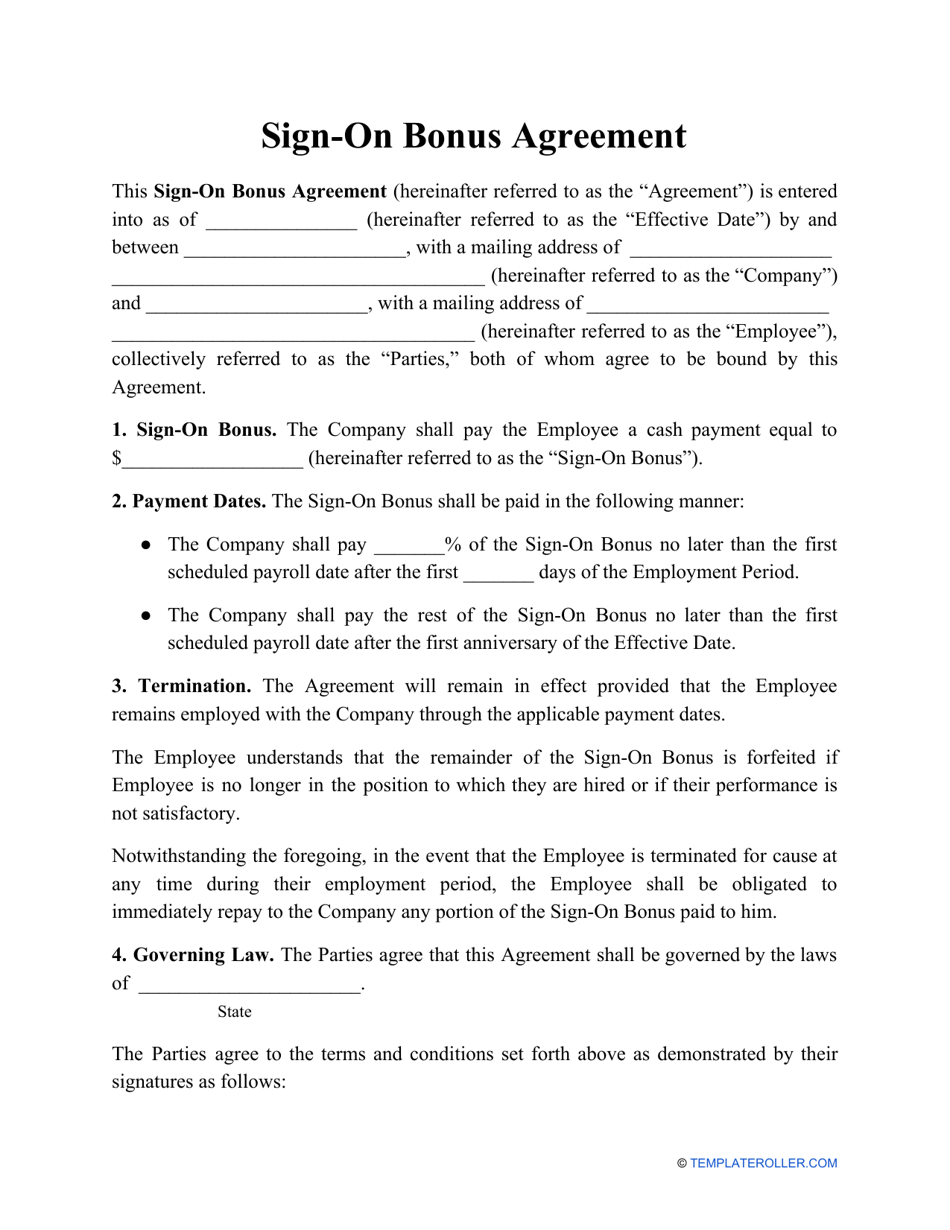

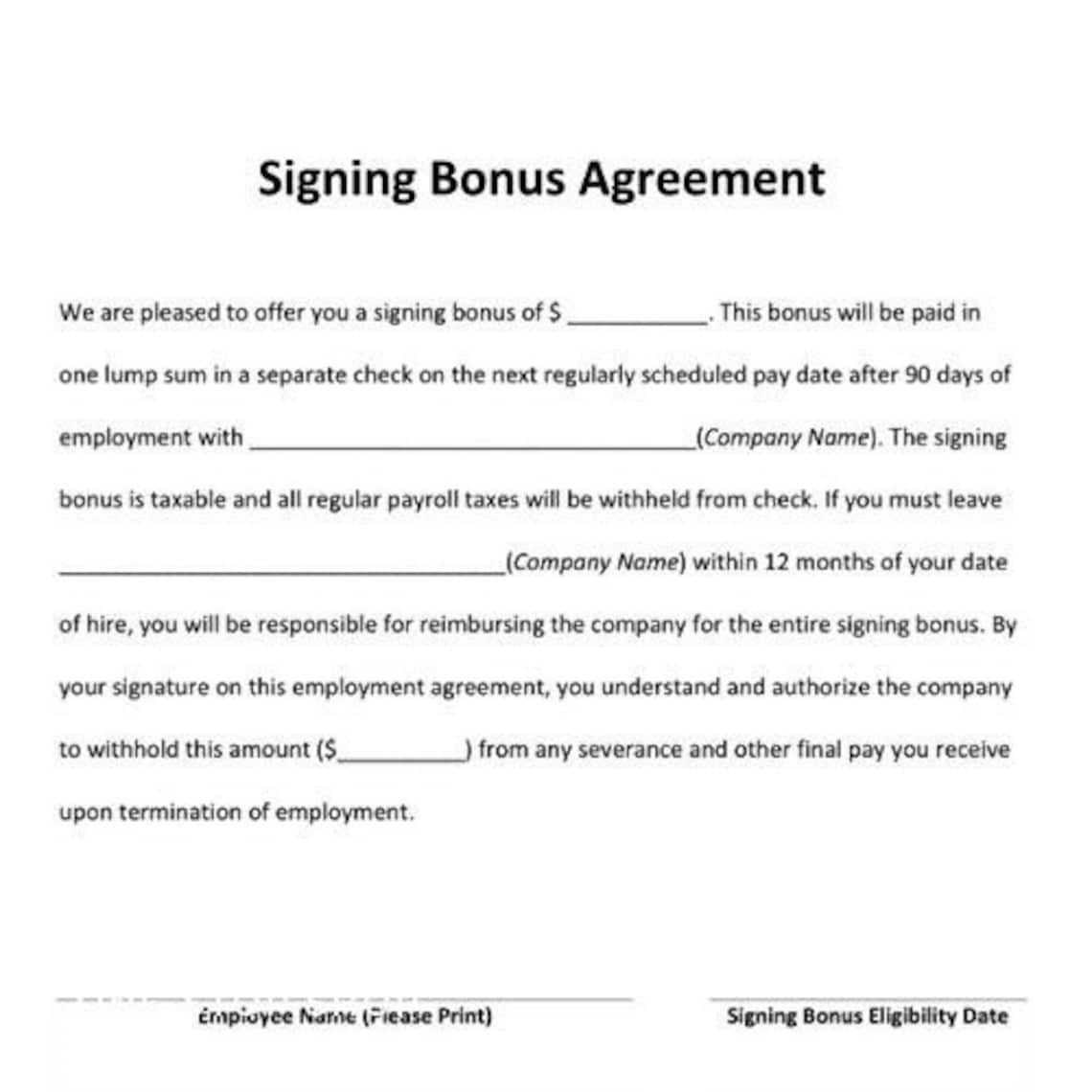

Sign On Bonus Contract Template

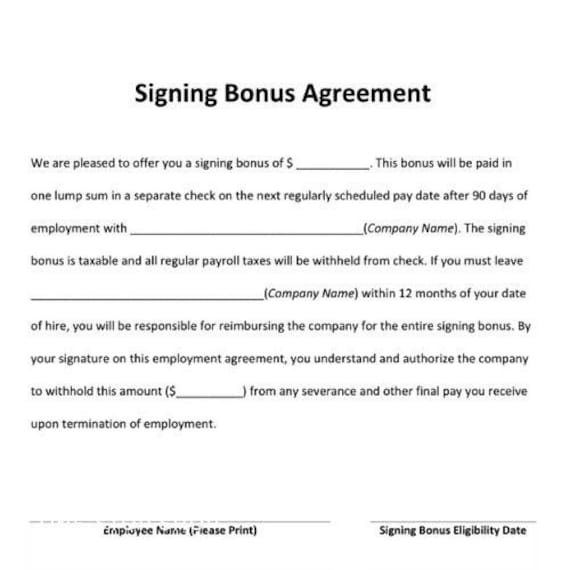

Sign On Bonus Contract Template - We are pleased to offer you a signing bonus of $50,000. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable. This bonus will be paid in one lump sum in a separate check on the next scheduled pay.

