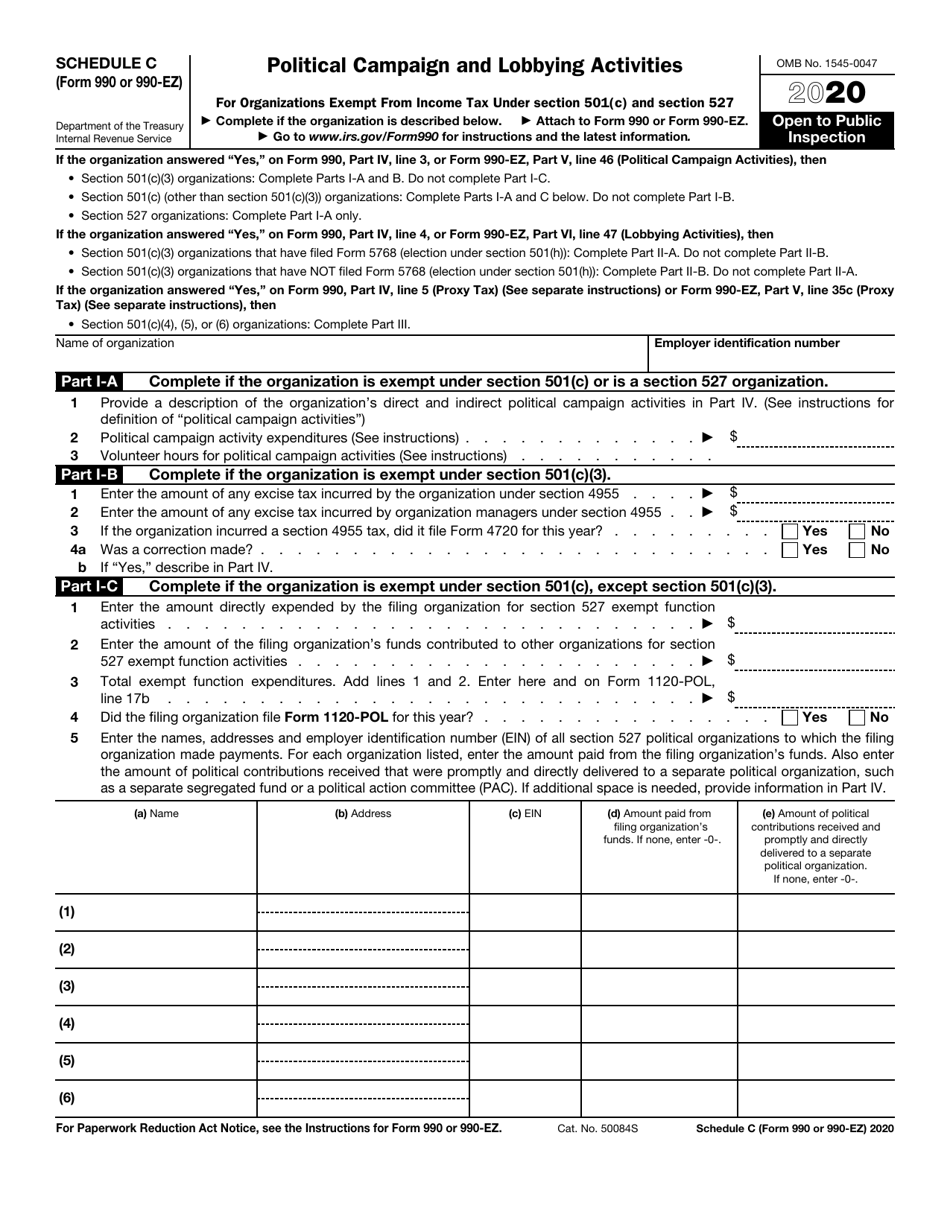

IRS Form 990 (990EZ) Schedule C Download Fillable PDF or Fill Online

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Schedule r is filed by the organization with form 990 to report information on related organizations.

Form 990 (Schedule R) Related Organizations and Unrelated

Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Schedule r (form 990) is used by an organization that files form 990 to provide information on related organizations, on certain transactions. Nonresident alien income tax return : Instruction 990 (schedule r) instructions for. Report each type of transaction for which.

This Document Provides Guidelines For Completing Schedule R Of Form 990, Detailing Related Organizations And Unrelated Partnerships.

Report each type of transaction for which you had $50,000 or more with a particular controlled entity during the fiscal year you’re. Schedule r is filed by the organization with form 990 to report information on related organizations and transactions made. Nonresident alien income tax return : Instruction 990 (schedule r) instructions for.