What Sales Tax Rate Will Quickbooks Online Apply

What Sales Tax Rate Will Quickbooks Online Apply - Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. You can create and apply custom rates from quickbooks online in buildbook. To create a custom tax rate, start by establishing the rate. In the sales tax center, you can add and edit tax. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings.

Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. Add multiple sales tax rates, including combined. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. To create a custom tax rate, start by establishing the rate. You can create and apply custom rates from quickbooks online in buildbook.

Learn how to set up, edit, and deactivate your sales tax rate and settings. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. In the sales tax center, you can add and edit tax. Add multiple sales tax rates, including combined. You can create and apply custom rates from quickbooks online in buildbook. To create a custom tax rate, start by establishing the rate.

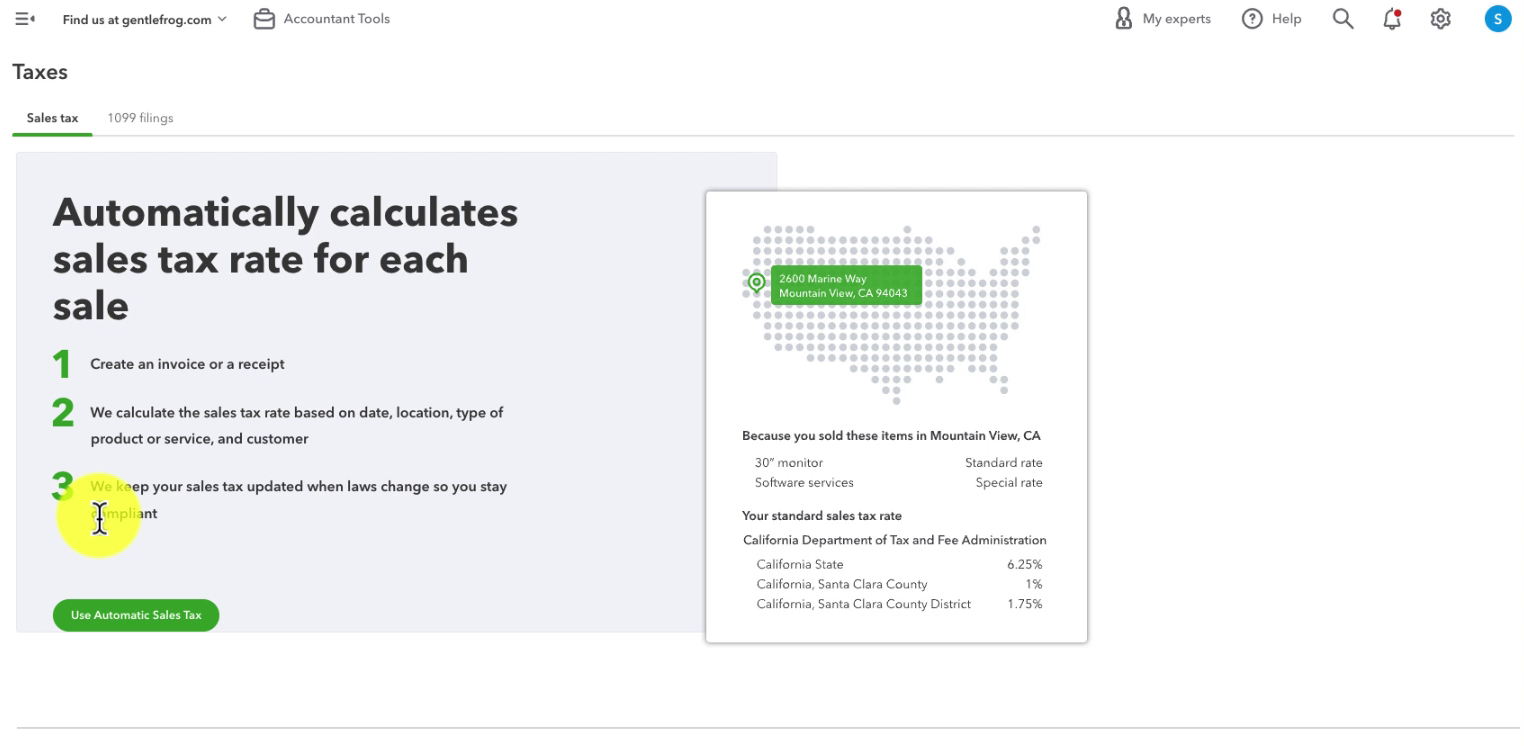

How to Set Up, Track & Pay Sales Tax in QuickBooks Online Gentle Frog

After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. In the sales tax center, you can add and edit tax. Add multiple sales tax rates, including combined. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. To create.