We are pleased to offer you a signing bonus of $50,000. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable.

In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus of $50,000.

SignOn Bonus Agreement Template Fill Out, Sign Online and Download

In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable. We are pleased to offer you a signing bonus of $50,000. In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will.

Sign On Bonus Contract Template

This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable. In the event that you leave the company within six (6) months of your date of. In connection with the commencement of your employment, you will receive a cash.

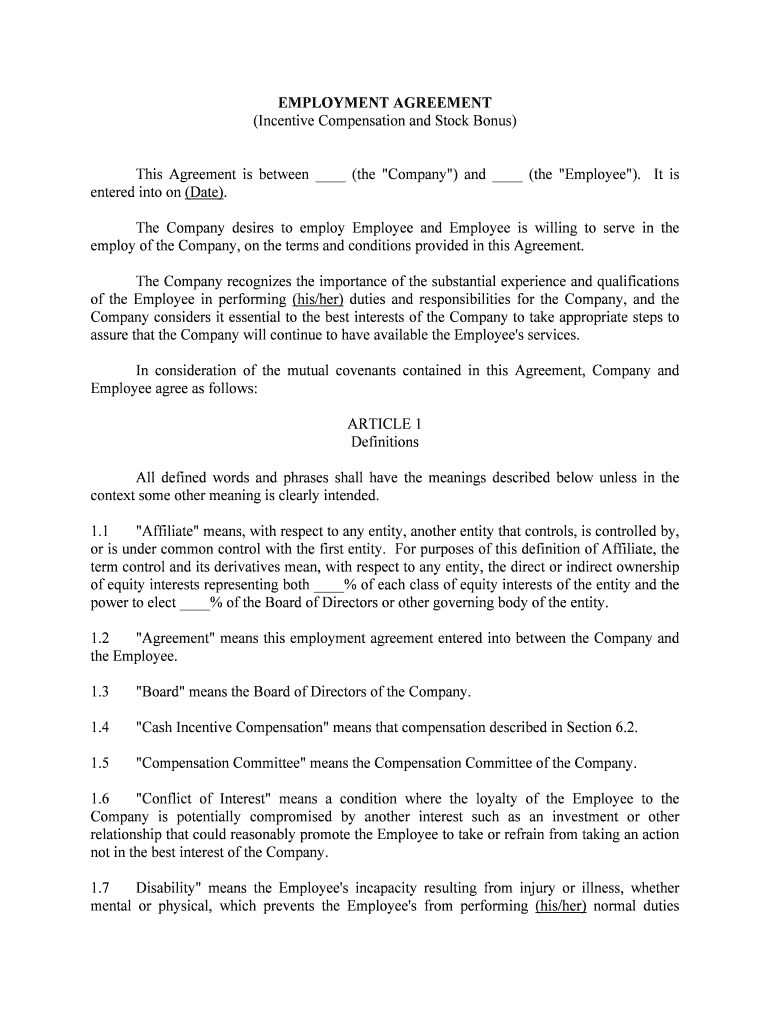

Bonus agreement template Fill out & sign online DocHub

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus.

Retention Bonus Agreement Template

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. In the event that you leave the company within six (6) months of your date of. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum and will be taxable. This bonus will.

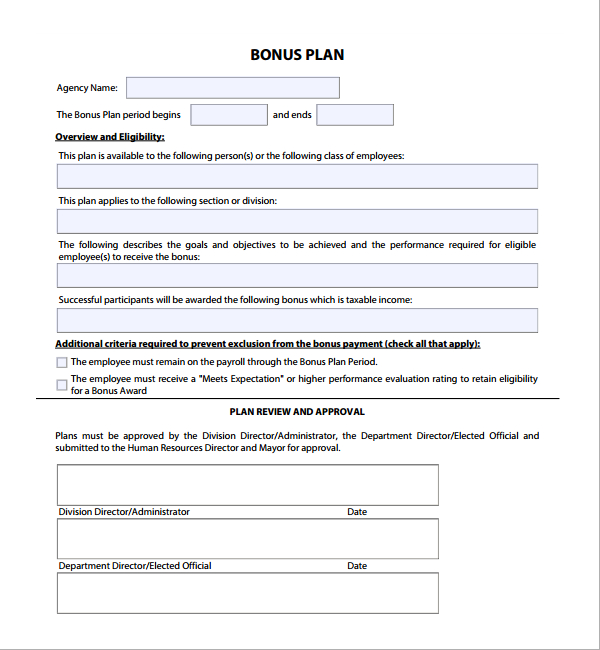

Annual Bonus Policy Template

In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In connection with the commencement of your employment, you will receive a cash.

