What Is A Valuation Allowance

What Is A Valuation Allowance - A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that. Learn how to account for. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit.

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

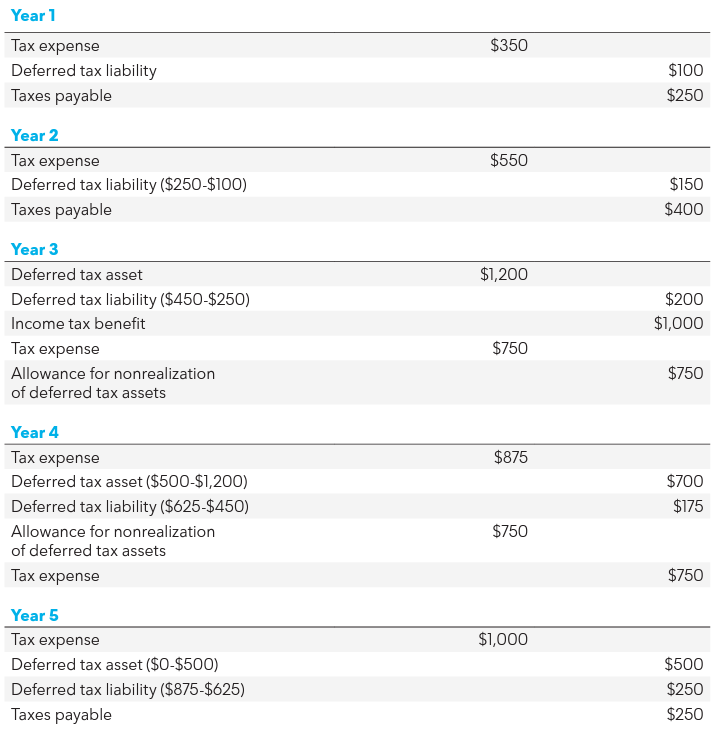

Example How Is a Valuation Allowance Recorded for Deferred Tax Assets?

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. The amount of the allowance is based on that.

Valuation Allowance Basics YouTube

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

What is Valuation Allowance?

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that.