How To Change Sales Tax Rate In Quickbooks

After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. You can create and apply custom rates from quickbooks online in buildbook. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. In the sales tax center, you can add.

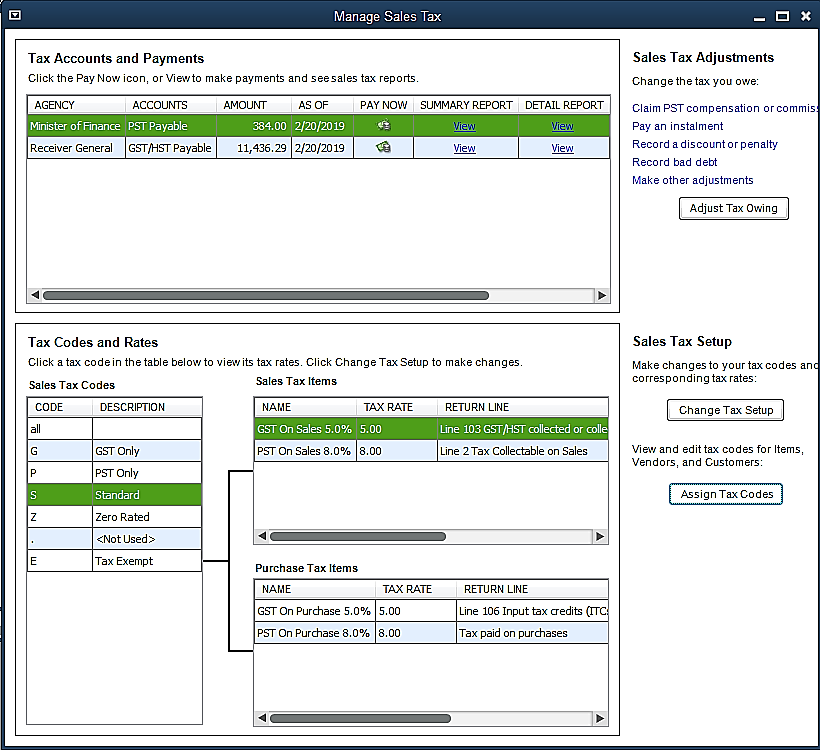

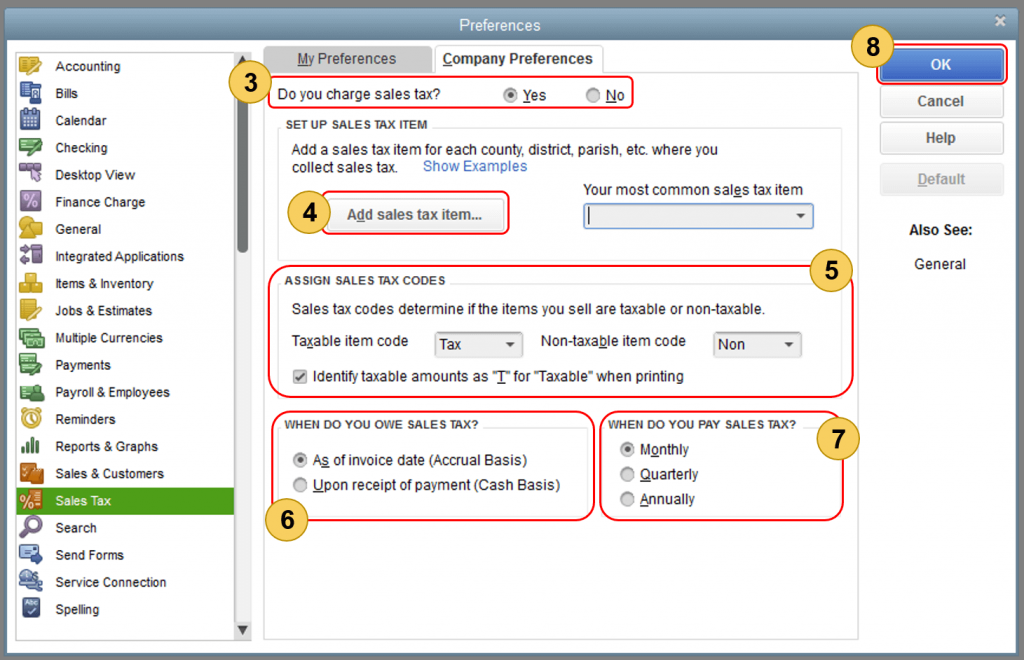

How to set up sales tax in QuickBooks Desktop

To create a custom tax rate, start by establishing the rate. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you.