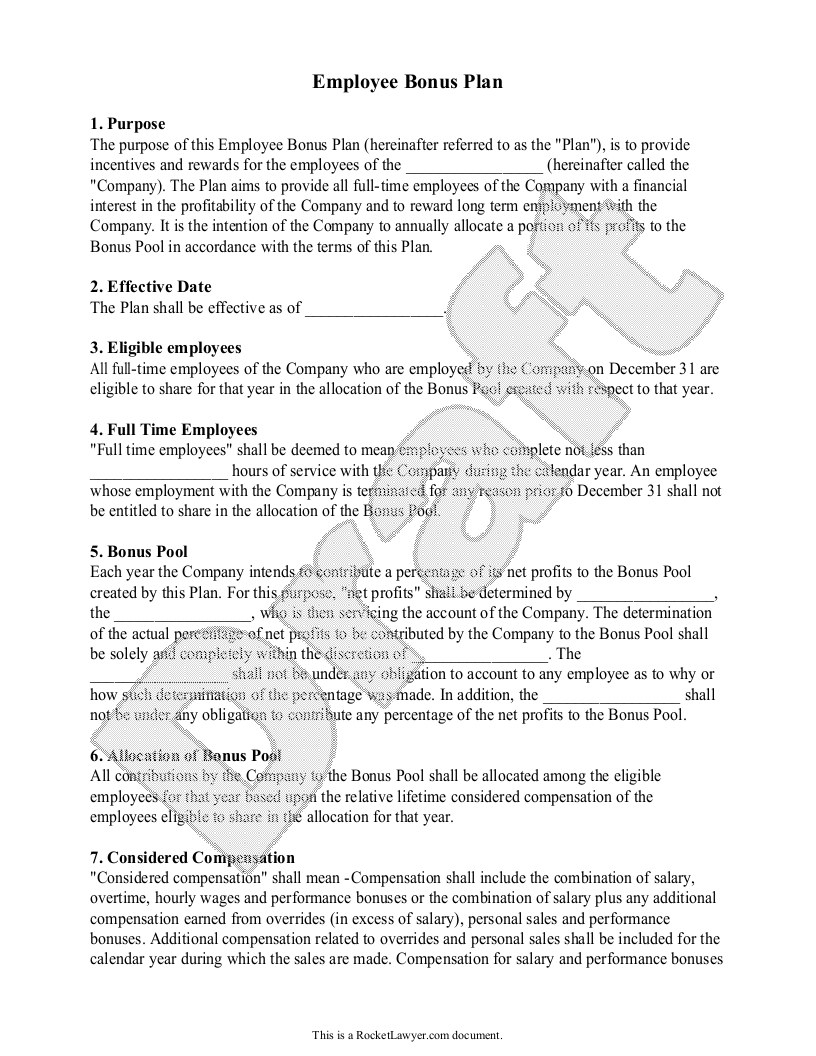

Employee Bonus Plan Template

We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum and will be taxable. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. In connection.

SignOn Bonus Letter Template

This bonus will be paid in one lump sum and will be taxable. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus of $50,000. In the event that you leave the company within six (6) months of your date of. In connection.