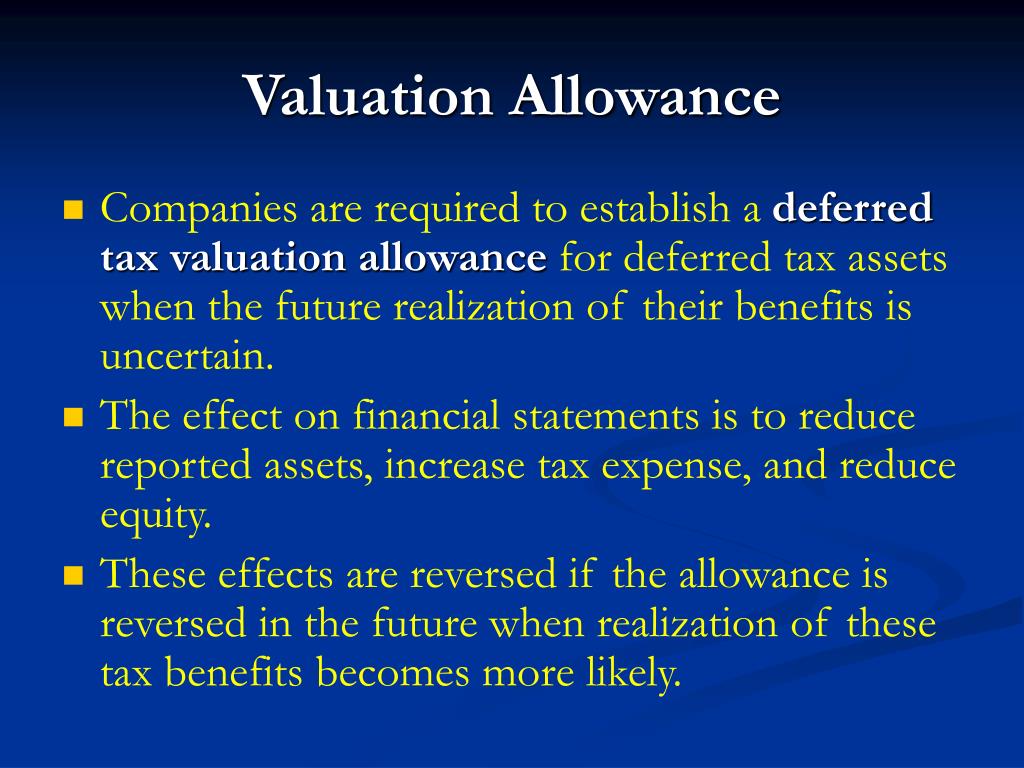

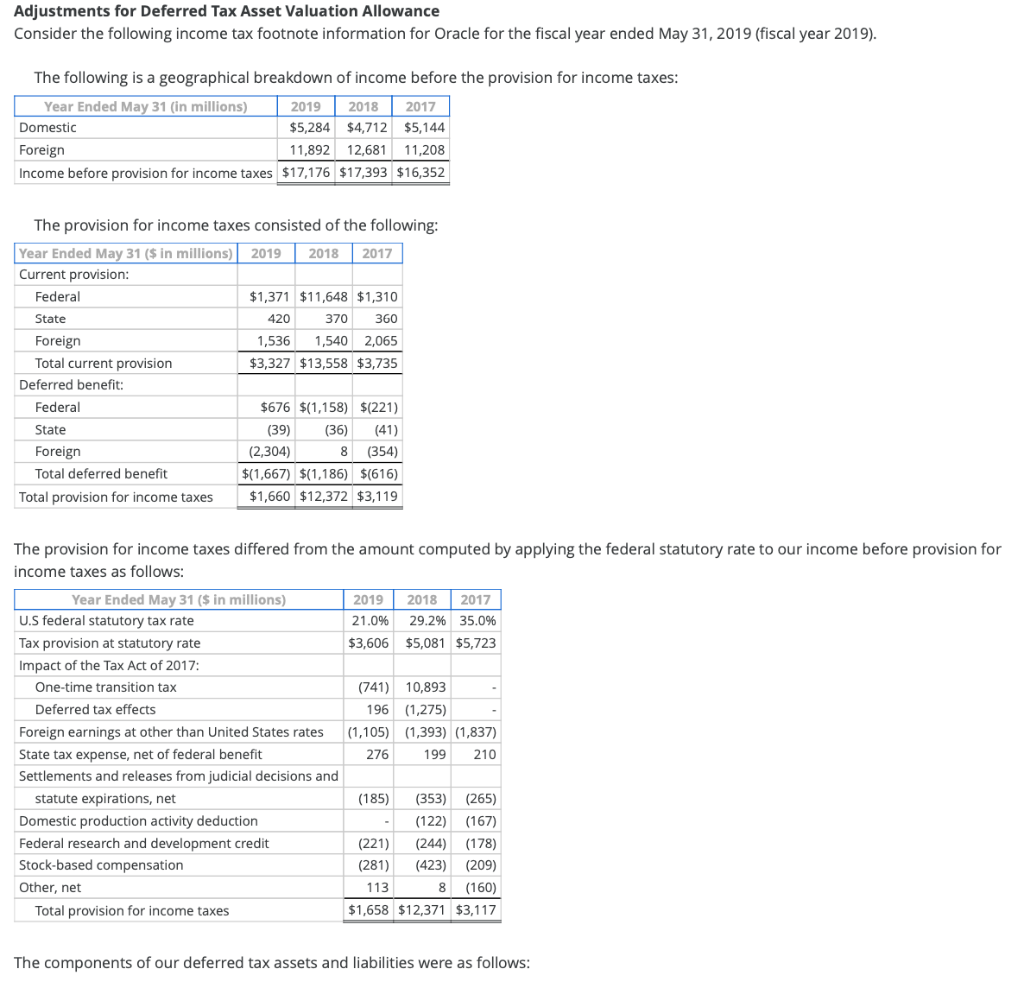

Adjustments for Deferred Tax Asset Valuation

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. The amount of the allowance is based on that.