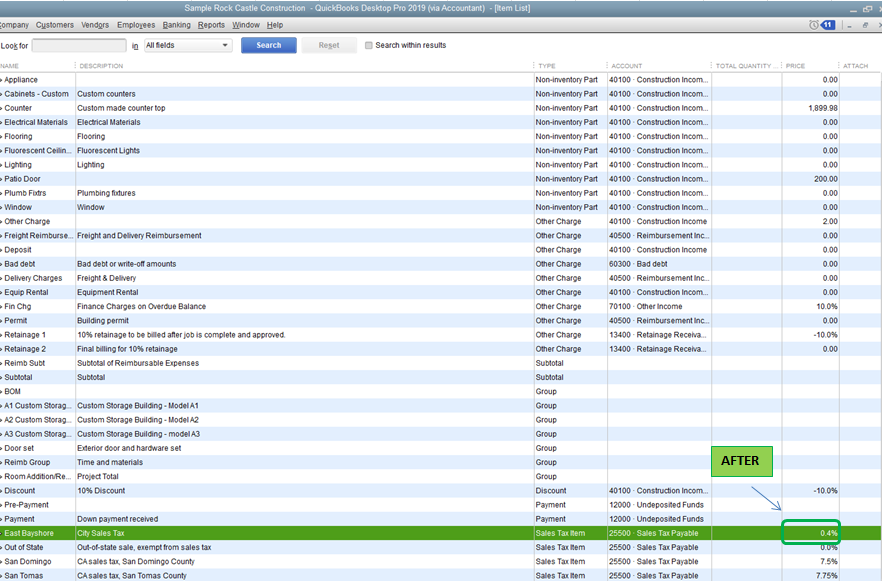

Solved Change the sales tax rate for all customers

Learn how to set up, edit, and deactivate your sales tax rate and settings. Add multiple sales tax rates, including combined. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. You can create and apply custom rates from quickbooks online in buildbook. To create a custom tax rate, start by establishing.

How To Change Sales Tax Rate In Quickbooks

Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. Quickbooks online will automatically apply the.