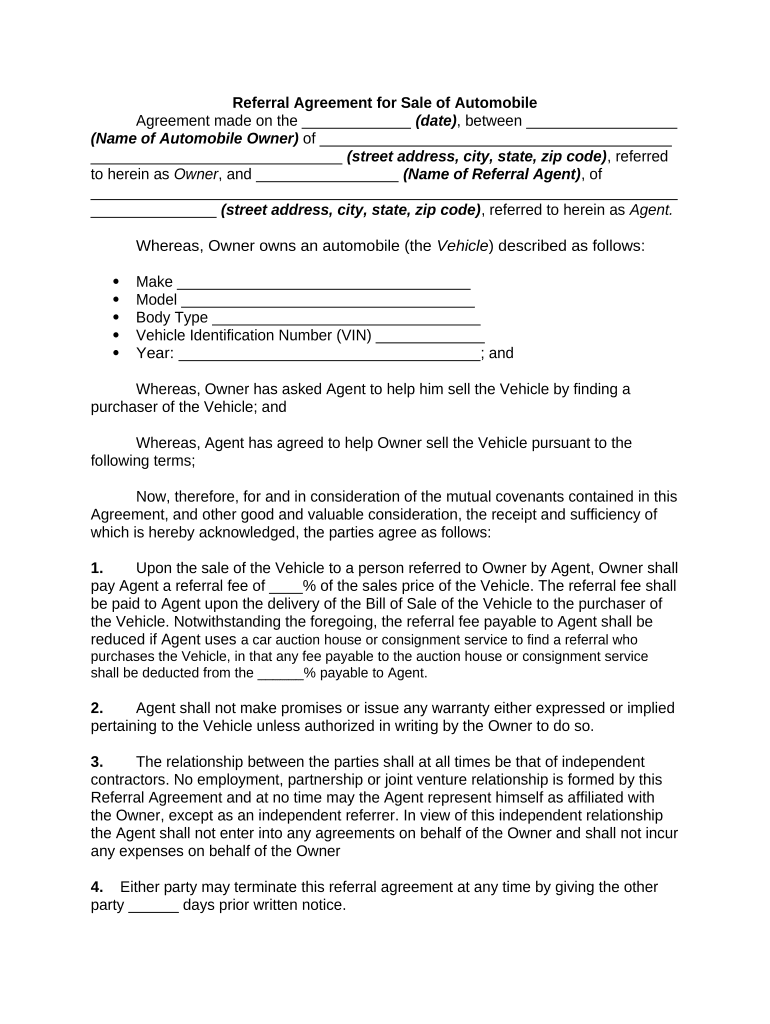

Sample Employee Bonus Plan Agreements RealDealDocs Form Fill Out and

We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable. In the event that you leave the company within six (6) months of your date of. In connection.

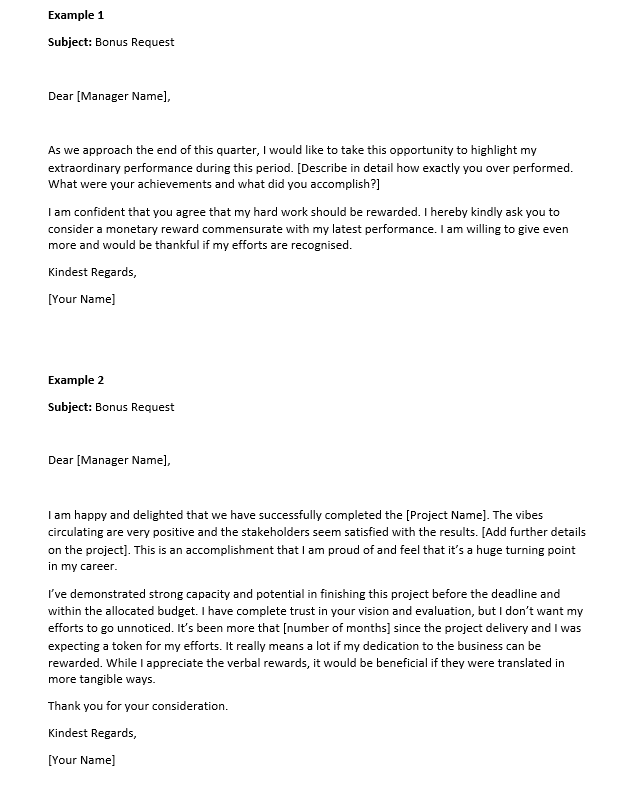

Fun Tips About Bonus Request Letter Format Cv Template Master Profitlayer

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus of $50,000. In the event that you leave the company within six (6) months of your.

Sign On Bonus Contract Template

This bonus will be paid in one lump sum in a separate check on the next scheduled pay. We are pleased to offer you a signing bonus of $50,000. In the event that you leave the company within six (6) months of your date of. This bonus will be paid in one lump sum and will be taxable. In connection.

In The Event That You Leave The Company Within Six (6) Months Of Your Date Of.

In connection with the commencement of your employment, you will receive a cash payment in the aggregate. We are pleased to offer you a signing bonus of $50,000. This bonus will be paid in one lump sum in a separate check on the next scheduled pay. This bonus will be paid in one lump sum and will be taxable.