Accounting for Taxes ppt download

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. The amount of the allowance is based on that.

PPT C H A P T E R 19 PowerPoint Presentation, free download ID3041049

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. The amount of the allowance is based on that. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. Learn how to account for.

Fannie Mae (FNMA) Fannie Mae Deferred Tax Asset (Valuation...

Learn how to account for. The amount of the allowance is based on that. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit.

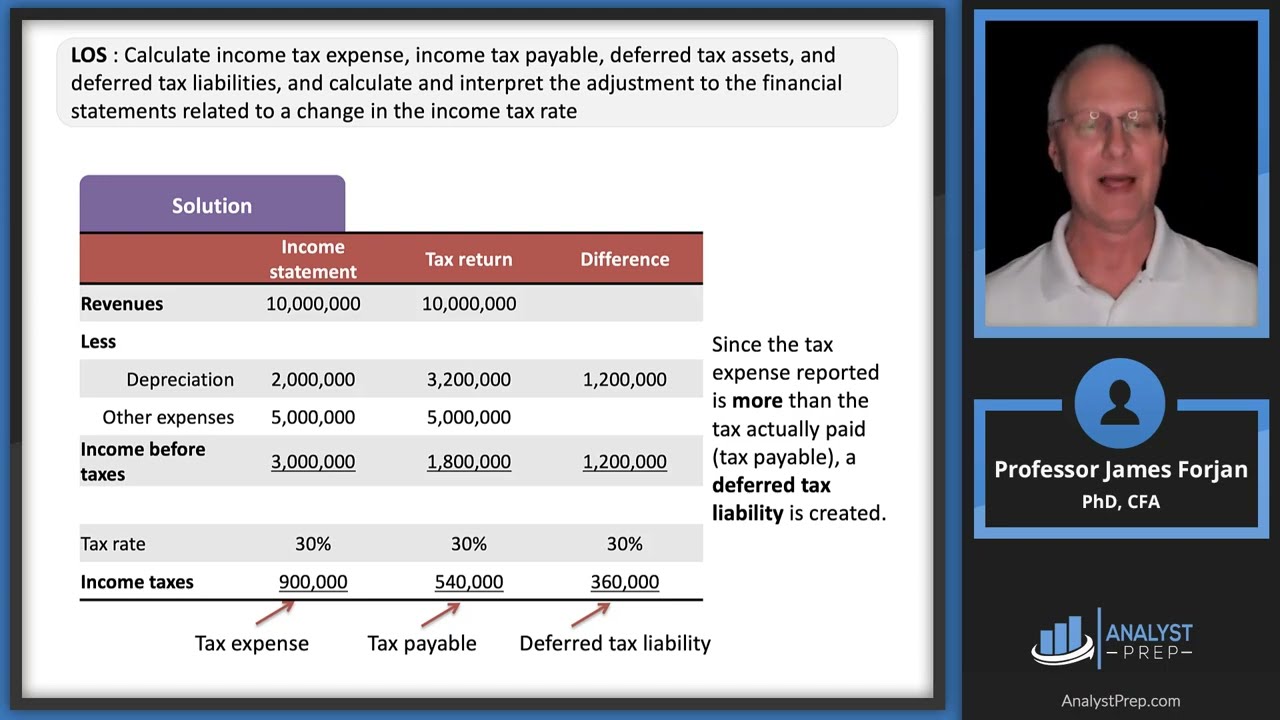

Valuation Allowance for Deferred Tax Assets CFA Level 1 AnalystPrep

Learn how to account for. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. The amount of the allowance is based on that.

PPT Module 5 PowerPoint Presentation, free download ID933435

A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that. Learn how to account for. A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset.

Valuation Allowance For Deferred Tax Assets A Quick Guide

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit. The amount of the allowance is based on that.

The Amount Of The Allowance Is Based On That.

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. Learn how to account for. A valuation allowance is a reduction to a deferred tax asset when there is a low probability of realizing its benefit.

_2-28-2013_p3.png)