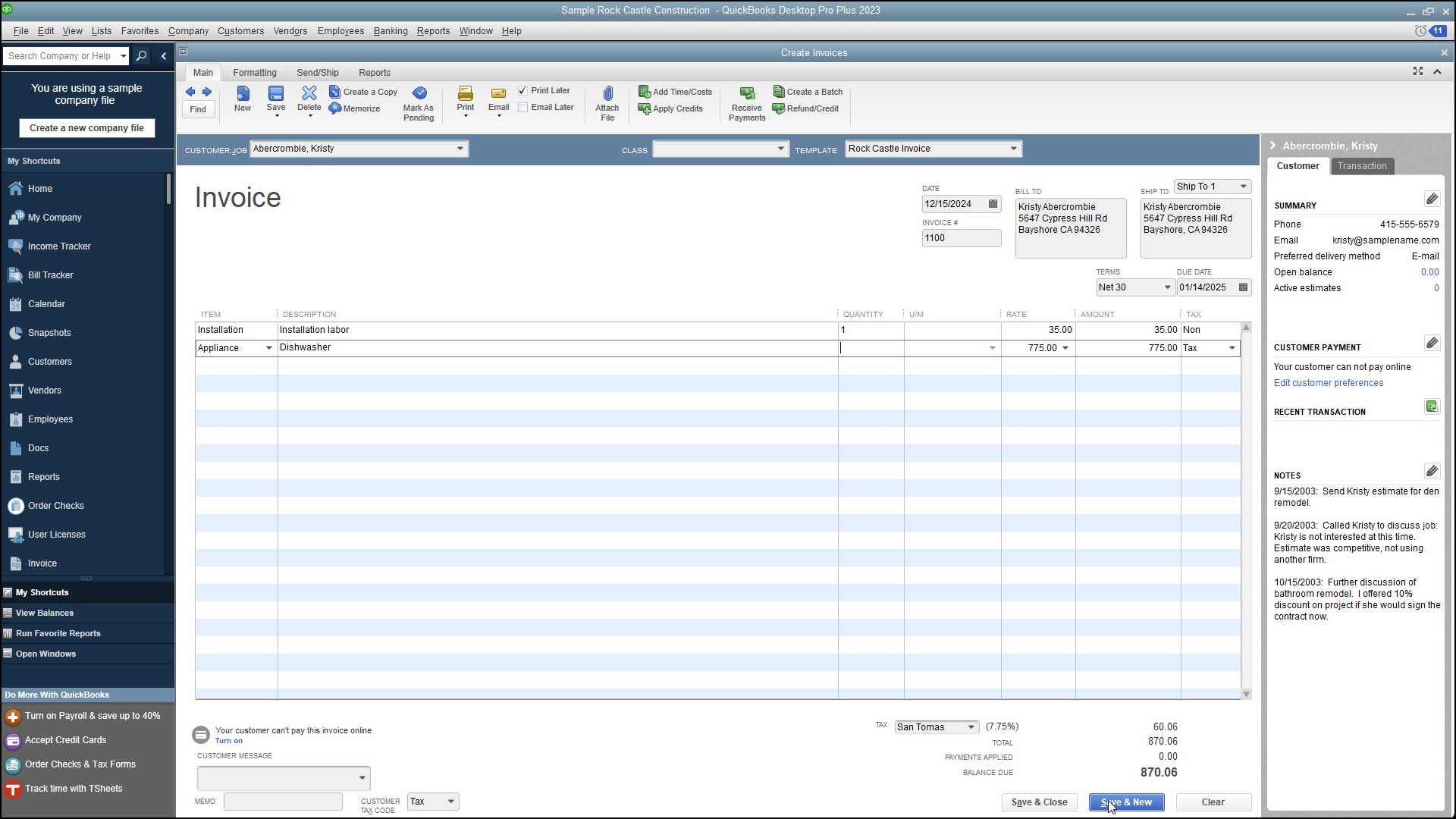

Create an Invoice in QuickBooks Desktop Pro Instructions

After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. You can create and apply custom rates from quickbooks online in buildbook. Learn how to set up, edit, and deactivate.

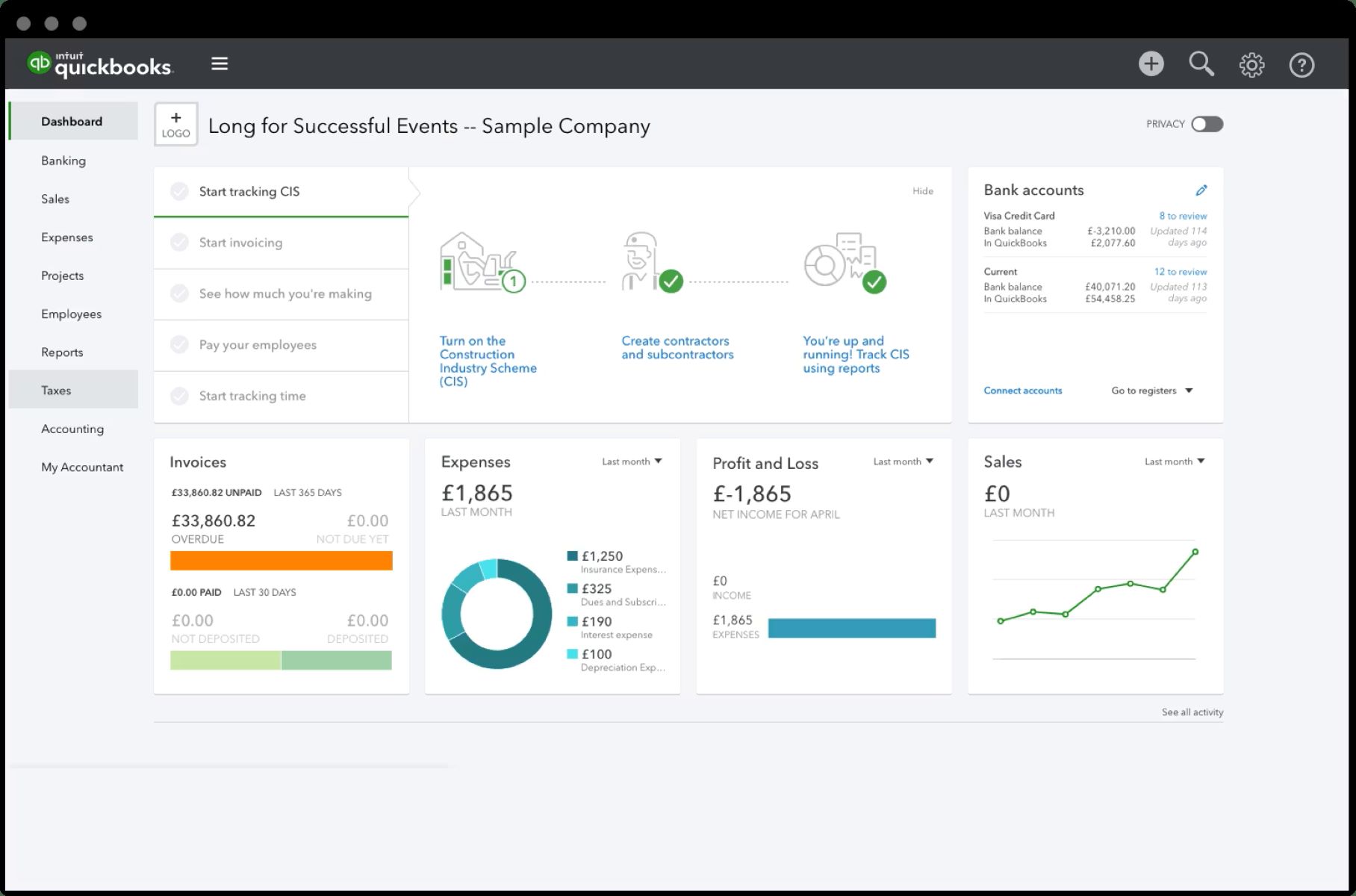

Set Up Sales Tax in QuickBooks Online Tutorial Quickbooks

To create a custom tax rate, start by establishing the rate. Learn how to set up, edit, and deactivate your sales tax rate and settings. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax.

Missouri Sales Tax Calculator 2024 State, County & Local Rates

Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. Learn how to set up, edit, and deactivate your sales tax rate and settings. In the sales tax center, you can add and edit tax. Add multiple sales tax rates, including combined. To create a custom tax rate, start by establishing the.

How to Setup Sales Tax in Quickbooks YouTube

In the sales tax center, you can add and edit tax. Add multiple sales tax rates, including combined. Learn how to set up, edit, and deactivate your sales tax rate and settings. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for. You can create and apply custom.

How to Set Up Sales Tax in QuickBooks Desktop?

Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. Learn how to set up, edit, and deactivate your sales tax rate and settings. To create a custom tax rate, start by establishing the rate. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax.

You Can Create And Apply Custom Rates From Quickbooks Online In Buildbook.

To create a custom tax rate, start by establishing the rate. Quickbooks online will automatically apply the correct sales tax rate to each transaction, based on the information you. Learn how to set up, edit, and deactivate your sales tax rate and settings. After selecting to use automated sales tax in quickbooks online, you’ll need to verify the correct tax category and tax rate for.

In The Sales Tax Center, You Can Add And Edit Tax.

Add multiple sales tax rates, including combined.